- StocksGeniusMastery

- Posts

- 💥 The Race for the World’s Largest Company Has Just Two Competitors Left

💥 The Race for the World’s Largest Company Has Just Two Competitors Left

Nvidia and Alphabet prepare for a trillion-dollar AI showdown

Hi Fellow Investors,

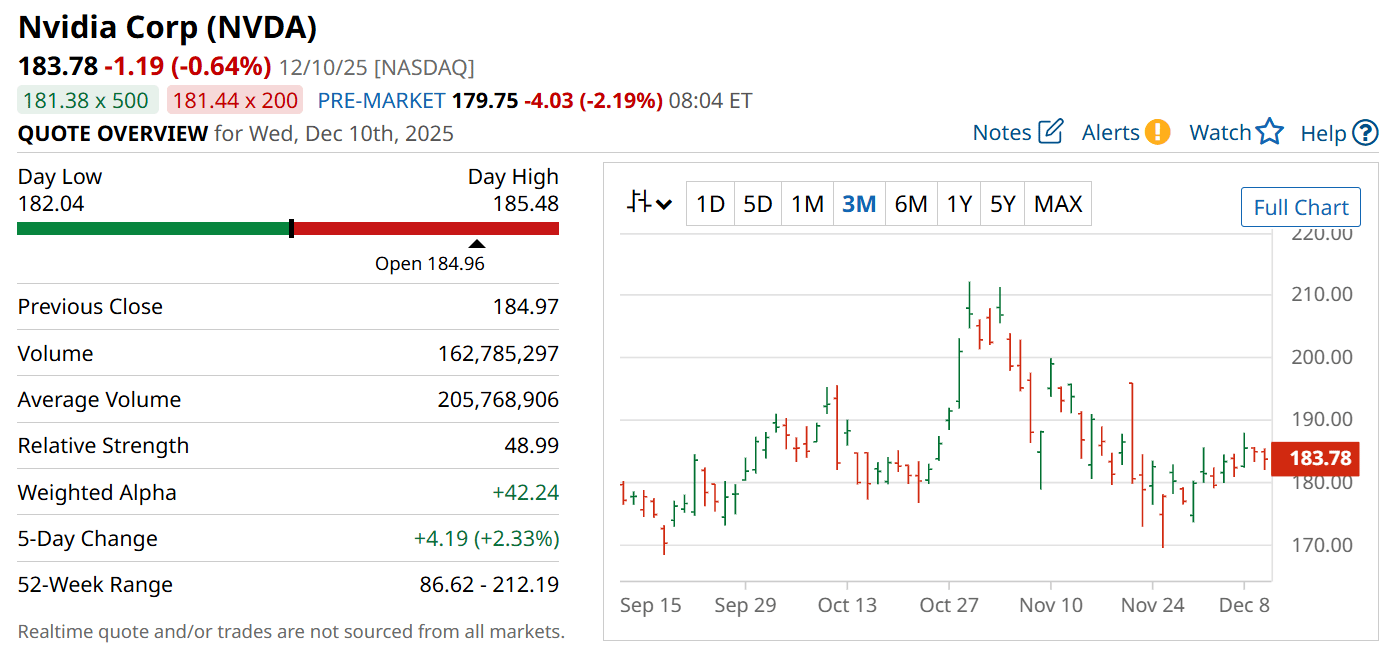

Nvidia (NASDAQ: NVDA) continues to ride unprecedented AI infrastructure spending, but new competition is quietly emerging.

Alphabet (NASDAQ: GOOGL) is exploring a bold shift that could fundamentally challenge Nvidia’s dominance.

The race to end 2026 as the world’s largest company is officially down to two players.

Key Points:

Nvidia’s data-center demand remains “sold out,” reinforcing its 2026 growth trajectory.

Alphabet may begin selling its custom TPUs externally, creating a powerful new revenue engine.

AI infrastructure spending is accelerating through 2027, raising the stakes for both giants.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Nvidia’s AI Engine Continues to Outpace Every Competitor

Nvidia remains the preferred computing supplier for every major hyperscaler, and its GPU demand is nowhere near slowing.

Record AI capex in 2025 is set to be surpassed again in 2026, creating a powerful multiyear spending cycle.

The company revealed that cloud GPUs remain fully “sold out,” showcasing unmatched demand and tight supply conditions.

Nvidia’s 62% year-over-year revenue surge last quarter shows that AI workloads are scaling faster than analysts expected.

Its long-term projection for $3 trillion to $4 trillion in global data-center capex by 2030 further strengthens its growth visibility.

If 2027 spending is also guided higher, Nvidia could extend its lead as the world’s most valuable company.

Strengths

Nvidia dominates the AI GPU market with unmatched ecosystem scale and performance leadership.

Cloud GPU shortages reinforce strong pricing power and sustained revenue acceleration.

Long-term AI infrastructure spending through 2030 gives Nvidia extraordinary growth runway.

Weaknesses

High pricing and supply constraints create opportunities for rival computing platforms.

Extreme dependence on hyperscaler spending introduces cyclical revenue risk.

Any slowdown in AI infrastructure investment could rapidly compress demand.

Potential

New AI systems, networking, and software layers could unlock multibillion-dollar revenue expansion.

Continued GPU scarcity may push Nvidia’s margins even higher into 2026.

If 2027 AI capex guidance hits new highs, Nvidia could widen its market-cap lead even further.

Alphabet’s TPU Strategy Could Trigger a Massive Business Model Shift

Alphabet has spent years refining its Tensor Processing Units, which deliver high-efficiency AI computing at a lower cost than GPUs when optimized correctly.

Until now, TPUs were kept mostly internal or leased through Google Cloud, giving Alphabet an operational advantage but not a hardware revenue stream.

Reports that Meta may purchase TPUs indicate Alphabet is considering a major new line of business.

This would diversify revenue beyond advertising, which still dominates its financials despite a 15% rise in Search last quarter.

If external TPU sales gain momentum in 2026, Alphabet could begin challenging Nvidia’s data-center computing supremacy.

Alphabet’s combination of mature advertising growth and emerging hardware monetization makes it a legitimate contender for the 2026 global crown.

Strengths

TPUs offer high-performance AI computing at lower cost, making them attractive to major enterprise buyers.

Alphabet’s massive ecosystem in Search, Cloud, and AI research provides stable long-term demand.

Diversifying beyond advertising strengthens Alphabet’s revenue durability.

Weaknesses

Advertising still drives most revenue, exposing Alphabet to cyclical marketing budgets.

TPU commercialization requires new supply chains, partnerships, and sales execution.

Nvidia’s head start and entrenched position remain difficult to disrupt quickly.

Potential

External TPU sales could create a multibillion-dollar hardware business by late 2026 or 2027.

Growing cloud adoption positions Google Cloud as a key platform for AI workloads.

If Alphabet scales TPU distribution successfully, it could close the valuation gap with Nvidia rapidly.

TODAY’S SPONSOR

Revolutionize Learning with AI-Powered Video Guides

Upgrade your organization training with engaging, interactive video content powered by Guidde.

Here’s what you’ll love about it:

1️⃣ Fast & Simple Creation: AI transforms text into video in moments.

2️⃣ Easily Editable: Update videos as fast as your processes evolve.

3️⃣ Language-Ready: Reach every learner with guides in their native tongue.

Bring your training materials to life.

The best part? The browser extension is 100% free.

Conclusion

Nvidia remains the strongest candidate to finish 2026 as the world’s largest company, backed by unprecedented AI infrastructure demand.

Alphabet’s TPU commercialization could become a powerful catalyst, but it requires significant execution before challenging Nvidia’s throne.

Investors should watch AI spending trends closely, as they will ultimately determine which tech titan takes the crown.

Final Thought

The next 12 months may define the hierarchy of global technology for the next decade.

Will Nvidia hold its lead—or will Alphabet finally leverage its hardware to disrupt the AI race?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply