- StocksGeniusMastery

- Posts

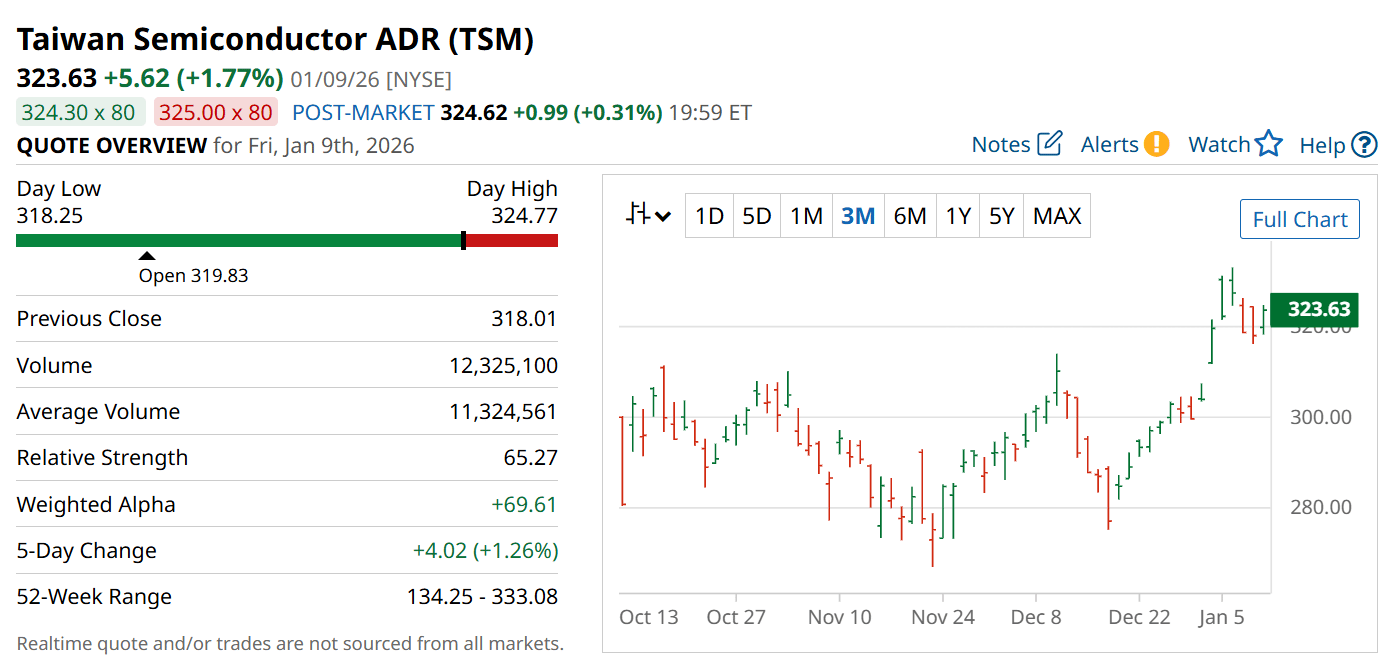

- 💥 TSMC Stock Ahead of Earnings: Smart Move or Risky Bet?

💥 TSMC Stock Ahead of Earnings: Smart Move or Risky Bet?

Why long-term investors may want to look past earnings day noise.

Hi Fellow Investors,

Expectations are building as Taiwan Semiconductor Manufacturing prepares to report its latest earnings.

The company delivered exceptional financial growth throughout 2025, yet the stock’s short-term reactions tell a different story.

This setup highlights the difference between trading earnings and investing in long-term dominance.

Key Points:

Taiwan Semiconductor Manufacturing is scheduled to release Q4 2025 earnings on Jan. 15.

Revenue, net income, and earnings per share all posted double-digit growth across the first three quarters of 2025.

The stock’s historical post-earnings performance suggests long-term investing may outperform short-term speculation.

TODAY’S SPONSOR

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

Earnings Strength Hasn’t Guaranteed Immediate Gains

Taiwan Semiconductor Manufacturing (NYSE: TSM) capped off 2025 as one of the market’s standout performers.

The stock surged more than 50% over the year, supported by record quarterly revenue and expanding margins.

Operational results in Q1 through Q3 showed consistent double-digit growth across revenue, profits, and earnings per share.

Despite that strength, the stock often struggled to rally immediately following earnings announcements.

This pattern highlights how strong fundamentals do not always translate into short-term price appreciation.

Post-Earnings History Sends a Clear Signal

Following Q1 earnings, the stock finished flat the next trading day.

After Q2 and Q3 results, shares declined roughly 2% despite solid financial beats.

Even five-day post-earnings returns were negative in two of the three quarters.

These reactions reinforce that earnings quality alone does not dictate short-term stock movement.

Market expectations, valuation, and broader sentiment often matter just as much.

Long-Term Demand Drivers Remain Intact

Taiwan Semiconductor Manufacturing sits at the center of global chip production.

Its advanced manufacturing powers leading technology companies across smartphones, data centers, and high-performance computing.

Artificial intelligence has accelerated semiconductor demand, and TSMC remains one of the primary beneficiaries.

While concerns about an AI bubble persist, the company’s exposure extends far beyond a single trend.

This diversification strengthens earnings durability over multi-year cycles.

Investment Thesis Favors Patience Over Timing

Buying ahead of earnings can be tempting, but historical data suggests caution.

Short-term traders may face volatility even after strong quarterly results.

Long-term investors, however, benefit from compounding growth driven by scale, technology leadership, and customer stickiness.

The real question is not what happens on Jan. 15, but where the company stands five to ten years from now.

That perspective aligns far better with TSMC’s proven execution track record.

Strengths

Unmatched scale and technological leadership make TSMC the backbone of global semiconductor manufacturing.

Strong margins and consistent revenue growth demonstrate pricing power and operational excellence.

Deep relationships with top-tier tech customers provide long-term demand visibility.

Weaknesses

The stock’s size and valuation can limit explosive short-term upside following earnings.

Heavy capital expenditures expose results to economic and industry cycles.

Geopolitical risks remain an overhang for investor sentiment.

Potential

Continued AI and high-performance computing adoption could drive multi-year revenue expansion.

Advanced process nodes strengthen competitive advantages against rival foundries.

Long-term investors may benefit from steady compounding rather than short-term price swings.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

Taiwan Semiconductor Manufacturing remains one of the highest-quality companies in the global technology ecosystem.

The stock’s history suggests earnings-day timing is less important than long-term conviction.

For patient investors, TSMC continues to represent durable growth backed by industry leadership.

Final Thought

Is chasing earnings worth the risk when long-term dominance is already in place?

Sometimes the best investment decision is focusing on the next decade, not the next headline.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply