- StocksGeniusMastery

- Posts

- 💥The Next $2 Trillion AI Titan? This Tech Powerhouse Is Closer Than You Think

💥The Next $2 Trillion AI Titan? This Tech Powerhouse Is Closer Than You Think

Wall Street is sleeping on one AI stock that’s quietly positioning itself to join the trillionaire elite—before the year ends.

Hello Fellow Investors!

The company behind some of the world’s most-used digital platforms is now unleashing its AI potential across every business segment.

Its foundation in social media, cloud infrastructure, and immersive technologies makes it uniquely positioned to dominate the AI wave.

While Nvidia’s market cap explosion has captivated investors, there’s another contender rising rapidly through the ranks—armed with proprietary models, massive user data, and unmatched reach.

It’s quietly emerging as a generative AI powerhouse.

With surging earnings, expanding margins, and strategic AI investments paying off, this stock may be the next to break the $2 trillion barrier—catching up with Nvidia, Microsoft, Amazon, and Alphabet in record time.

Key Points:

AI-driven growth is propelling a new generation of tech leaders toward multitrillion-dollar valuations.

This company’s powerful ecosystem and generative AI breakthroughs are accelerating revenue and margin expansion.

With a still-reasonable valuation and surging demand, the $2 trillion milestone could arrive sooner than expected.

TODAY’S SPONSOR

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

One AI Powerhouse Quietly Closing In on the $2 Trillion Club

Meta Platforms (NASDAQ: META) is rapidly transforming from a social media empire into one of the most advanced AI-driven companies in the world.

While names like Nvidia and Microsoft dominate headlines, Meta has quietly integrated generative AI into nearly every corner of its business.

From personalized content delivery to fully automated ad campaigns and immersive AR/AI hardware, Meta’s AI strategy spans both immediate monetization and long-term innovation.

With its first-quarter earnings highlighting five core AI growth engines—including AI-powered ad creation, content generation, messaging agents, an AI assistant, and smart devices—Meta is positioning itself for explosive revenue growth.

What makes this shift even more compelling is Meta’s proprietary AI models and in-house infrastructure, which gives it a cost advantage over competitors relying on third-party AI platforms.

As generative AI redefines digital experiences, Meta may not just benefit—it could become the industry’s defining force.

A Trillion-Dollar Opportunity at a Discounted Price

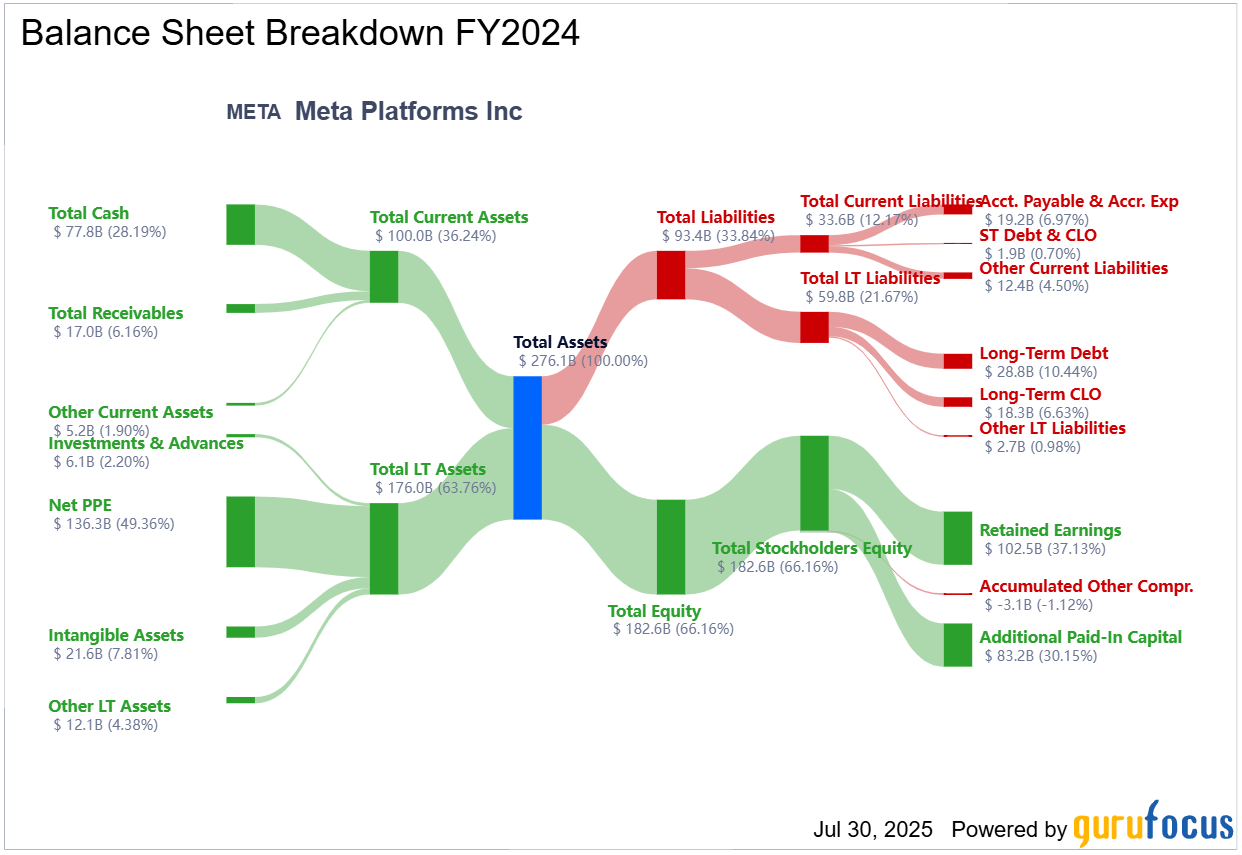

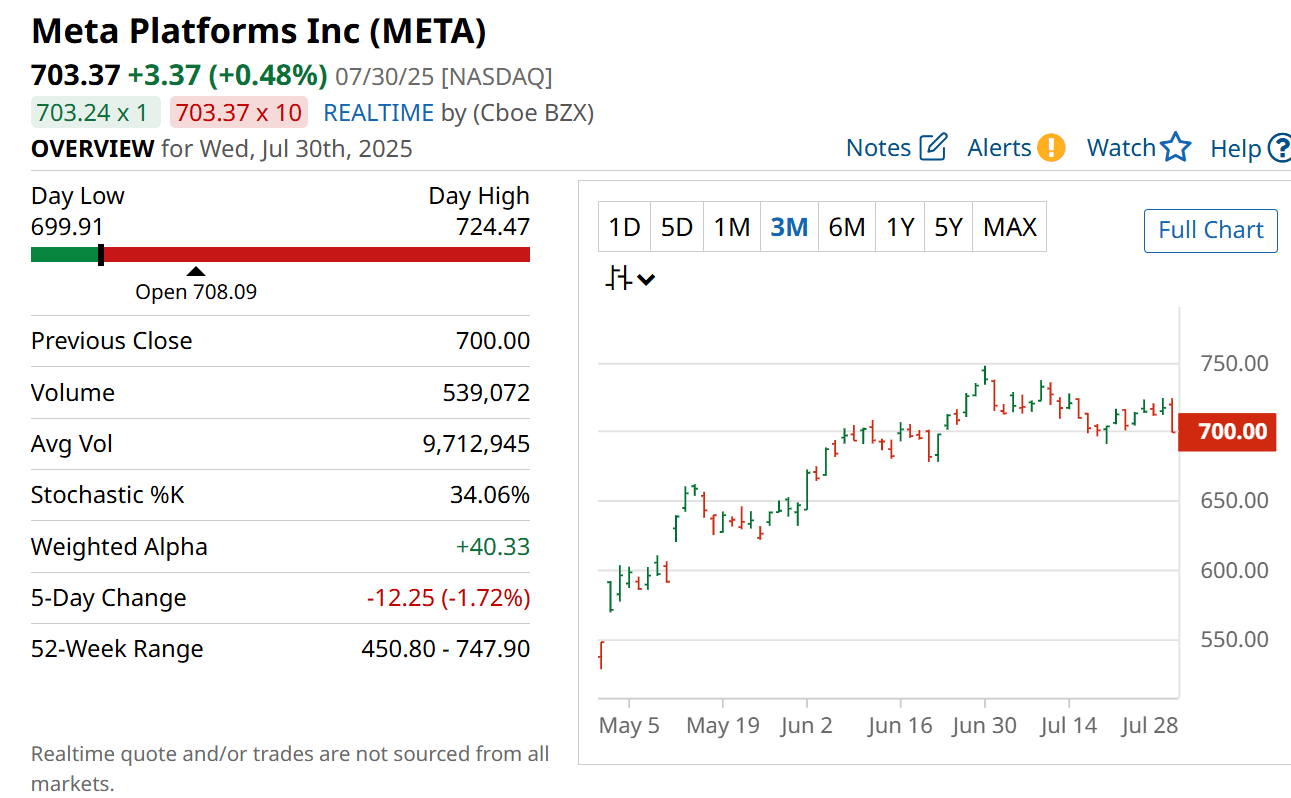

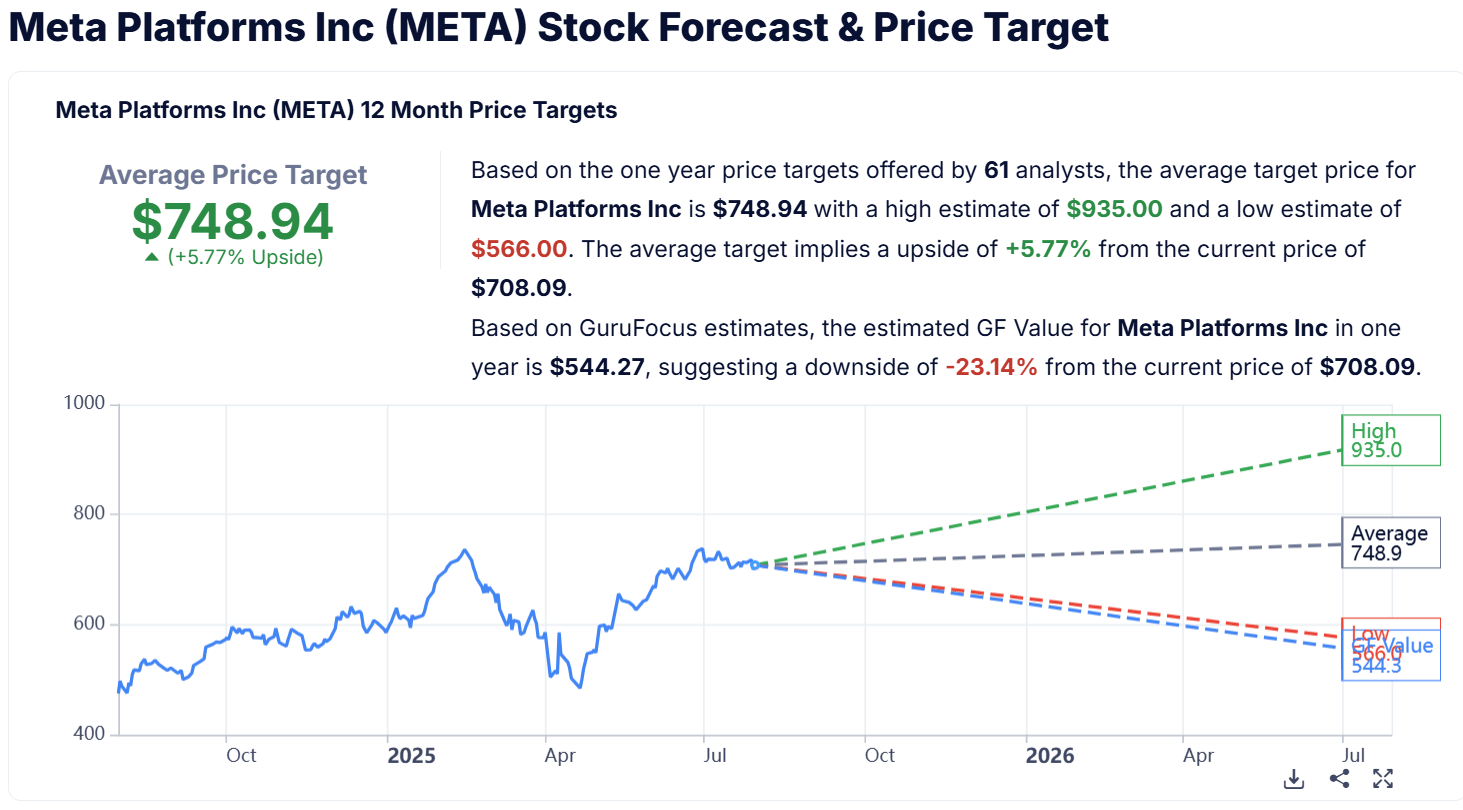

Despite being less than 12% away from the $2 trillion mark, Meta’s stock still trades at a valuation that suggests there’s significant upside left.

With 16% revenue growth and 27% year-over-year operating income growth last quarter, the company is showcasing the kind of operational leverage that can power long-term returns.

Short-term pressure from capital expenditures may weigh on profits, but those investments are fueling scalable AI infrastructure that will pay off over time.

Meanwhile, Meta’s $70 billion in cash and aggressive $13.4 billion buyback program further enhance shareholder value.

Trading at just 28 times earnings with accelerating growth drivers, Meta doesn’t need a stretch to justify a $2 trillion valuation—it just needs to maintain momentum.

If results exceed expectations, that valuation could be reached even at today’s multiple, giving investors a rare chance to buy into the next AI superpower before it breaks through.

Strengths

Diverse AI Integration: Meta applies generative AI across ads, content, messaging, and devices—creating multiple revenue channels.

Massive User Base: Billions of users across Facebook, Instagram, and WhatsApp give Meta unmatched data to train and deploy AI models.

Cost-Efficient AI Development: Owning its own large language models and infrastructure reduces reliance on third parties, enhancing margins.

Weaknesses

Heavy CapEx Commitments: Large-scale infrastructure spending could pressure near-term earnings and investor sentiment.

Regulatory Risks: Meta remains under scrutiny for privacy, antitrust, and content moderation—potentially slowing growth.

Competition in AI Arms Race: With Microsoft, Alphabet, and Amazon also pushing AI boundaries, Meta must continuously innovate to stay ahead.

Potential

Advertising Disruption: AI agents capable of ru

nning full ad campaigns may revolutionize Meta’s core business and attract new advertisers.

AI-Driven Monetization: Stand-alone AI chatbots and smart glasses offer untapped avenues for ad inventory and user engagement.

Rapid Valuation Upside: A modest bump in earnings multiple or quarterly outperformance could be enough to push Meta past the $2 trillion line.

TODAY’S SPONSOR

CTV ads made easy: Black Friday edition

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting — plus creative upscaling tools that transform existing assets into CTV-ready video ads. Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Conclusion

Meta’s transformation from a social platform to a full-stack AI innovator is already underway—and the numbers are starting to prove it.

With five bold AI initiatives firing on all cylinders, unmatched scale, and a war chest to reinvest in innovation, Meta is not only ready to compete with the likes of Nvidia and Microsoft—it’s set to join them.

For investors looking for the next breakout tech juggernaut, Meta may offer the rare opportunity to ride the wave before the world catches on.

Final Thought

Will Meta be remembered as the company that redefined social media—or the one that reshaped artificial intelligence for the next generation?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply