- StocksGeniusMastery

- Posts

- Top 3 AI Stocks Analysts Can't Stop Talking About

Top 3 AI Stocks Analysts Can't Stop Talking About

Discover the AI investments set to soar and transform your portfolio

Top 3 AI Stocks Analysts Can't Stop Talking About

Analysts are buzzing about AI stocks as global demand for cutting-edge software and technology continues to surge. While many AI stocks have already seen exponential growth, analysts have highlighted some lesser-known gems with exciting potential.

Three AI stocks have emerged with strong ratings, reflecting their exceptional resilience to economic conditions and consistent demand. Staying informed with these top picks can offer investors significant advantages in the rapidly evolving AI market.

Let's dive into the reasons behind analysts' bullish outlook on these stocks and explore how their innovative contributions to the AI landscape make them must-buy investments.

Baidu (BIDU): This Chinese tech giant is set to rebound from economic challenges, leveraging its AI capabilities to drive future growth.

Taiwan Semiconductor Manufacturing (TSM): As the backbone of the AI industry, TSM continues to dominate the semiconductor market with its cutting-edge technology.

SentinelOne (S): Analysts see massive potential in this emerging cybersecurity firm, making it a promising investment in the AI-driven future.

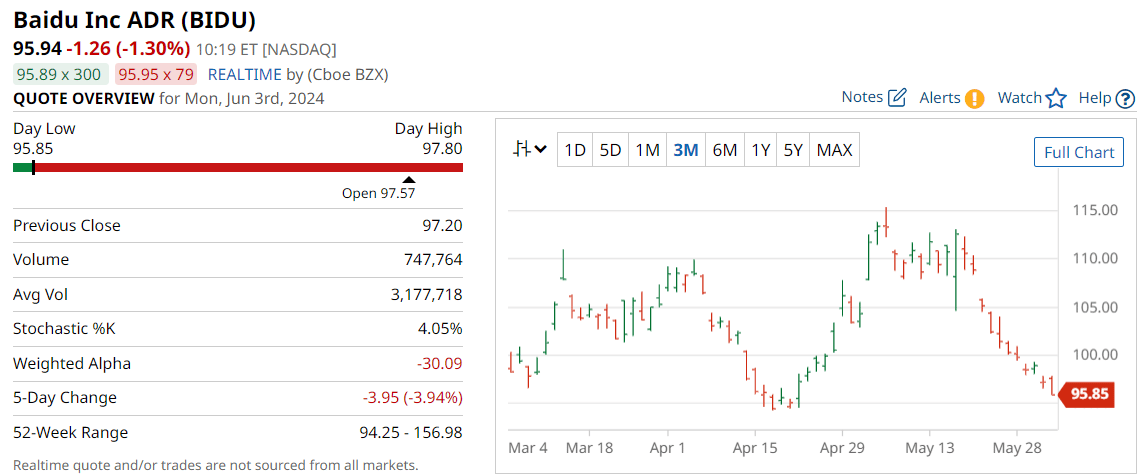

Baidu (NASDAQ: BIDU)

Baidu is a dominant player in the Chinese market, overcoming economic challenges with a strong focus on AI. Analysts are optimistic following Baidu's recent earnings beat.

Strengths:

Earnings Beat: Baidu exceeded EPS estimates by 26% and saw a 10% increase in income in the first quarter.

AI Contributions: Success in cloud computing and automated ride-sharing.

Healthy Cash Flow: Continuous growth funding further innovation.

Weaknesses:

Economic Headwinds: Impact from broader economic conditions in China.

Market Perception: Often seen primarily as a search engine rather than an AI leader.

Price Target Fluctuations: Analysts’ targets have varied recently.

Potential:

Affordable Valuation: Trades at a P/E ratio of 15.31, presenting a bargain.

Strong Buy Rating: Analysts maintain a buy rating despite recent fluctuations.

Expansion in AI: Continued investment in AI segments promises future growth.

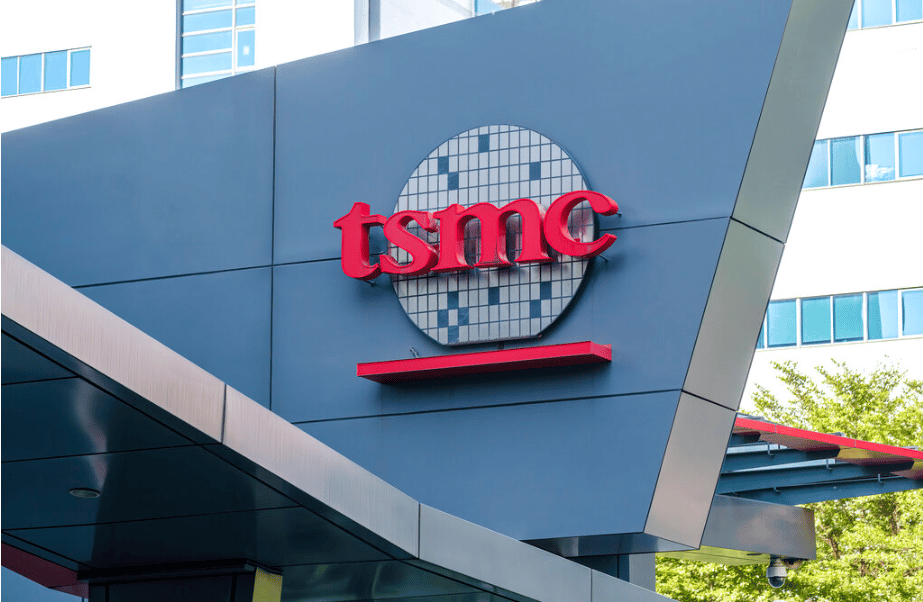

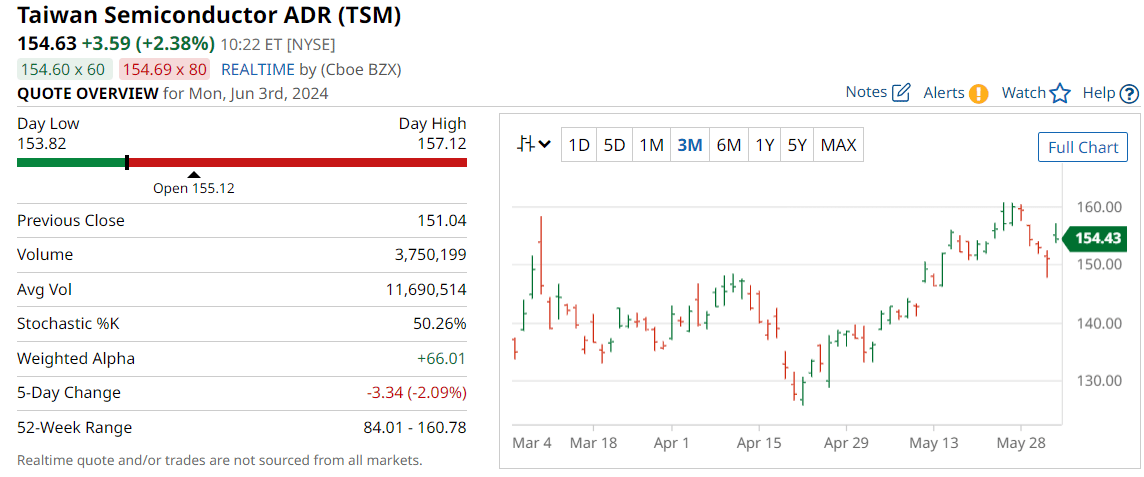

Taiwan Semiconductor Manufacturing (NYSE: TSM)

TSM stands as the backbone of AI hardware, manufacturing essential semiconductor chips for companies like Nvidia and AMD. Analysts see high potential following a robust earnings report.

Strengths:

Market Dominance: Unmatched manufacturing capacity for AI hardware.

Advanced Technology: Leading with 3nm chip technology.

Strong Earnings: Year-over-year increases in net income and revenue.

Weaknesses:

Market Dependency: Heavy reliance on demand from major tech companies.

Technological Costs: High expenses associated with maintaining cutting-edge technology.

Competitive Pressure: Constant need to innovate against competitors.

Potential:

Steady Growth: Expected to maintain a consistent growth rate.

Reasonable Valuation: Valued attractively considering its market position.

AI Demand: Strong demand for AI-related products indicates future success.

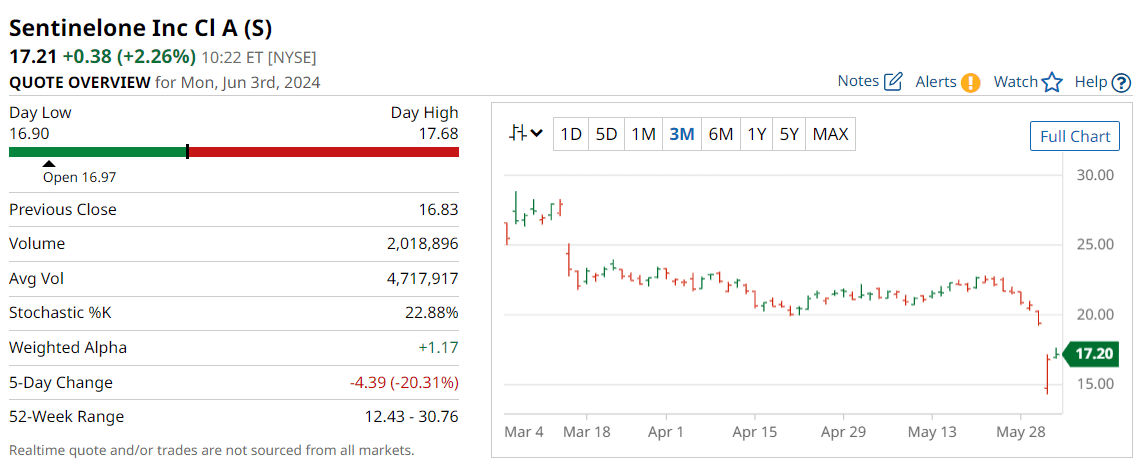

SentinelOne (NYSE: S)

SentinelOne is a rising star in cybersecurity, utilizing AI to drive its innovative Singularity platform. Analysts are impressed with its revenue growth and customer retention.

Strengths:

Revenue Growth: 47% increase year-over-year, with promising future guidance.

AI Integration: Uses machine learning to enhance cybersecurity measures.

Subscription Model: Growing customer base with increasing annual recurring revenue.

Weaknesses:

Inconsistent Path: Revenue growth has not always been steady.

High Competition: Faces intense competition in the cybersecurity sector.

Operational Costs: Significant investment needed for continuous AI development.

Potential:

Customer Loyalty: High growth in loyal, high-spending customers.

Analyst Optimism: Strong expectations for continued growth.

AI-driven Security: Cutting-edge AI solutions place it ahead in cybersecurity innovation.

Summary

Baidu, TSM, and SentinelOne are emerging as top picks in the AI sector, each demonstrating unique strengths and promising futures. Baidu capitalizes on its robust AI initiatives despite economic challenges. TSM leverages its dominance in semiconductor manufacturing to support AI advancements. SentinelOne leads in cybersecurity innovation with impressive revenue growth and customer retention.

Conclusion

The resilience and forward-looking strategies of these companies underscore their potential to deliver significant returns. Baidu’s affordable valuation and continuous investment in AI ensure its place as a strong contender in the AI space. TSM’s consistent financial performance and critical role in the AI ecosystem make it a reliable growth stock. Meanwhile, SentinelOne’s impressive revenue increase and expanding customer base demonstrate its capacity for rapid growth and market disruption.

By investing in these stocks, investors can harness the robust growth potential of the AI sector, driven by relentless innovation and increasing global demand. These companies are not only adapting to the current market dynamics but are also setting the stage for the future of AI technology.

Final Thought

In the ever-evolving landscape of AI, which of these powerhouse stocks will lead the next wave of innovation and deliver the highest returns for our savvy investors?

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors. Let’s strive towards financial freedom together!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply