- StocksGeniusMastery

- Posts

- 💥Two Trillion-Dollar Giants, One Tough Choice

💥Two Trillion-Dollar Giants, One Tough Choice

Why Amazon and Microsoft Are Battling for AI Cloud Supremacy

Hi Fellow Investors,

Two mega-cap technology leaders are entering 2026 with accelerating cloud growth and unprecedented AI demand.

Both companies are spending aggressively to build the infrastructure powering the next decade of computing.

Valuation may be the deciding factor that separates the better long-term buy.

Key Points:

Amazon and Microsoft are seeing renewed acceleration in cloud revenue as AI adoption surges.

Massive AI infrastructure spending is pressuring free cash flow but positioning both firms for long-term dominance.

Amazon’s valuation currently appears slightly more attractive than Microsoft’s.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Amazon’s Business Is Far More Than Online Retail

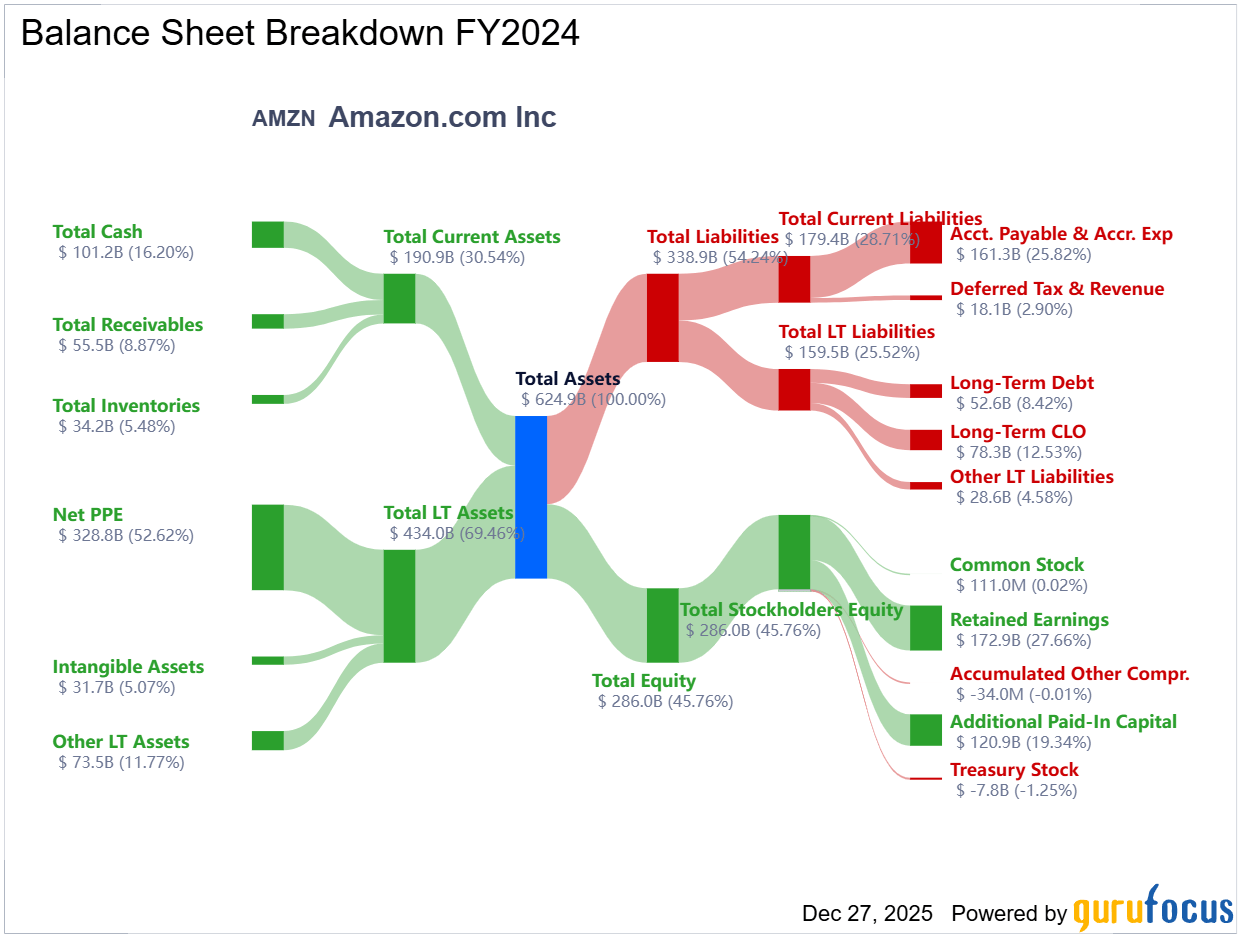

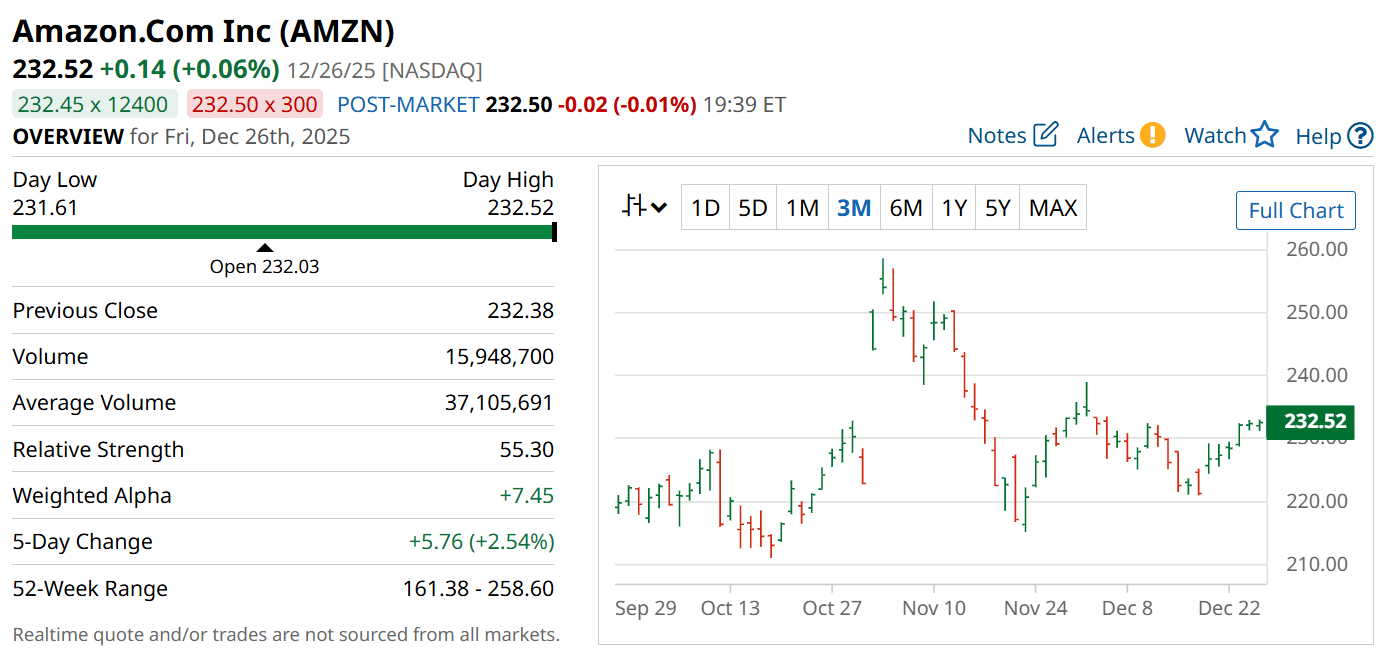

Amazon (NASDAQ: AMZN) continues to redefine itself as a high-margin technology platform rather than a pure retail operation.

Total revenue growth remains solid, but operating income is increasingly driven by Amazon Web Services rather than e-commerce.

AWS produced the majority of operating profits, highlighting its importance as Amazon’s core earnings engine.

Cloud growth is reaccelerating, with AWS revenue growth rebounding meaningfully compared to the prior quarter.

Advertising has quietly become another powerful profit lever, growing faster than both retail and cloud.

However, heavy capital spending on AI infrastructure is weighing on free cash flow despite strong operating cash generation.

Strengths

AWS remains the global leader in cloud infrastructure, giving Amazon unmatched scale and customer reach.

High-margin advertising revenue adds a fast-growing profit stream beyond retail and cloud services.

Diversified business lines reduce reliance on any single growth driver.

Weaknesses

Free cash flow has declined sharply due to massive capital expenditures.

Retail operations still carry structurally lower margins compared to cloud peers.

Heavy AI investment raises execution risk if demand normalizes.

Potential

Continued AWS acceleration could dramatically expand operating leverage over the next several years.

AI-driven cloud services may unlock premium pricing and long-term customer lock-in.

Advertising could evolve into a profit engine rivaling AWS over time.

Microsoft’s Software Empire Is Scaling Faster

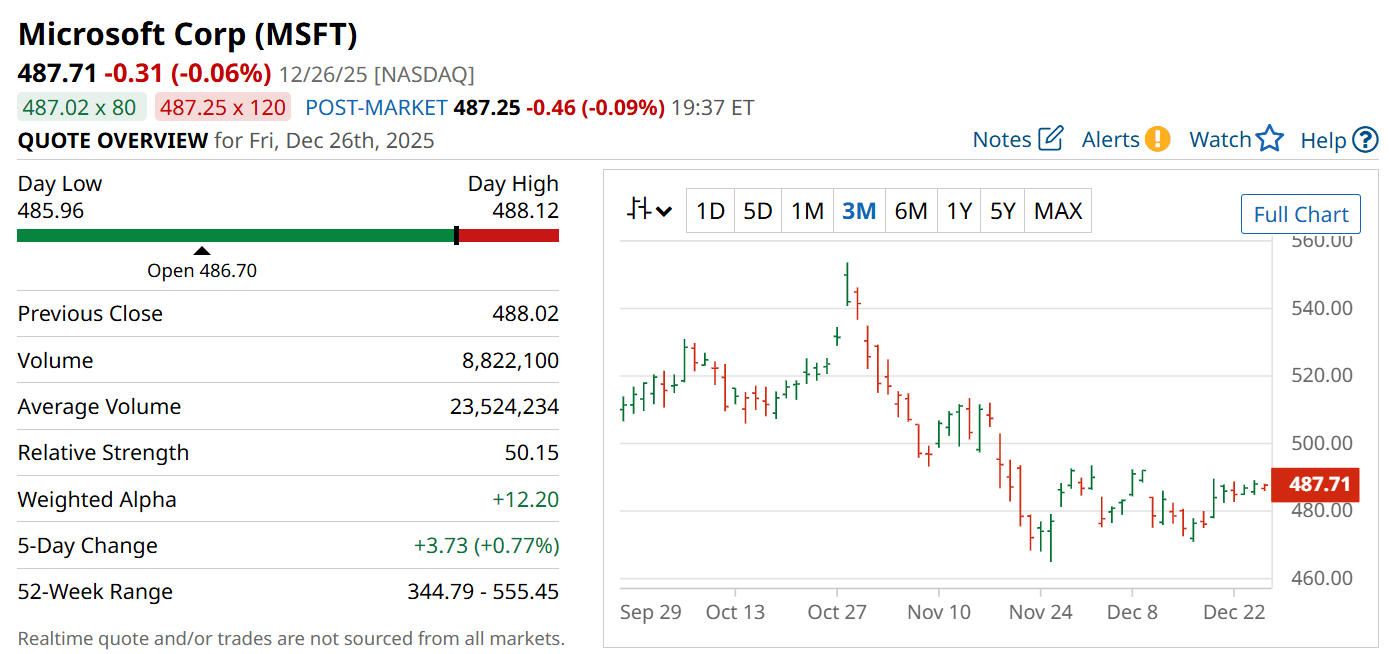

Microsoft (NASDAQ: MSFT) enters 2026 with faster overall revenue and operating income growth than Amazon.

The company’s cloud ecosystem spans far beyond infrastructure, encompassing productivity software, enterprise tools, and professional networking.

Azure remains a central growth driver, delivering exceptional expansion as enterprises scale AI workloads.

Unlike Amazon, Microsoft benefits from deeply embedded software subscriptions that provide recurring, high-margin revenue.

AI integration across Microsoft 365, Azure, and enterprise tools strengthens customer stickiness.

At the same time, Microsoft is committing vast capital to AI data centers, increasing near-term spending intensity.

Strengths

Broad software ecosystem delivers recurring, high-margin revenue across multiple platforms.

Azure’s rapid growth positions Microsoft as a major AI infrastructure beneficiary.

Strong profitability provides flexibility to fund long-term AI investments.

Weaknesses

Valuation premium reflects high expectations, leaving less room for execution errors.

Capital intensity is rising as AI infrastructure spending accelerates.

Cloud growth comparisons may become tougher as scale increases.

Potential

AI-powered productivity tools could drive sustained pricing power across enterprise software.

Azure’s momentum may close the gap with the cloud market leader.

Deep AI integration could further entrench Microsoft within enterprise workflows.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

Both Amazon and Microsoft are exceptionally positioned to benefit from cloud and AI adoption well beyond 2026.

Microsoft offers faster growth and superior margins, while Amazon provides cloud leadership and a slightly lower valuation.

For long-term investors weighing risk versus reward, Amazon currently holds a modest valuation edge.

Final Thought

When two dominant companies are both executing well, valuation often becomes the deciding factor.

The real question is whether today’s AI investments will justify tomorrow’s expectations.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply