- StocksGeniusMastery

- Posts

- 💥 Two Tech Titans Built to Dominate the Next Decade

💥 Two Tech Titans Built to Dominate the Next Decade

Why These Two AI Leaders Could Define the Next Five Years

Hi Fellow Investors,

Artificial intelligence continues to reshape the global economy at an accelerating pace.

Established technology leaders are uniquely positioned to monetize this transformation at scale.

Two dominant companies stand out as long-term compounders through the end of the decade.

Key Points:

Alphabet’s AI-driven search and cloud platforms continue to gain market share and pricing power.

Microsoft is embedding AI across its ecosystem, reaching over 900 million users worldwide.

Both companies combine strong earnings growth with reasonable valuations for long-term investors.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Alphabet’s AI Engine Is Firing on All Cylinders

Alphabet (NASDAQ: GOOGL) has transformed artificial intelligence into a powerful growth catalyst across its core businesses.

Google Search continues to generate massive cash flow while integrating AI features that increase engagement.

AI Overviews and AI Mode are driving higher query volumes, reinforcing Google’s unmatched data advantage.

That data flywheel strengthens the Gemini AI platform, improving relevance, speed, and monetization.

Meanwhile, Google Cloud is emerging as a major profit engine with strong enterprise adoption.

Strengths

Dominant search platform with billions of daily queries creates an unmatched AI training advantage.

Rapidly growing cloud business benefits from enterprise demand for AI-enabled infrastructure.

Strong balance sheet enables sustained investment in cutting-edge AI technologies.

Weaknesses

Heavy reliance on advertising revenue exposes the business to economic slowdowns.

Increasing regulatory scrutiny could pressure margins or limit strategic flexibility.

Intense competition in cloud services requires continued capital spending.

Potential

AI-enhanced search and productivity tools can unlock higher monetization per user.

Continued cloud market share gains could significantly expand operating margins.

Long-term earnings growth supports substantial upside through 2030 and beyond.

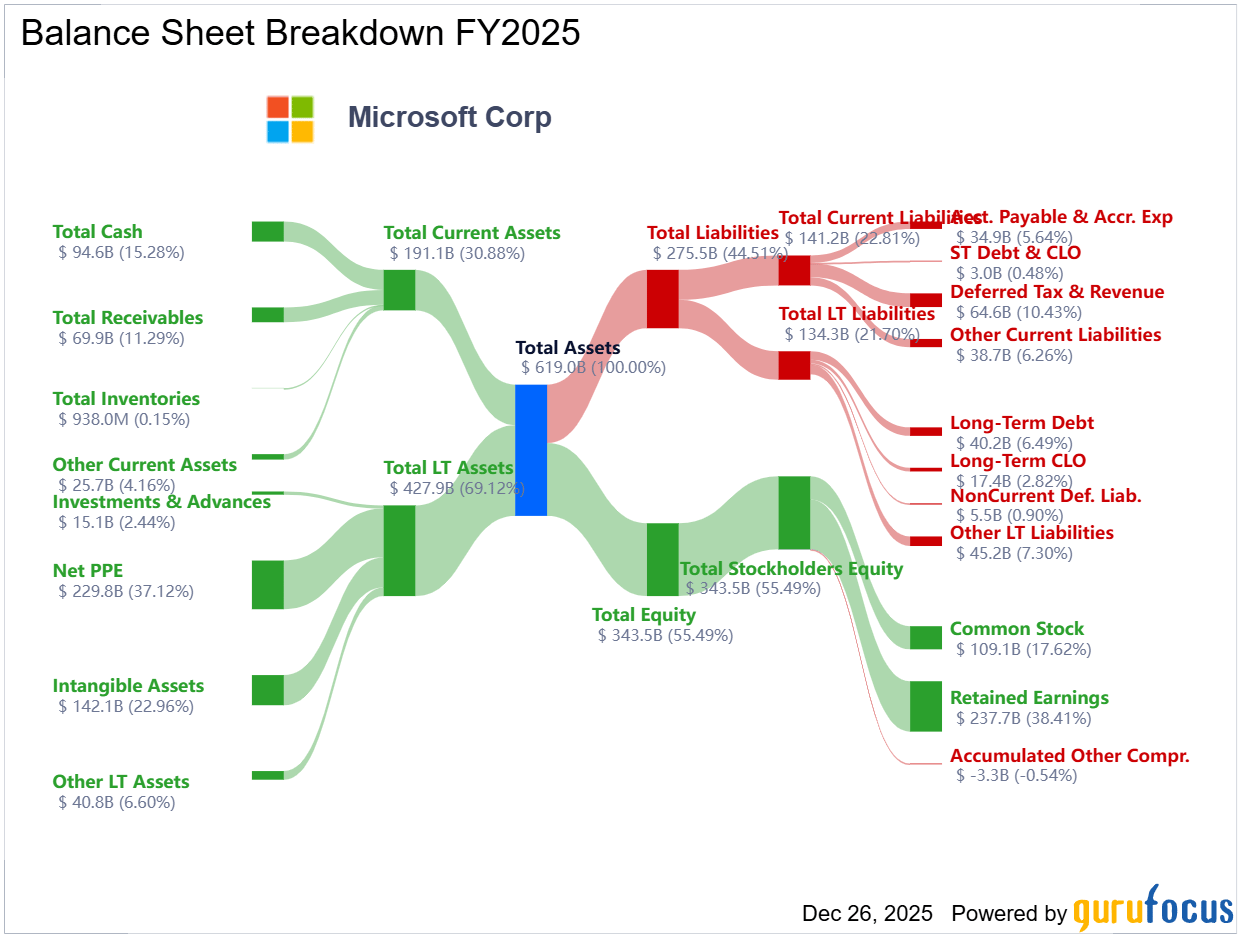

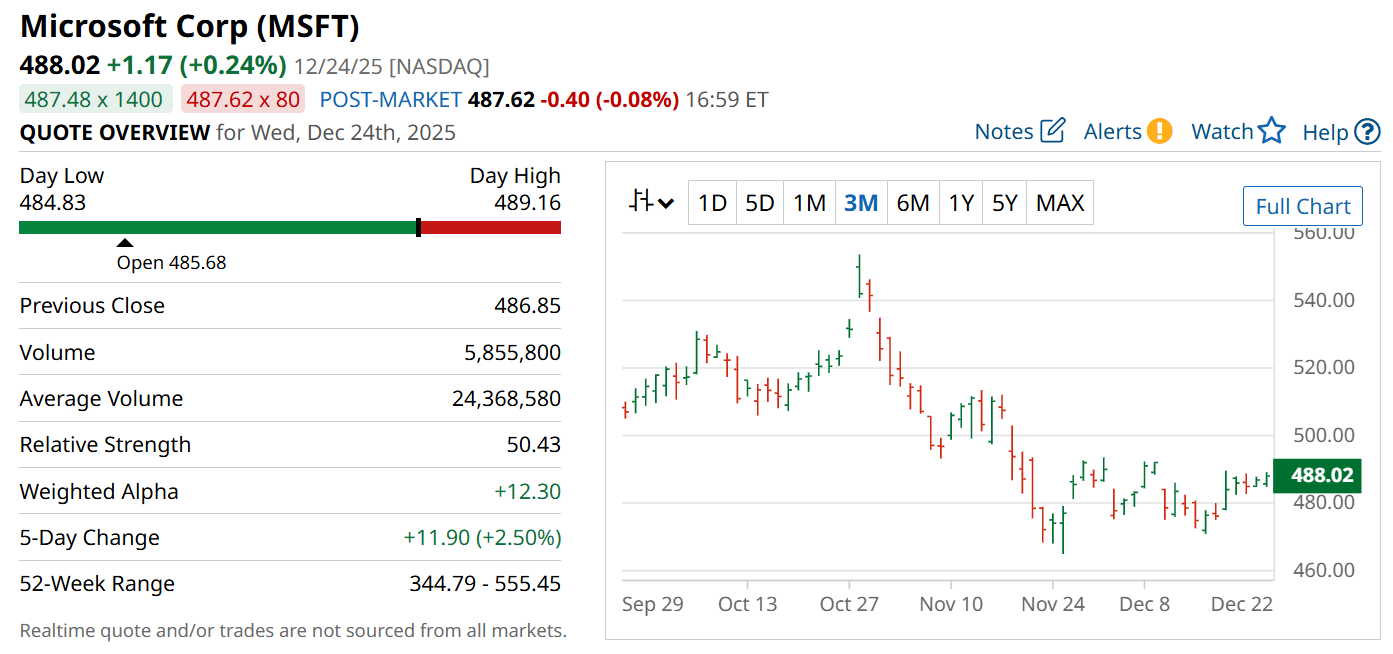

Microsoft’s AI Ecosystem Is Scaling at Unmatched Speed

Microsoft (NASDAQ: MSFT) is leveraging its massive installed user base to commercialize AI faster than any competitor.

AI features are now embedded across Windows, Office, and enterprise cloud services.

Over 900 million users actively engage with AI-powered tools across Microsoft’s ecosystem.

Microsoft 365 continues to see strong subscription growth as new AI features drive upgrades.

The company’s cloud platform supports both consumer and enterprise workloads at global scale.

Rising long-term enterprise commitments highlight Microsoft’s durable revenue visibility.

Strengths

Massive installed base allows rapid AI adoption without customer acquisition friction.

Strong enterprise relationships support long-term recurring revenue growth.

Cloud and software integration creates powerful cross-selling opportunities.

Weaknesses

Premium valuation leaves less margin for error during market pullbacks.

Heavy capital expenditures required to support AI and cloud infrastructure.

Dependence on enterprise spending cycles may introduce short-term volatility.

Potential

AI-driven productivity gains can justify higher subscription pricing over time.

Expanding cloud demand supports sustained double-digit earnings growth.

Microsoft’s role in the AI transformation positions it for long-term market leadership.

TODAY’S SPONSOR

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

Conclusion

Alphabet and Microsoft combine scale, profitability, and AI leadership into rare long-term investment opportunities.

Their entrenched ecosystems provide durable competitive advantages as AI adoption accelerates.

For patient investors, these two stocks offer compelling paths to compound wealth through the next decade.

Final Thought

The most powerful investment returns often come from owning exceptional businesses during transformative eras.

The question is not whether AI will reshape the economy, but which companies will capture the greatest value.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply