- StocksGeniusMastery

- Posts

- 💥This AI Giant Could Hit $2 Trillion by 2028!

💥This AI Giant Could Hit $2 Trillion by 2028!

Broadcom's explosive rise in custom AI chips could cement its place as the next tech giant to cross the $2 trillion milestone.

Hello Fellow Investors!

Broadcom (NASDAQ: AVGO) is quickly emerging as one of the most important players in the booming AI semiconductor space, thanks to its custom-built ASICs that deliver powerful, efficient performance tailored to the demands of modern data centers.

As cloud giants shift away from traditional GPUs in favor of cost-effective, high-performance solutions, Broadcom has become their go-to partner.

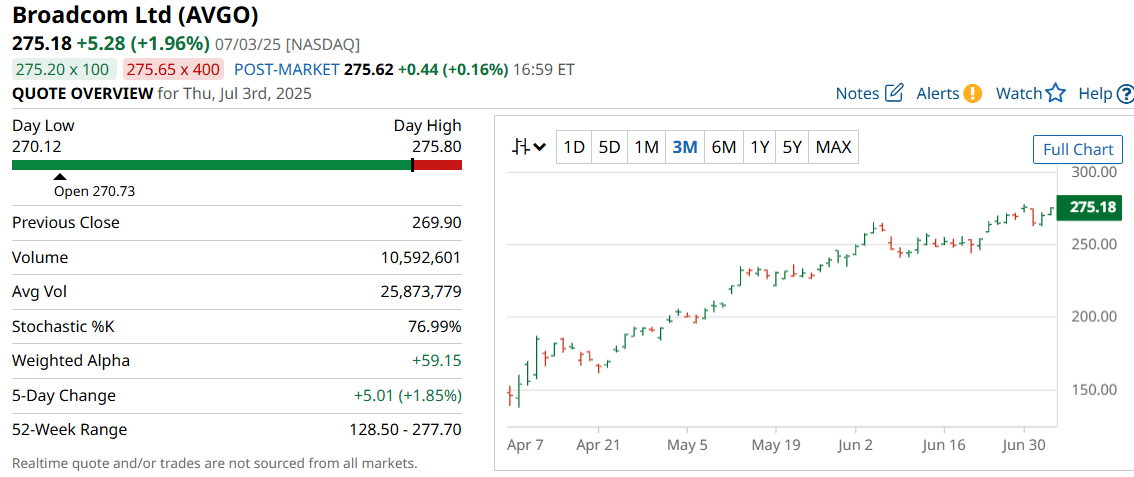

The company’s stock has surged 65% over the past year—more than doubling the return of Nvidia during the same period—as investors rush to gain exposure to its AI-driven growth story.

With a current market cap near $1.3 trillion and AI revenues accelerating, Broadcom is clearly in breakout territory.

All signs now point to Broadcom being the next tech titan to join the exclusive $2 trillion club—and it could happen much sooner than most expect.

Key Points:

Broadcom is rapidly scaling its AI chip business, with top customers like Microsoft, Meta, OpenAI, and Alphabet.

The company’s AI revenue could soar to $50 billion annually by 2027, quadrupling from current levels.

With its dominant market share and growing adoption of custom chips, Broadcom may be on track for a $2 trillion valuation by 2028.

TODAY’S SPONSOR

Tailored HR Software Recommendations for Your Organization

Choosing HR software can be overwhelming—with over 1,000+ tools on the market, it’s easy to spend days and still feel unsure.

That’s why thousands of HR teams rely on SSR’s HR software advisors. Instead of spending hundreds of hours on research and demos, you’ll get free 1:1 help from an HR software expert who understands your requirements and provides 2–3 tailored recommendations based on your unique needs.

Whether you're looking for an HRIS, ATS, or Payroll solution, we help you cut through the noise and make confident decisions—fast.

Why HR teams trust SSR HR Advisors:

✅ 100% free for HR teams

✅ Get 2-3 Tailored solutions from 1,000+ options

✅ 1:1 expert guidance from HR advisors

✅ Trusted by 15,000+ companies

From MIT to the Indianapolis Colts, smart HR teams trust SSR to find the right software—without the stress.

Dominating the AI Chip Race with Custom Precision

Broadcom is quickly emerging as a critical force in the AI semiconductor industry, thanks to its custom-built ASICs that outperform traditional GPUs on cost and efficiency.

Major hyperscalers and AI firms are increasingly choosing Broadcom to power their infrastructure, including Microsoft, Alphabet, OpenAI, and Meta.

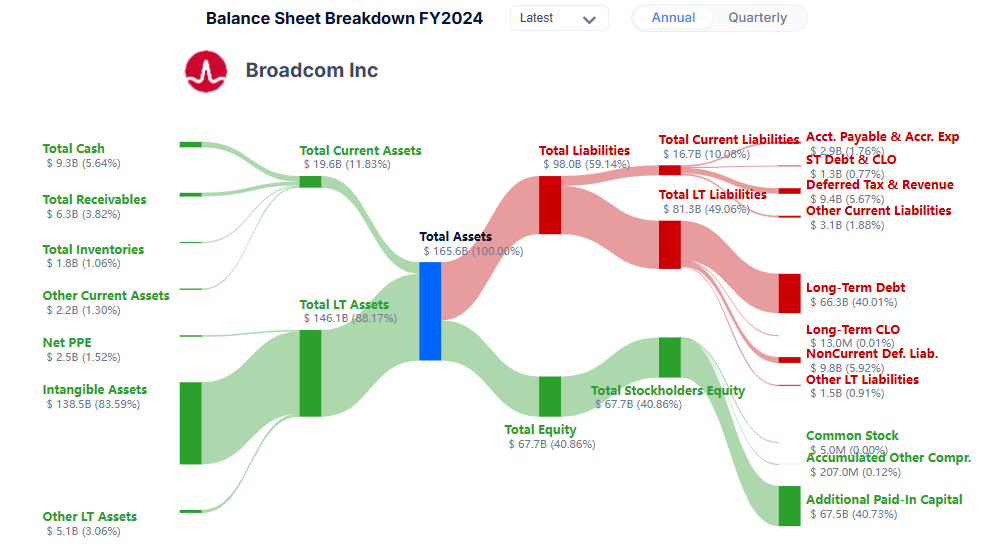

With AI chip sales accounting for nearly 30% of total revenue in the latest quarter, momentum is accelerating fast.

The company expects $5.1 billion in AI revenue this quarter alone—a staggering 60% year-over-year jump.

As industry demand shifts toward custom silicon, Broadcom’s early leadership is creating a wide moat that could fuel even stronger growth through 2028.

AI Momentum Could Propel a Market Cap Explosion

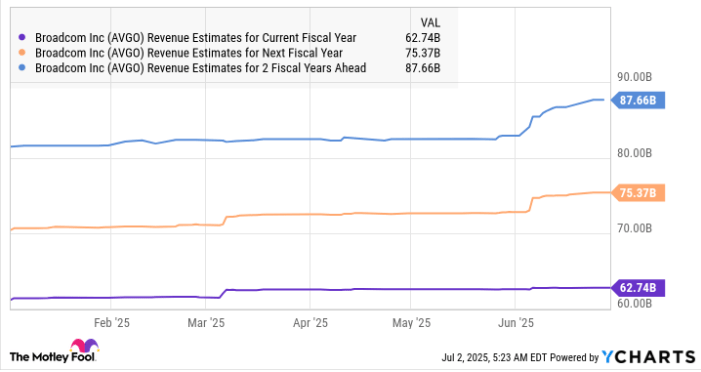

Broadcom's AI chip revenue is projected to skyrocket from $12.2 billion in 2024 to as much as $50 billion annually by 2027.

If the rest of the business remains stable, this massive AI tailwind could drive total revenue to nearly $90 billion.

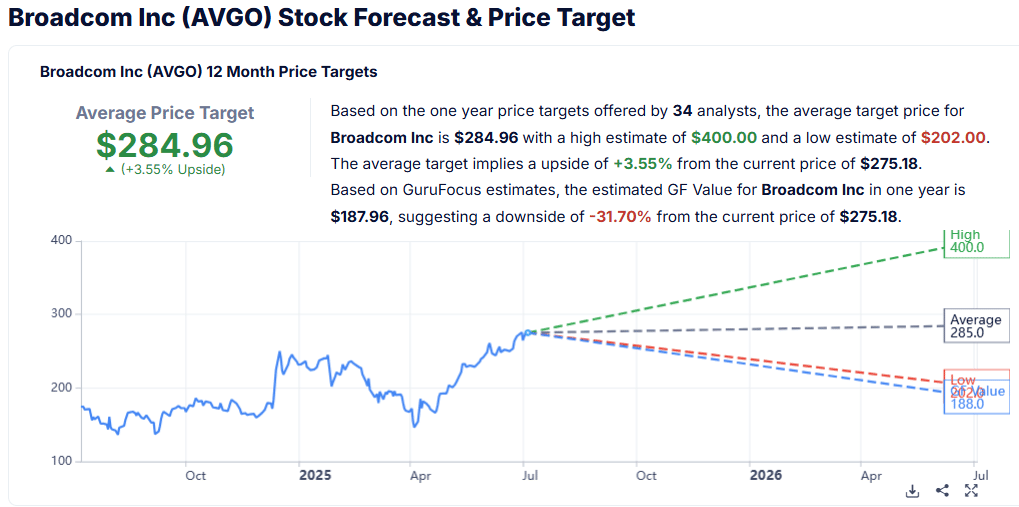

Given its strong price-to-sales ratio and rapidly expanding clientele, a $2 trillion valuation is well within reach—implying another 60% upside from today’s levels.

With its AI dominance, unmatched custom chip partnerships, and sustained profitability,

Broadcom may be the next mega-cap stock investors can’t afford to miss.

The current valuation premium could be just the beginning of its re-rating.

Strengths

Dominant AI chip market share: Broadcom controls an estimated 70% of the custom AI chip market, giving it pricing power and long-term scalability.

Elite customer base: Partnerships with tech giants like Microsoft, Alphabet, Meta, and OpenAI solidify credibility and long-term revenue visibility.

Massive addressable market: The shift toward in-house AI silicon is expanding Broadcom's addressable market to as much as $90 billion by 2027.

Weaknesses

Premium valuation: Broadcom's current high price-to-sales multiple leaves limited room for error and may deter value-focused investors.

Customer concentration risk: Heavy reliance on a few hyperscale clients could pose a risk if any shift supplier strategies or internalize chip production.

Cyclicality in semiconductors: Despite strong AI demand, the broader chip industry remains susceptible to economic cycles and inventory corrections.

Potential

AI boom just beginning: Global demand for efficient, scalable AI computing will continue to explode, and Broadcom is poised to capitalize early.

New partnerships incoming: Future deals with companies like xAI, Oracle, and Apple could dramatically expand revenue streams.

Valuation catch-up story: If Broadcom executes flawlessly on its roadmap, its valuation may rise further to reflect its AI leadership premium.

TODAY’S SPONSOR

Tackle your credit card debt by paying 0% interest until nearly 2027

If you have outstanding credit card debt, getting a new 0% intro APR credit card could help ease the pressure while you pay down your balances. Our credit card experts identified top credit cards that are perfect for anyone looking to pay down debt and not add to it! Click through to see what all the hype is about.

Conclusion

Broadcom has quietly become one of the most formidable players in the AI chip space, with surging revenue, top-tier clients, and a robust custom silicon strategy.

As hyperscalers demand more efficient chips tailored for AI workloads, Broadcom is positioned to reap massive gains.

Its AI revenue trajectory and dominant market share suggest that a $2 trillion valuation is not just possible—it may be inevitable.

Final Thought

If custom AI chips are the future of computing, could Broadcom be the Nvidia of the next wave?

The $2 trillion question might already have an answer.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply