- StocksGeniusMastery

- Posts

- 💥 These 2 Tech Titans Could Compound Wealth for 10 Years

💥 These 2 Tech Titans Could Compound Wealth for 10 Years

Strong cash flow, AI integration, and scalable platforms make them long-term core holdings.

Hi Fellow Investors,

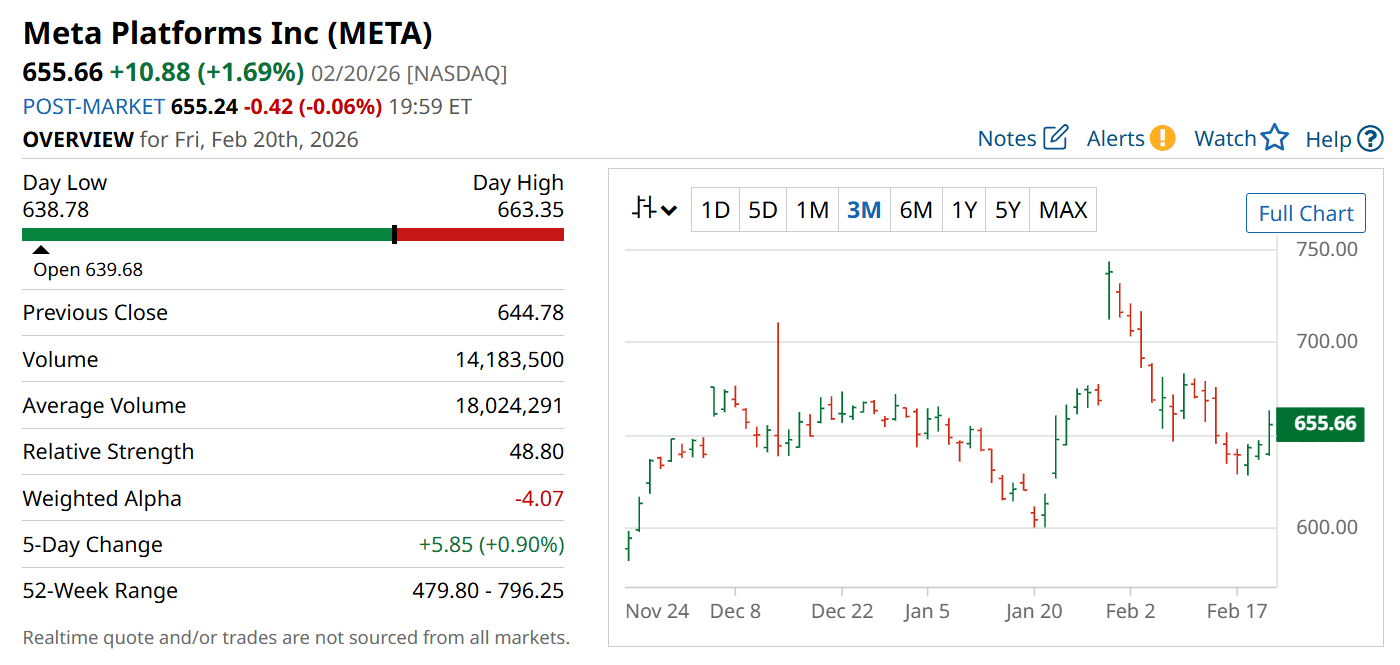

Amazon (NASDAQ: AMZN) and Meta Platforms (NASDAQ: META) remain two dominant franchises positioned to benefit from artificial intelligence for years to come.

Both companies combine market leadership with accelerating growth.

Even more compelling, each trades at valuations that appear reasonable relative to long-term opportunity.

Key Points:

Amazon leads in both e-commerce and cloud computing, with AWS growth accelerating.

Meta is leveraging AI to drive engagement, ad pricing, and monetization expansion.

Both stocks trade at forward P/E multiples that look attractive compared to peers.

TODAY’S SPONSOR

Fast, accurate financial writeups

When accuracy matters, typing can introduce errors and slow you down. Wispr Flow captures your spoken thinking and turns it into formatted, number-ready text for reports, investor notes, and executive briefings. It cleans filler words, enforces clear lists, and keeps your voice professional. Use voice snippets for standard financial lines, recurring commentary, or compliance-ready summaries. Works on Mac, Windows, and iPhone. Try Wispr Flow for finance.

Amazon: Retail Powerhouse Meets Cloud AI Engine

Amazon remains the market share leader in global e-commerce.

Its massive logistics network gives it scale advantages that are difficult to replicate.

The company is now integrating robotics and AI to improve warehouse efficiency and delivery speeds.

That operating leverage was evident last quarter, with North American operating income rising 24% on 10% revenue growth.

Meanwhile, Amazon Web Services continues to accelerate, posting 24% revenue growth — its fastest pace in more than three years.

With capital expenditures reaching $200 billion this year, Amazon is doubling down on AI infrastructure to secure long-term cloud dominance.

Strengths

Market leadership in both e-commerce and cloud computing creates diversified growth streams.

AWS remains the most profitable segment and is reaccelerating.

Forward P/E below 27 compares favorably to many large-cap retail peers trading above 40.

Weaknesses

Heavy capital expenditures increase short-term pressure on free cash flow.

Retail margins remain sensitive to consumer demand cycles.

Competitive intensity in cloud computing remains elevated.

Potential

AI-driven services within AWS could sustain multi-year double-digit revenue growth.

Robotics and automation may further expand retail margins.

Long-term operating leverage across segments could drive earnings compounding for a decade.

Meta Platforms: AI-Powered Advertising Machine

Meta has emerged as one of the most effective companies at deploying AI to drive user engagement.

Its recommendation algorithms keep users on its platforms longer, boosting ad impressions.

Ad impressions increased 18% year over year last quarter as revenue growth accelerated to 24%.

Management projected even stronger near-term growth, signaling continued momentum.

AI-powered advertising tools are helping marketers improve targeting and conversion rates.

Meta is also expanding monetization on WhatsApp and Threads, opening new revenue channels.

Strengths

Industry-leading AI-driven ad targeting improves pricing power.

Revenue growth is reaccelerating, with strong engagement metrics.

Forward P/E around 21 appears modest for a company growing revenue above 20%.

Weaknesses

Heavy reliance on digital advertising exposes it to macroeconomic slowdowns.

Regulatory scrutiny remains an ongoing risk.

Metaverse investments may weigh on profitability if returns lag expectations.

Potential

WhatsApp and Threads monetization could unlock substantial incremental revenue.

AI enhancements may continue driving higher engagement and ad yield.

Sustained margin expansion could support significant earnings growth over the next decade.

TODAY’S SPONSOR

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Conclusion

Amazon and Meta combine durable competitive advantages with accelerating AI-driven growth.

Both companies are investing aggressively to secure leadership in critical digital ecosystems.

For long-term investors, these stocks offer the potential to compound value well into the next decade.

Final Thought

The best decade-long investments often begin with dominant platforms adapting to new technology waves.

Are Amazon and Meta positioning themselves to define the AI era the same way they defined the last one?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply