- StocksGeniusMastery

- Posts

- 💥 This Cybersecurity Leader Crushed 2025 Returns — Is CrowdStrike Still a Buy?

💥 This Cybersecurity Leader Crushed 2025 Returns — Is CrowdStrike Still a Buy?

Why CRWD’s AI edge matters more than its expensive valuation.

Hi Fellow Investors,

Cybersecurity stocks have quietly slipped out of the spotlight as artificial intelligence dominates market narratives.

This shift has created selective opportunities for investors willing to look past short-term hype cycles.

One of the most debated names heading into 2026 is CrowdStrike (NASDAQ: CRWD).

Key Points:

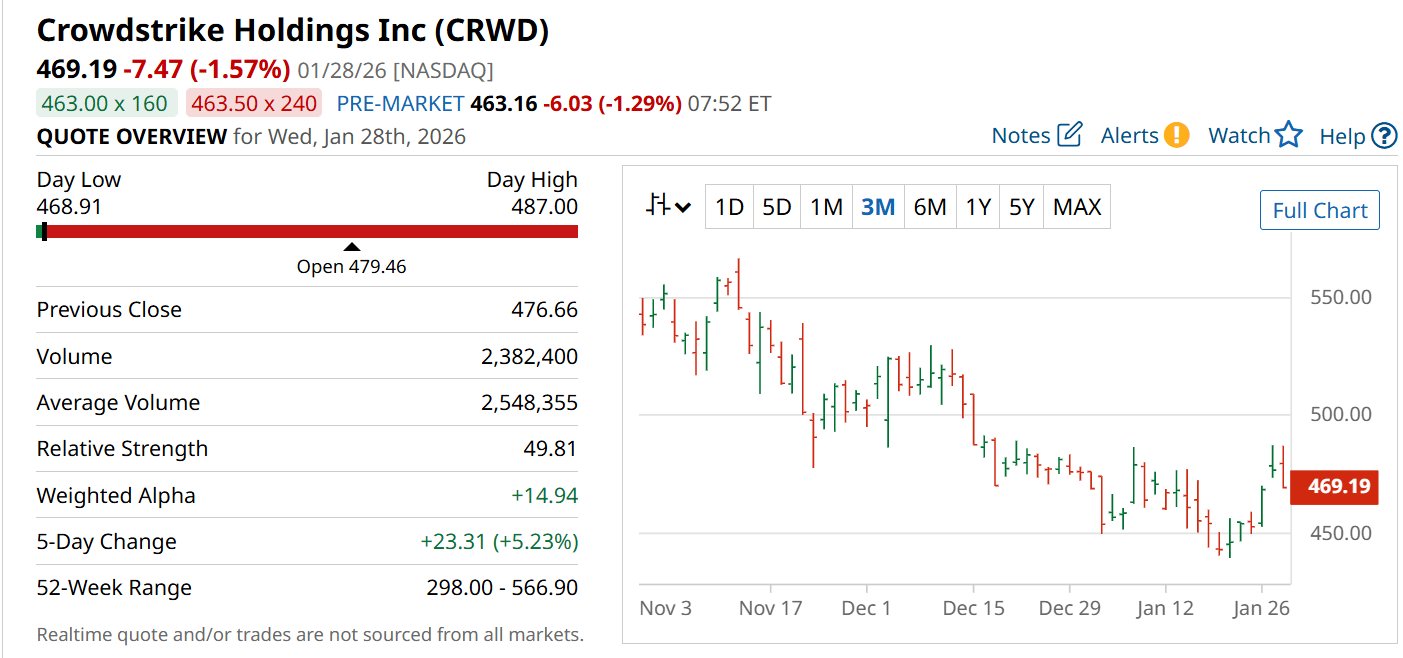

CrowdStrike delivered a 37% gain in 2025 as its stock rebounded and investor confidence returned.

AI-driven cybersecurity demand continues to expand, supporting strong long-term growth prospects.

Valuation remains elevated, raising questions about return potential in 2026.

TODAY’S SPONSOR

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

AI Is Powering the Next Phase of Cybersecurity Growth

CrowdStrike’s platform relies heavily on artificial intelligence to detect and neutralize threats before damage occurs.

As cybercriminals increasingly use AI-driven tools, defensive systems must evolve at the same pace.

This dynamic has kept demand strong for premium endpoint security solutions.

Revenue growth has remained robust, with analysts projecting approximately 22% growth into fiscal 2027.

Management estimates the cybersecurity total addressable market could expand from $140 billion today to $300 billion by 2030.

Why Cybersecurity Is Quietly Back on Investors’ Radar

Cybersecurity lost momentum after 2023 as AI-focused stocks captured most investor attention.

That shift has created attractive setups in established leaders with durable competitive advantages.

CrowdStrike remains one of the most recognized platforms in enterprise cybersecurity.

Its cloud-native architecture and subscription-based model provide recurring revenue visibility.

Long-term digital transformation trends continue to favor companies protecting critical data and infrastructure.

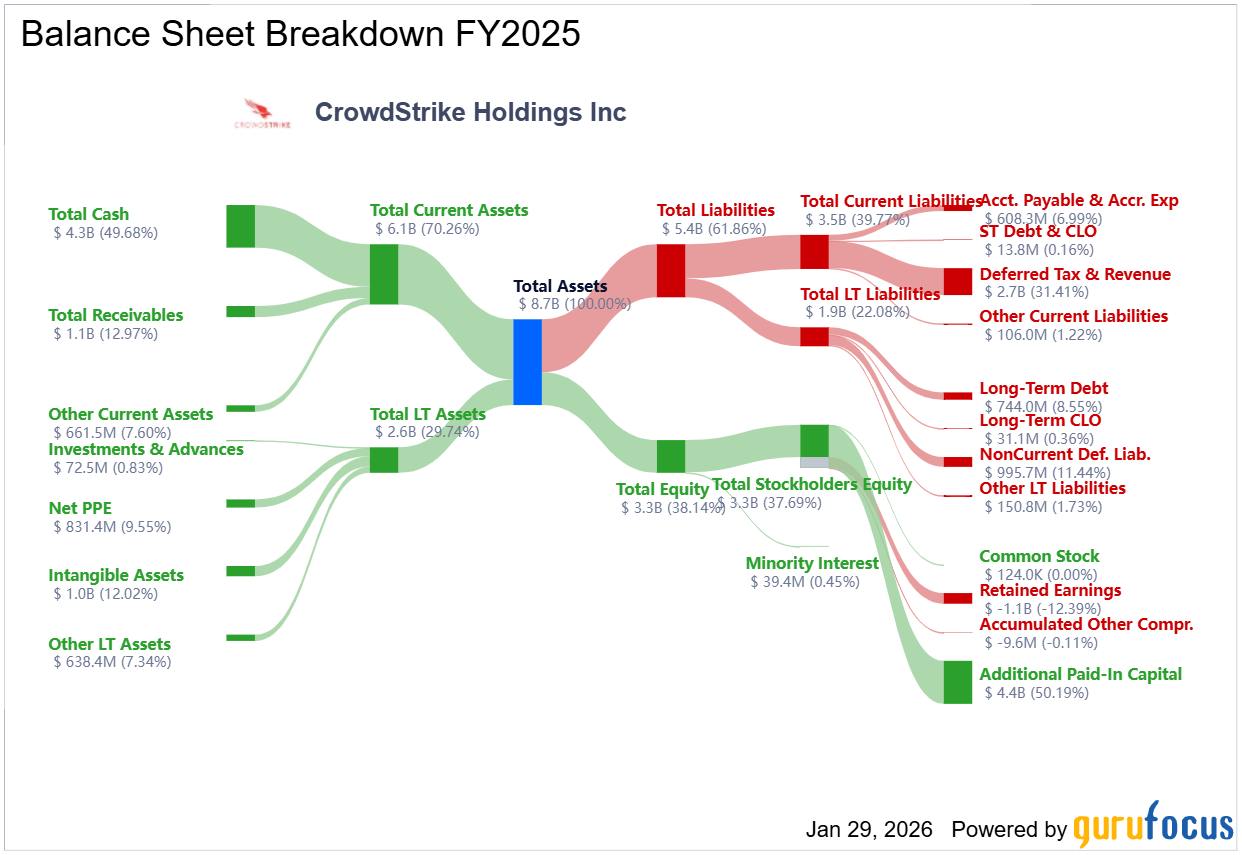

The 2024 Outage Still Shapes Today’s Valuation Debate

CrowdStrike suffered a major reputational hit after a faulty update triggered a global outage in July 2024.

The stock sold off sharply following the incident as trust concerns weighed on sentiment.

By 2025, much of that damage had been repaired, fueling a powerful rebound to new highs.

This recovery explains a large portion of the stock’s 2025 performance.

However, today’s valuation reflects optimism that leaves less room for error.

Valuation Is the Key Risk Heading Into 2026

CrowdStrike currently trades near 25 times sales, a premium even among elite software companies.

Revenue growth, while strong, does not fully justify the multiple from a conservative valuation lens.

Historically, high-multiple software stocks perform best when growth significantly outpaces valuation.

That imbalance creates the possibility of more modest returns going forward.

Mid-teens appreciation in 2026 appears more realistic than another breakout year.

Strengths

AI-driven threat detection positions the platform at the forefront of modern cybersecurity defense.

Strong brand recognition and enterprise adoption create durable competitive advantages.

Massive long-term market expansion provides a powerful runway for sustained growth.

Weaknesses

Premium valuation limits upside potential if growth slows or expectations reset.

Past operational missteps highlight execution risk in mission-critical software.

Stock performance may lag if investor focus shifts away from high-multiple tech names.

Potential

Continued AI adoption could reinforce CrowdStrike’s leadership position.

International expansion and module upselling may accelerate revenue per customer.

Long-term cybersecurity spending trends support steady market-beating returns.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

CrowdStrike enters 2026 as a fundamentally strong business with clear long-term tailwinds.

While another 37% surge appears unlikely, steady outperformance remains achievable.

For patient investors, the stock still offers compelling exposure to cybersecurity’s next growth phase.

Final Thought

Market darlings change, but mission-critical technologies rarely lose relevance.

The question for investors is not whether cybersecurity matters, but how much growth is already priced in.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply