- StocksGeniusMastery

- Posts

- 💥This AI Stock May Soon Be Worth More Than Alphabet and Amazon Combined — and It’s Not Nvidia

💥This AI Stock May Soon Be Worth More Than Alphabet and Amazon Combined — and It’s Not Nvidia

Microsoft’s enterprise AI revolution could make it the most valuable company in history.

Hello Fellow Investors!

Artificial intelligence continues to transform how companies operate and compete for global dominance.

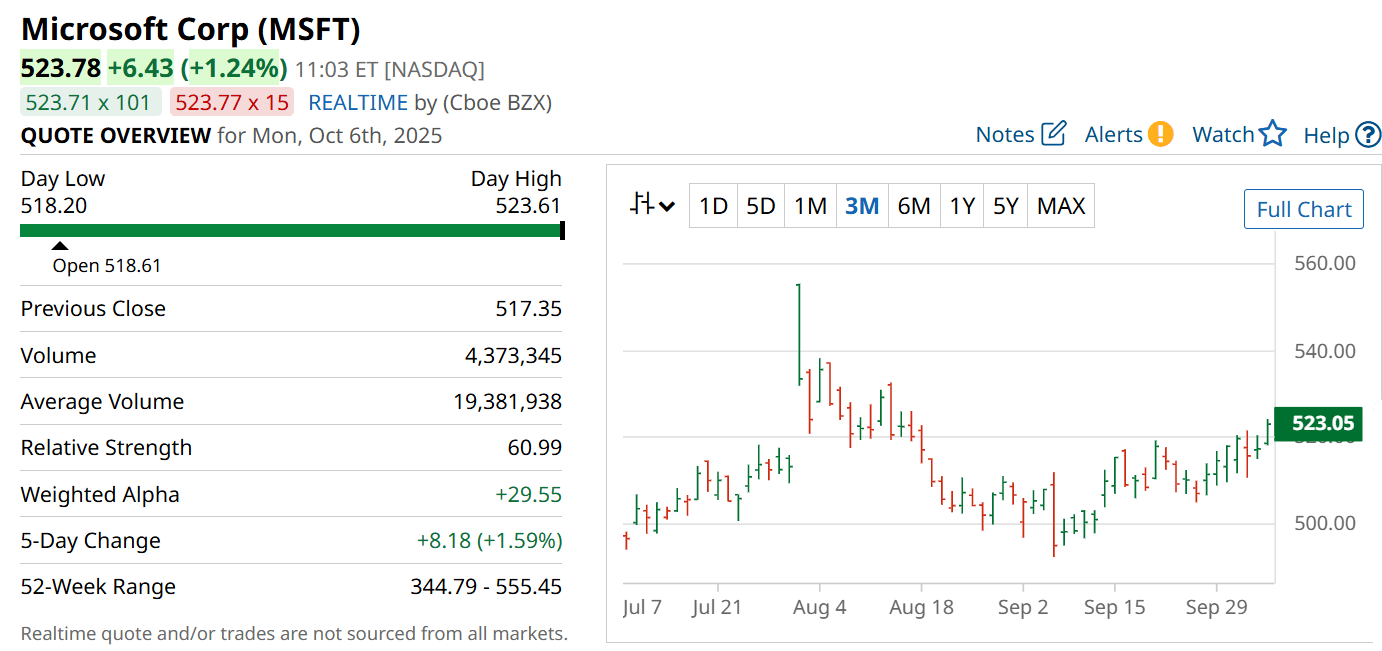

Among the tech titans, Microsoft (NASDAQ: MSFT) stands apart — its enterprise-first AI strategy may make it the most valuable company in the world by 2030.

Let’s break down why this bold prediction could soon become a reality.

Key Points:

Microsoft’s enterprise AI focus and recurring revenue model offer unmatched resilience.

Alphabet and Amazon face consumer exposure risks that could limit AI-driven growth.

Analysts predict Microsoft’s valuation could exceed $5 trillion by 2026 — and more than $6 trillion by 2030.

TODAY’S SPONSOR

The Simplest Way To Create and Launch AI Agents

Imagine if ChatGPT, Zapier, and Webflow all had a baby. That's Lindy.

With Lindy, you can build AI agents and apps in minutes simply by describing what you want in plain English.

→ "Create a booking platform for my business"

→ "Automate my sales outreach"

→ "Create a weekly summary about each employee's performance and send it as an email"

From inbound lead qualification to AI-powered customer support and full-blown apps, Lindy has hundreds of agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy automate workflows, save time, and grow your business.

The AI Supercycle: Microsoft’s Enterprise Model Leads the Charge

Artificial intelligence is reshaping every layer of business — and Microsoft is building the infrastructure to power it.

Unlike Alphabet (NASDAQ: GOOGL) or Amazon (NASDAQ: AMZN), which rely heavily on consumer markets like ads and e-commerce, Microsoft’s foundation is built on long-term enterprise contracts.

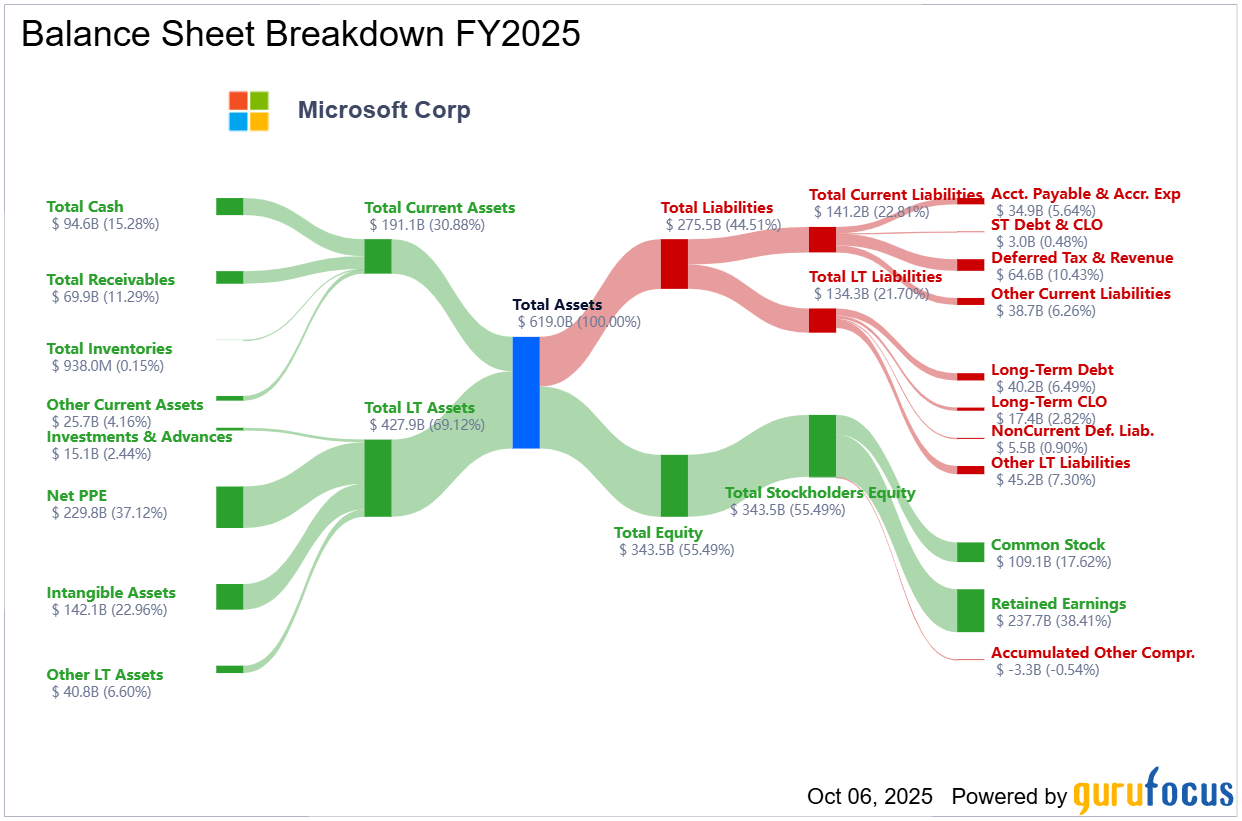

Its enterprise-first model gives it unparalleled revenue visibility — with 98% of revenues classified as recurring.

At the end of fiscal 2025, Microsoft reported a record $368 billion contracted backlog, showing investors just how sticky its customer base has become.

This structural edge makes Microsoft uniquely positioned to thrive even in volatile economic environments.

Copilot and Azure: Microsoft’s Secret Weapons for the AI Era

The company’s integration of AI through Copilot is nothing short of revolutionary.

Over 800 million monthly users engage with AI features across Microsoft’s ecosystem — from Office and Teams to GitHub and Dynamics.

Copilot’s usage by 70% of Fortune 500 companies underscores its dominance in enterprise adoption.

With more than 430 million paid Microsoft 365 seats and pricing starting at $30 per month, the monetization runway is massive.

Meanwhile, Azure, with a 20% global market share, continues to expand at double-digit growth rates — outpacing AWS in year-over-year revenue increases.

Together, Copilot and Azure create a powerful flywheel effect that strengthens Microsoft’s AI ecosystem with every new enterprise deployment.

Why Alphabet and Amazon May Struggle to Keep Up

Alphabet remains a key AI innovator, yet its dependence on ad revenue poses significant headwinds.

AI chatbots and generative search alternatives threaten its core Search business, while regulatory pressures in the EU constrain its ability to integrate AI deeply across platforms.

Amazon’s AI initiatives — including its Bedrock service and Trainium chips — show promise but face scaling and profitability challenges.

AWS, still the largest cloud player, reported 17.5% growth — far below Azure’s 34%.

With thinner e-commerce margins and higher costs tied to AI infrastructure, Amazon’s balance between innovation and profit could become increasingly difficult to maintain.

Microsoft’s Multi-Layered AI Stack Creates an Enduring Moat

From infrastructure to application, Microsoft owns the AI stack end-to-end.

Azure AI Foundry empowers enterprises to customize AI agents, while Fabric enables unified data analytics across systems.

Copilot Studio and Copilot Tuning allow organizations to embed generative AI directly into daily workflows, deepening customer stickiness.

This full-stack approach positions Microsoft as the operating system for enterprise AI — a role no other competitor currently matches.

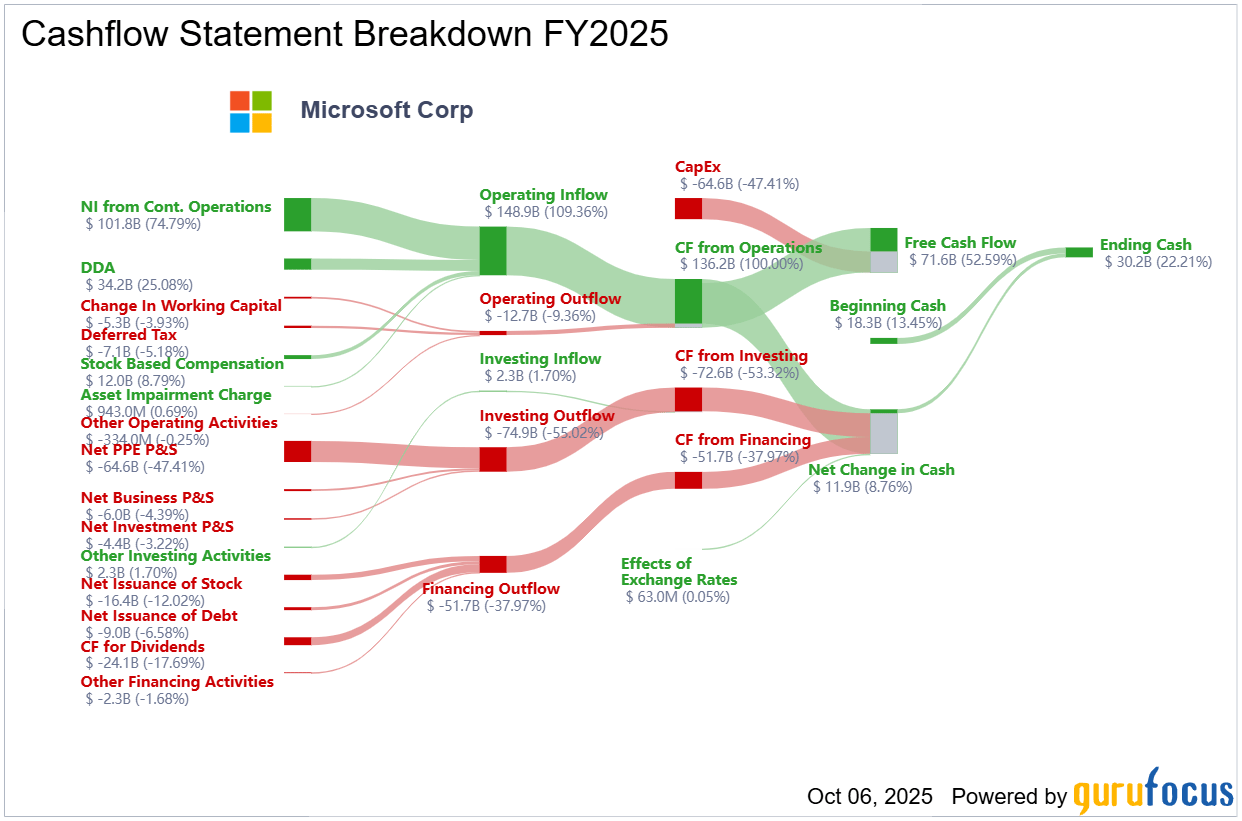

As adoption scales and margins improve through innovations like liquid-cooled data centers, Microsoft’s earnings potential could accelerate faster than any of its peers.

Strengths

A 98% recurring revenue model gives Microsoft unmatched income stability and forward visibility.

Copilot’s deep enterprise integration drives sustainable user engagement and premium pricing opportunities.

Azure’s accelerating market share and AI infrastructure expansion create a long-term growth flywheel.

Weaknesses

Valuation remains elevated at over 28x forward earnings, leaving limited room for short-term missteps.

Heavy reliance on enterprise adoption could slow if corporate budgets tighten in a macro downturn.

Rising AI competition from Alphabet, Amazon, and emerging players could pressure pricing in the future.

Potential

Microsoft could surpass a $6 trillion market cap by 2030, outpacing Alphabet and Amazon combined.

Expanding Copilot monetization across every Microsoft suite could drive record ARPU growth.

Continued Azure scale and AI efficiency improvements could unlock unprecedented operating leverage.

TODAY’S SPONSOR

Get Real Estate Training from Wharton Experts

Gain the skills top firms demand with the Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate.

In 8 weeks, learn from leaders at Blackstone, KKR, Ares, and more while analyzing real deals.

Save $300 with code SAVE300 + $200 with early enrollment by January 12.

Conclusion

Microsoft’s enterprise-centric AI empire is rapidly becoming the foundation of global business transformation.

With massive recurring revenue, unmatched integration, and accelerating AI adoption, it’s poised to dominate the next decade of market capitalization growth.

For investors betting on the next trillion-dollar leap, Microsoft may be the single most strategic play in artificial intelligence.

Final Thought

In a world chasing consumer clicks, Microsoft quietly built the infrastructure powering the AI economy.

The question isn’t if it will surpass Alphabet and Amazon — it’s when.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply