- StocksGeniusMastery

- Posts

- 💥 The Smarter AI Buy for 2026

💥 The Smarter AI Buy for 2026

Nvidia dominates hardware, but Alphabet may dominate risk-adjusted returns.

Hi Fellow Investors,

Artificial intelligence continues to reshape global markets and investor expectations.

Two of the most powerful ways to invest in AI today are through infrastructure leaders and scaled platform operators.

Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOGL) represent the best of both worlds, but valuation and durability matter more than hype.

Key Points:

Nvidia’s revenue and margins remain extraordinary, but the stock reflects near-perfect execution expectations.

Alphabet is showing accelerating AI-driven growth alongside improving cloud profitability and diversification.

Valuation and business cyclicality suggest Alphabet offers a more balanced risk-reward profile for 2026.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Nvidia’s Explosive AI Infrastructure Growth

Nvidia (NASDAQ: NVDA) continues to dominate the global AI infrastructure buildout as the primary supplier of high-performance GPUs powering data centers.

Revenue growth exceeding 60% year over year reflects unprecedented demand from hyperscalers and enterprise customers racing to deploy AI capabilities.

Data center revenue growth approaching 70% confirms Nvidia’s central role in the AI supply chain.

Gross margins above 70% demonstrate rare pricing power within the semiconductor industry.

These results position Nvidia as the most visible beneficiary of the current AI investment cycle.

Why Nvidia’s Valuation Raises the Stakes

Despite its operational excellence, Nvidia’s stock price assumes sustained hypergrowth with little tolerance for demand volatility.

The semiconductor industry has historically experienced boom-and-bust cycles, even among category leaders.

As competitors develop custom AI silicon and alternative architectures, long-term pricing pressure could emerge.

Nvidia remains a phenomenal company, but the stock requires near-perfect execution to justify current multiples.

For investors, the question is not whether Nvidia will grow, but whether it can continue exceeding already extreme expectations.

Strengths

Unmatched dominance in AI GPU performance and ecosystem integration across global data centers.

Exceptional gross margins reflecting technological leadership and strong customer demand.

Deep relationships with hyperscalers that drive sustained near-term revenue visibility.

Weaknesses

Valuation reflects perfection, leaving minimal room for cyclical or competitive pressures.

Heavy reliance on AI infrastructure spending exposes the company to capital expenditure slowdowns.

Long-term competitive threats from in-house silicon and alternative AI architectures.

Potential

Continued AI adoption could extend Nvidia’s leadership well beyond current growth assumptions.

Platform expansion and software monetization may strengthen ecosystem lock-in.

Structural shifts in computing demand could justify higher long-term valuation norms.

Alphabet’s AI Strategy Is Built for Scale

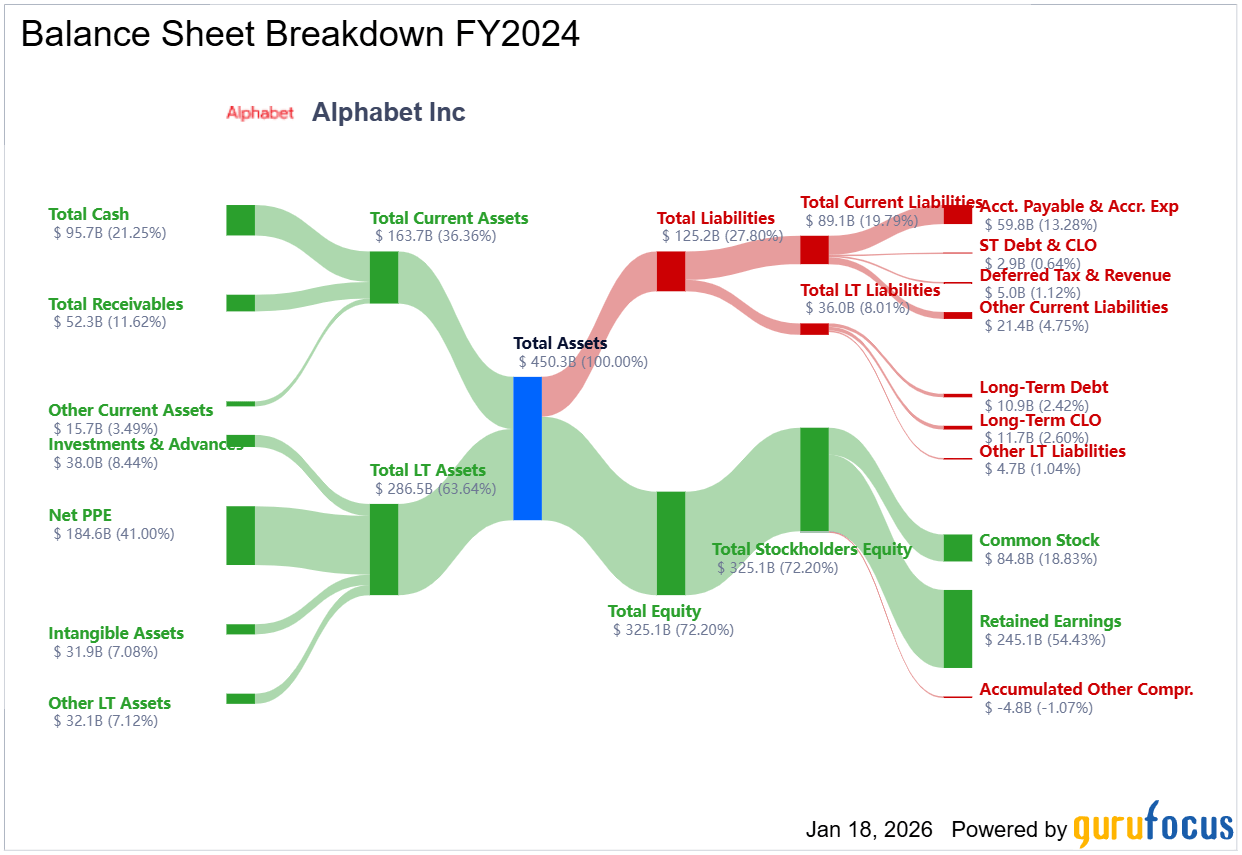

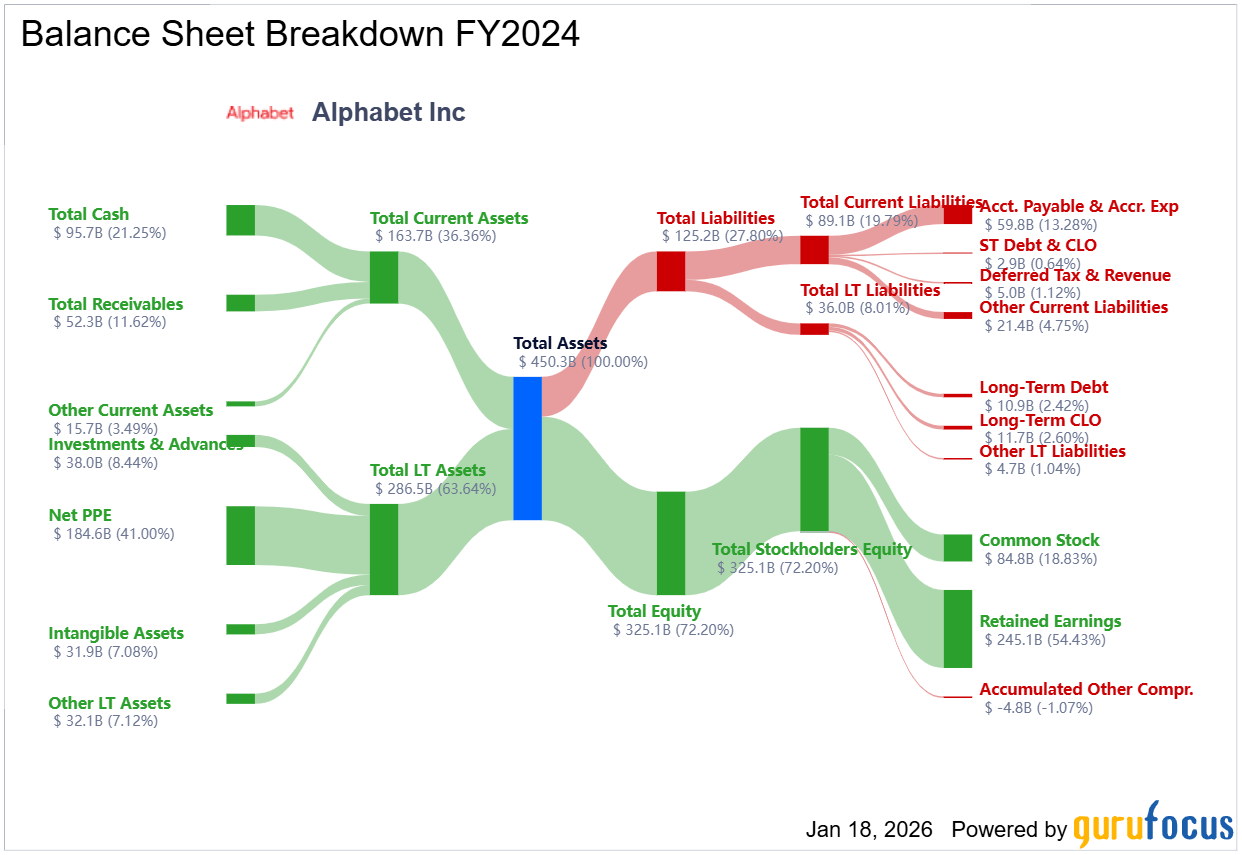

Alphabet’s (NASDAQ: GOOGL) approach to AI is increasingly embedded across its entire ecosystem rather than concentrated in a single product category.

Search, YouTube, subscriptions, and devices are all benefiting from AI-driven engagement and monetization improvements.

Overall revenue growth in the mid-teens reflects broad-based strength rather than isolated wins.

Alphabet’s massive user base allows AI enhancements to scale instantly across billions of interactions.

This positions AI as a recurring growth engine rather than a speculative investment.

Cloud Momentum and Gemini Expand Alphabet’s AI Reach

Google Cloud is becoming a central driver of Alphabet’s AI narrative and financial performance.

Cloud revenue growth above 30% combined with rapidly expanding operating margins signals a profitability inflection point.

A fast-growing backlog provides strong revenue visibility heading into 2026 and beyond.

Alphabet’s Gemini models are gaining credibility across both enterprise and consumer use cases.

The multi-year collaboration with Apple embeds Gemini into Apple Intelligence and Siri.

This partnership places Alphabet’s AI technology at the center of one of the world’s largest consumer device ecosystems.

Strengths

Highly diversified revenue streams reduce dependence on any single AI-driven market.

Improving Google Cloud profitability adds a powerful second earnings engine.

Gemini’s expanding distribution strengthens Alphabet’s long-term AI relevance.

Weaknesses

Valuation remains elevated relative to historical averages.

Advertising exposure ties earnings to broader macroeconomic conditions.

Regulatory scrutiny continues to pose long-term uncertainty.

Potential

Sustained double-digit growth with margin expansion could drive durable shareholder value.

Cloud backlog growth supports long-term AI revenue visibility.

Gemini adoption across platforms could cement Alphabet as a foundational AI provider.

TODAY’S SPONSOR

We’re running a super short survey to see if our newsletter ads are being noticed. It takes about 20 seconds and there's just a few easy questions.

Your feedback helps us make smarter, better ads.

Conclusion

Nvidia offers unmatched AI infrastructure growth but carries elevated valuation risk.

Alphabet delivers diversified AI monetization with improving profitability and scale advantages.

For investors focused on 2026 and beyond, Alphabet presents a more balanced risk-reward profile.

Final Thought

AI investing is not just about speed, but about sustainability through cycles.

The strongest platforms often reveal themselves when expectations cool and fundamentals endure.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply