- StocksGeniusMastery

- Posts

- 💥This $180 Billion AI Stock Could Be the Next Big Winner After Nvidia and Broadcom

💥This $180 Billion AI Stock Could Be the Next Big Winner After Nvidia and Broadcom

Lam Research’s surging sales and strong valuation outlook make it a must-watch AI enabler

Hi Fellow Investors,

Lam Research (NASDAQ: LRCX) has soared nearly 80% in 2025, yet Wall Street is still underestimating its role in the AI revolution.

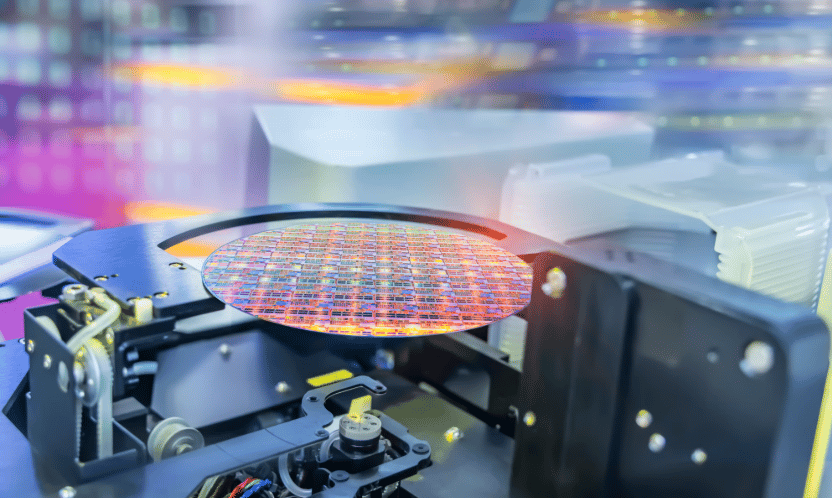

While Nvidia and Broadcom dominate the headlines, Lam Research builds the precision tools that make their chips possible.

With rapid growth in advanced packaging and wafer-fabrication equipment, Lam is quietly positioning itself as one of the most important players in the semiconductor supply chain.

And as global AI spending accelerates, this overlooked stock may have plenty more room to run.

Key Points:

Lam Research’s etching and deposition tools are essential for making advanced AI chips.

Advanced packaging revenue is surging, with demand rising sixfold since 2021.

Analysts see shares climbing another 20%–40% by 2027, with long-term upside even greater.

TODAY’S SPONSOR

Typing is a thing of the past

Typeless turns your raw, unfiltered voice into beautifully polished writing - in real time.

It works like magic, feels like cheating, and allows your thoughts to flow more freely than ever before.

With Typeless, you become more creative. More inspired. And more in-tune with your own ideas.

Your voice is your strength. Typeless turns it into a superpower.

Why Lam’s Chipmaking Tools Matter More Than Ever

Nvidia and Broadcom may design the processors, but Lam Research supplies the pick-and-shovel tools that bring those designs to life.

Its etching and deposition systems are critical for 3nm and below manufacturing, where extreme ultraviolet lithography alone isn’t enough.

Lam also leads in gate-all-around transistor technology and atomic layer deposition, enabling faster, more power-efficient chips.

These breakthroughs are what allow AI accelerators, GPUs, and CPUs to keep advancing as transistors shrink and workloads intensify.

In short, without Lam Research, the AI boom simply wouldn’t be possible.

The $105 Billion Market Opportunity

Global wafer-fabrication equipment spending is expected to hit $105 billion in 2025, driven largely by China’s AI investments.

Lam expects to capture a mid-30% share of this market, potentially reaching nearly 40% over time.

That translates into a massive opportunity, as every new AI chip requires denser memory, smaller transistors, and advanced packaging — all of which depend on Lam’s tools.

Its Q4 2025 results underscore this momentum: revenue jumped 33.6% to $5.2 billion, and gross margin hit a record 50.3%.

Meanwhile, the company returned $1.6 billion to shareholders in the form of buybacks and dividends, proving that growth doesn’t come at the expense of stability.

Beyond etching and deposition, Lam is becoming a powerhouse in advanced packaging.

Its SABRE 3D copper-plating tool and decades of metallization expertise give it an edge as demand explodes.

AI data centers now spend six times more on packaging than in 2021, underscoring how vital this segment has become.

With its technology improving memory density, bandwidth, and energy efficiency, Lam is carving out a leadership role that competitors can’t easily replicate.

This is where Lam could see its fastest growth over the next decade, as AI workloads scale globally.

Strengths

Lam Research is the ultimate pick-and-shovel play, providing indispensable tools that every major chipmaker needs to produce advanced AI processors.

Explosive financial growth highlights its momentum, with quarterly revenue up 33.6% year over year and record-setting gross margins above 50%.

Its leadership in advanced packaging positions it for decades of AI growth, capturing demand from GPUs, CPUs, and data center accelerators.

Weaknesses

Valuation is climbing, with the stock trading at nearly 29 times forward earnings, leaving less margin for error if growth slows.

Dependence on cyclical wafer-fab spending exposes Lam to downturns, particularly if global chip demand temporarily cools.

Competition in semiconductor equipment is intense, with rivals pushing into deposition and packaging segments.

Potential

Analysts project 20%–40% upside by 2027, with shares potentially reaching $182 in just two years.

Long-term demand for AI chip manufacturing could drive Lam’s market share even higher, giving it sustained growth momentum.

As AI chip complexity rises, Lam’s tools become more mission-critical, ensuring it remains a top-tier beneficiary of the AI megatrend.

TODAY’S SPONSOR

What do Carlyle, Blackstone, and KKR all have in common?

Leaders from Carlyle, Blackstone, and KKR are among the guest speakers in the Wharton Online + Wall Street Prep PE Certificate Program.

Over 8 weeks, you will:

Learn directly from Wharton faculty

Get hands-on training with insights from top firms

Earn a respected certificate upon successful completion

Save $300 with code SAVE300 at checkout + $200 with early enrollment by January 12.

Program starts February 9.

Conclusion

Lam Research may not grab headlines like Nvidia or Broadcom, but it’s one of the most vital players in the AI supply chain.

Its cutting-edge tools, record financial results, and expanding role in advanced packaging give it a powerful runway for growth.

For investors looking to diversify into AI infrastructure, Lam Research offers a compelling opportunity.

Final Thought

In every gold rush, it’s the pick-and-shovel providers who quietly build fortunes.

Could Lam Research be the AI revolution’s biggest unsung hero?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply