- StocksGeniusMastery

- Posts

- 💥This $1.5 Trillion Chip Giant Could Be the Next AI Goldmine

💥This $1.5 Trillion Chip Giant Could Be the Next AI Goldmine

Taiwan Semiconductor Could Deliver Triple-Digit Returns as the AI Revolution Accelerates Faster Than Wall Street Expects.

Hi Fellow Investors,

Artificial intelligence continues to reshape every corner of the tech world.

But there’s one company quietly powering nearly every breakthrough — and it’s not the flashy name you might expect.

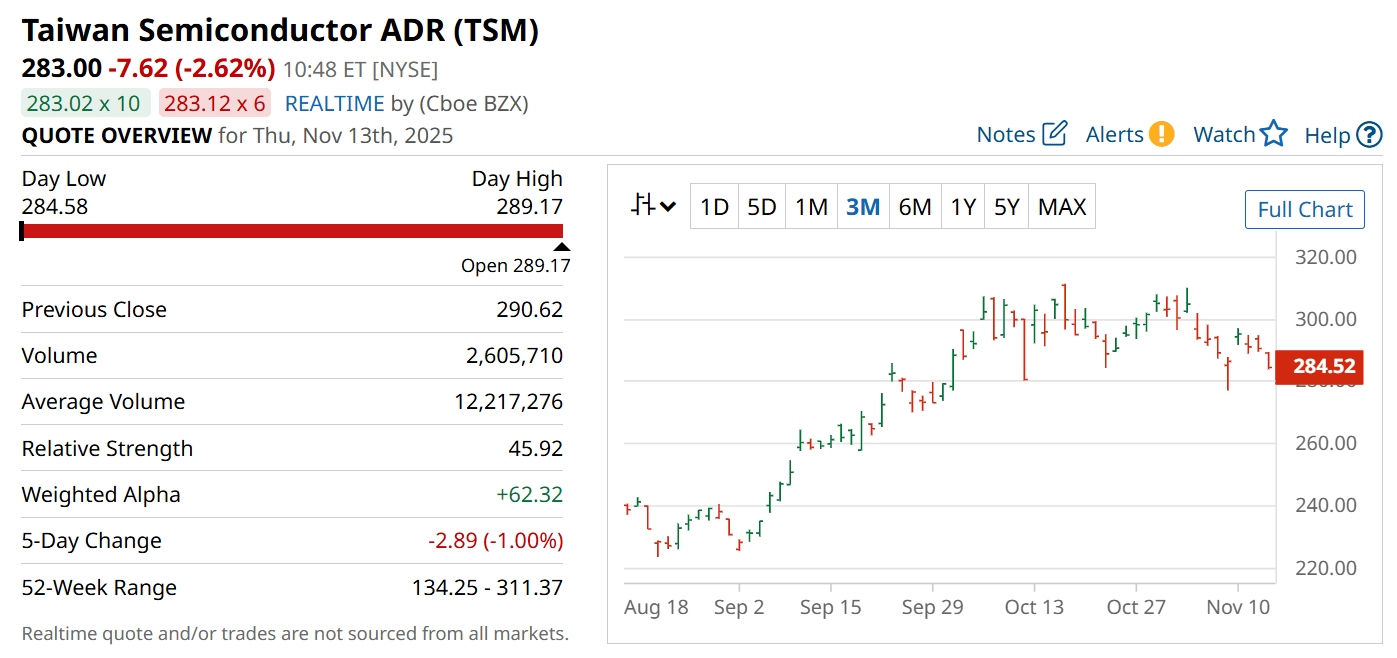

As the global race for AI dominance accelerates, Taiwan Semiconductor Manufacturing (NYSE: TSM) stands at the center of the storm — printing profits from every chipmaker fighting for the top spot.

Key Points:

Taiwan Semiconductor dominates the global chipmaking industry and fuels the AI hardware revolution.

Analysts expect 25% annualized EPS growth that could help the stock double by 2028.

With a $1.5 trillion market cap and unmatched scale, TSMC remains a long-term AI powerhouse.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The AI Engine Behind Every Major Chipmaker

While the headlines focus on Nvidia and AMD, Taiwan Semiconductor Manufacturing (NYSE: TSM) quietly builds the chips that make their innovations possible.

The company’s foundries produce thousands of products annually using 288 different manufacturing processes.

Nearly three-quarters of its revenue now comes from the most advanced 3-nanometer, 5-nanometer, and 7-nanometer chips that power everything from smartphones to AI data centers.

That technological edge, built through decades of disciplined investment, keeps TSMC far ahead of rivals in both efficiency and capability.

Why Investors Are Eyeing TSMC for the Next AI Supercycle

The AI revolution requires more than clever algorithms — it demands raw computing power on a massive scale.

Every surge in AI demand translates directly into more chip orders for TSMC.

Because TSMC manufactures for virtually every major chip designer, investors don’t have to pick a winner in the AI race — TSMC profits from all of them.

Over the past year, the company delivered $50 billion in net income on $115 billion in revenue, boasting a robust 58% gross margin.

Even at a reasonable valuation of 23x next year’s earnings, TSMC’s growth trajectory suggests major upside potential for patient investors.

Strengths

Dominant global foundry position serving virtually every major semiconductor brand.

High-margin business with strong pricing power and unmatched manufacturing scale.

Deep expertise in cutting-edge chip nodes, including 3nm and 5nm technologies crucial to AI processing.

Weaknesses

Heavy reliance on global tech demand cycles exposes revenue to market fluctuations.

Geopolitical risks remain elevated due to Taiwan’s strategic position in the semiconductor supply chain.

Massive capital expenditures required to stay ahead in process innovation could pressure short-term cash flow.

Potential

With 25% annual EPS growth expected, the stock could double within three years if current valuation multiples hold.

Expansion into new fabrication sites outside Taiwan could reduce risk and attract global investment inflows.

As AI becomes the backbone of every major industry, TSMC’s chips could power the next trillion-dollar phase of tech growth.

TODAY’S SPONSOR

Revolutionize Learning with AI-Powered Video Guides

Upgrade your organization training with engaging, interactive video content powered by Guidde.

Here’s what you’ll love about it:

1️⃣ Fast & Simple Creation: AI transforms text into video in moments.

2️⃣ Easily Editable: Update videos as fast as your processes evolve.

3️⃣ Language-Ready: Reach every learner with guides in their native tongue.

Bring your training materials to life.

The best part? The browser extension is 100% free.

Conclusion

Taiwan Semiconductor isn’t just another chip company — it’s the infrastructure behind the AI revolution.

Its unmatched scale, cutting-edge technology, and broad customer base make it one of the most compelling long-term investments in the market today.

For investors seeking exposure to the AI megatrend without the volatility of individual chip bets, TSMC remains a powerful and steady choice.

Final Thought

Every great tech revolution needs a foundation — and Taiwan Semiconductor has quietly become that bedrock for the AI era.

The question isn’t whether the AI wave will continue — it’s whether you’ll ride it with the company building the chips that make it all possible.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply