- StocksGeniusMastery

- Posts

- 💥 The Most Surprising Magnificent Seven Pick for 2026 Isn’t Nvidia or Apple

💥 The Most Surprising Magnificent Seven Pick for 2026 Isn’t Nvidia or Apple

The overlooked tech giant quietly rebuilding its next growth engine.

Hi Fellow Investors,

Amazon (NASDAQ: AMZN) has tested investor patience recently, yet beneath the headline volatility, several long-term value drivers continue to strengthen quietly.

Being out of favor today does not eliminate Amazon’s competitive advantages, especially as the company invests aggressively for future growth cycles.

Key Points:

Amazon’s massive AI and cloud investments have pressured near-term cash flow but position the company for long-term dominance.

Amazon Web Services is expanding computing capacity aggressively to capture future AI-driven demand.

Advertising has emerged as a fast-growing, high-margin profit engine that could materially boost earnings in 2026.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Why Amazon Has Fallen Behind Its Magnificent Seven Peers

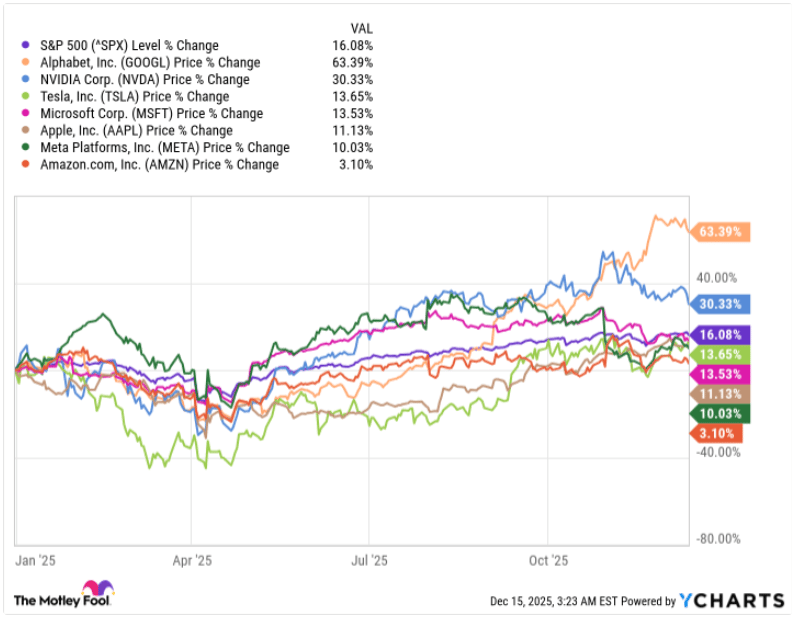

Amazon’s stock has lagged in 2025 even as most Magnificent Seven peers delivered strong double-digit gains.

This underperformance stems largely from aggressive capital expenditures totaling roughly $90 billion through the first nine months of the year.

A significant portion of this spending has been directed toward AI and cloud infrastructure, pressuring free cash flow in the short term.

High investor expectations combined with limited immediate financial payoff left little tolerance for execution delays.

Despite the recent pullback, the current slowdown reflects investment timing rather than any deterioration in Amazon’s core business strength.

AWS Is Quietly Laying the Foundation for the Next Growth Cycle

Amazon Web Services remains the world’s largest cloud platform despite gradually losing market share to major competitors.

Cloud infrastructure continues to serve as the backbone for artificial intelligence training, inference, and large-scale deployment.

Over the past twelve months, Amazon has added more than 3.8 gigawatts of new computing capacity across its global footprint.

Management has outlined plans to double total capacity by 2027 to stay ahead of anticipated AI-driven demand.

Each incremental gigawatt of capacity could translate into billions of dollars in additional annual revenue as utilization ramps higher.

Advertising Is Amazon’s Underrated Profit Multiplier

AWS generates the majority of Amazon’s operating income, but advertising has emerged as an increasingly powerful secondary profit engine.

Amazon’s deep insight into consumer behavior enables advertisers to target customers with exceptional accuracy and efficiency.

Its expansive ecosystem offers multiple advertising touchpoints across shopping, streaming, gaming, and digital media platforms.

Recent partnerships extend Amazon’s advertising reach beyond its own ecosystem to platforms such as Netflix, Spotify, and SiriusXM.

Advertising revenue surged 24% year over year in the third quarter, underscoring both its scalability and attractive margin profile.

Strengths

AWS remains the largest global cloud platform, positioning Amazon at the center of long-term AI infrastructure demand.

Advertising delivers high-margin growth by leveraging Amazon’s unmatched consumer data and ecosystem reach.

The company’s massive scale across commerce, cloud, and media creates diversified and resilient revenue streams.

Weaknesses

Elevated capital spending continues to pressure free cash flow and challenge short-term investor confidence.

Gradual AWS market share erosion has intensified concerns around competitive dynamics.

Premium valuation levels leave the stock sensitive during periods of slower growth visibility.

Potential

AI-driven cloud demand could unlock tens of billions in incremental AWS revenue over the next several years.

Advertising growth may meaningfully expand operating margins and overall profitability by 2026.

Investor sentiment could reverse sharply as heavy investments translate into tangible earnings leverage.

TODAY’S SPONSOR

Revolutionize Learning with AI-Powered Video Guides

Upgrade your organization training with engaging, interactive video content powered by Guidde.

Here’s what you’ll love about it:

1️⃣ Fast & Simple Creation: AI transforms text into video in moments.

2️⃣ Easily Editable: Update videos as fast as your processes evolve.

3️⃣ Language-Ready: Reach every learner with guides in their native tongue.

Bring your training materials to life.

The best part? The browser extension is 100% free.

Conclusion

Amazon’s recent underperformance reflects short-term discomfort rather than long-term decline.

The company is investing aggressively where future demand is likely to be strongest.

For patient investors, Amazon may represent one of the most compelling Magnificent Seven opportunities heading into 2026.

Final Thought

When a dominant company invests heavily while sentiment turns negative, the next chapter is often written in upside surprises.

Could Amazon’s current pause be setting the stage for its next breakout year?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply