- StocksGeniusMastery

- Posts

- 💥 This Magnificent Seven Giant Is Trading at a Rare Discount

💥 This Magnificent Seven Giant Is Trading at a Rare Discount

Why Wall Street May Be Underestimating This AI Powerhouse

Hi Fellow Investors,

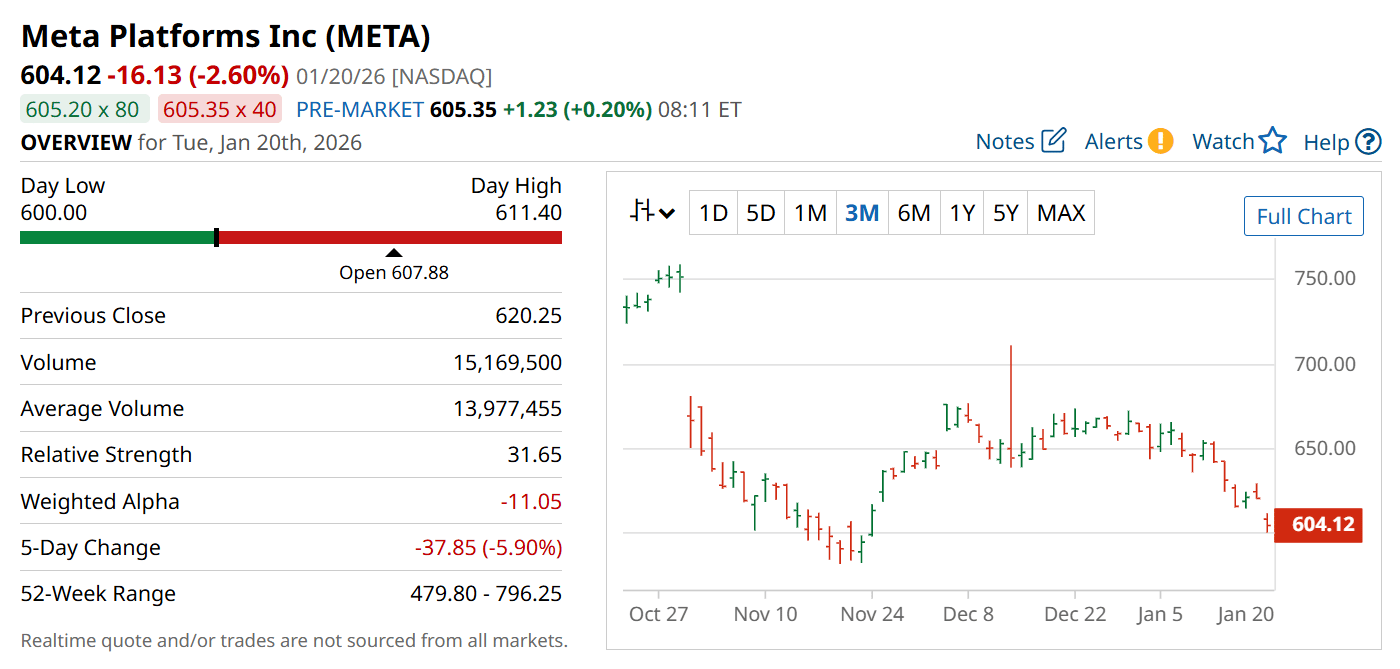

One of the Magnificent Seven stocks is trading near its lowest valuation in a year.

AI investments are accelerating, even as the market questions near-term spending.

A potential catalyst in advertising automation could emerge in 2026.

Key Points:

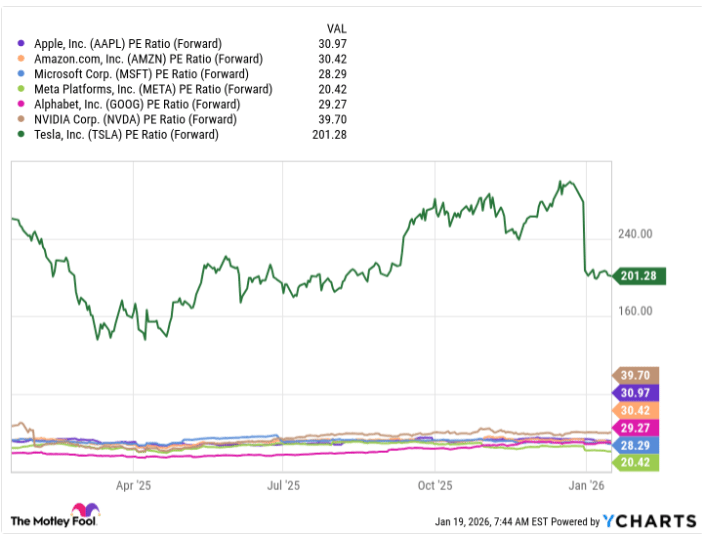

This Magnificent Seven stock trades at the lowest forward valuation among its peers.

Aggressive AI investments may unlock long-term growth despite near-term pressure.

A major advertising catalyst could reshape revenue growth by 2026.

TODAY’S SPONSOR

Help us make better ads

Did you recently see an ad for beehiiv in a newsletter? We’re running a short brand lift survey to understand what’s actually breaking through (and what’s not).

It takes about 20 seconds, the questions are super easy, and your feedback directly helps us improve how we show up in the newsletters you read and love.

If you’ve got a few moments, we’d really appreciate your insight.

Why This Magnificent Seven Stock Looks Mispriced

Meta Platforms (NASDAQ: META) stands out among the Magnificent Seven for one simple reason: valuation.

The stock trades at roughly 20 times forward earnings, well below peers trading at 28 times or higher.

This multiple places the company near its lowest valuation level of the past year.

Such pricing is unusual for a business with global scale and durable earnings power.

Market skepticism has created a rare opening for long-term investors.

Meta’s platforms reach roughly 3.5 billion daily users across Facebook, Instagram, Messenger, and WhatsApp.

This unmatched scale makes the company indispensable to global advertisers.

Advertising revenue has consistently fueled long-term earnings growth.

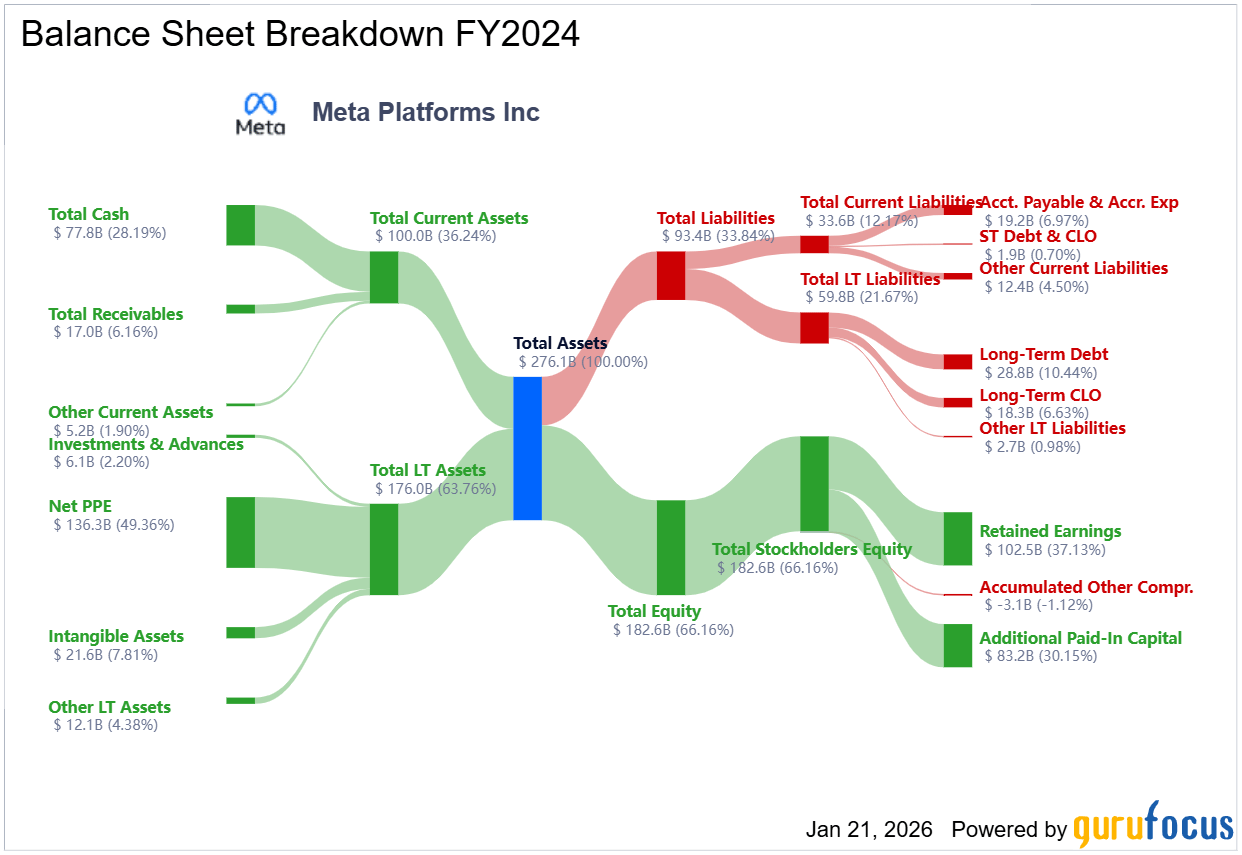

Strong cash flow has enabled aggressive reinvestment while still supporting shareholder returns.

The introduction of a dividend in 2024 reinforced Meta’s financial strength.

AI Is Becoming the Core Growth Engine

Meta has spent years building internal AI capabilities and large-scale data centers.

The company continues to increase AI-related capital expenditures to support future growth.

Its large language model development underpins both consumer and enterprise applications.

The launch of Meta Superintelligence Labs signaled a deeper commitment to AI leadership.

Top-tier talent acquisitions further strengthened execution potential.

Short-Term Concerns Are Masking Long-Term Opportunity

Heavy AI infrastructure spending has pressured near-term sentiment.

Some investors worry about excess capacity if AI demand slows.

Management has addressed these concerns, citing sustained demand for compute.

Flexible infrastructure plans allow spending to slow if conditions change.

The current valuation reflects caution rather than long-term fundamentals.

Strengths

Dominant global advertising platform supported by unmatched user scale.

Strong free cash flow enables AI investment, dividends, and long-term growth.

AI integration enhances targeting efficiency and advertiser return on investment.

Weaknesses

Heavy capital expenditures may pressure margins in the near term.

Regulatory scrutiny remains a persistent overhang.

AI monetization timelines remain uncertain.

Potential

Advertising automation could unlock a new phase of revenue acceleration.

AI-driven efficiency gains may expand margins over time.

Valuation re-rating is possible if AI investments begin delivering visible returns.

TODAY’S SPONSOR

Equipment policies break when you hire globally

Deel’s latest policy template on IT Equipment Policies can help HR teams stay organized when handling requests across time zones (and even languages). This free template gives you:

Clear provisioning rules across all countries

Security protocols that prevent compliance gaps

Return processes that actually work remotely

This free equipment provisioning policy will enable you to adjust to any state or country you hire from instead of producing a new policy every time. That means less complexity and more time for greater priorities.

Conclusion

This Magnificent Seven stock combines a rare valuation discount with a powerful AI roadmap.

Advertising automation could serve as a meaningful catalyst heading into 2026.

For long-term investors, current pricing offers an attractive risk-reward setup.

Final Thought

When a dominant tech leader trades at its lowest valuation in a year, opportunity often hides behind uncertainty.

The question is whether investors will recognize the value before the catalyst arrives.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply