- StocksGeniusMastery

- Posts

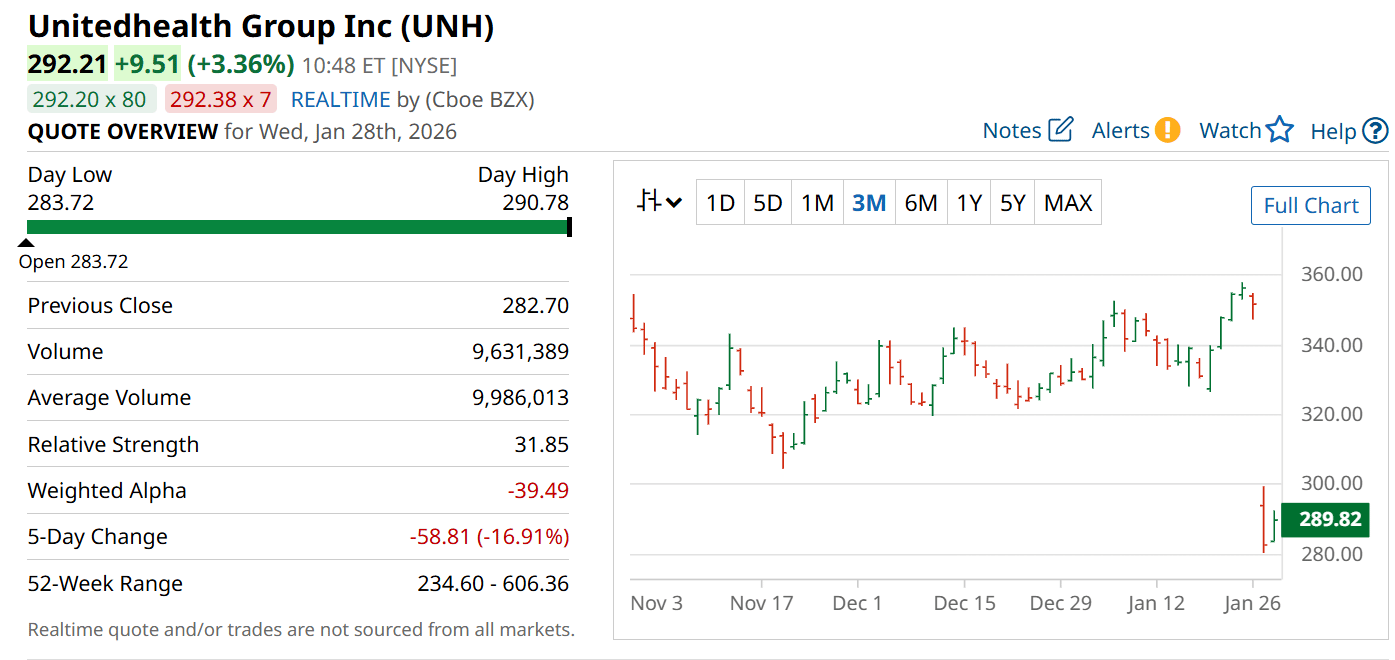

- 💥 UnitedHealth’s Turnaround Just Hit a Wall

💥 UnitedHealth’s Turnaround Just Hit a Wall

The Two Headwinds Threatening the Recovery Story

Hi Fellow Investors,

UnitedHealth Group (NYSE: UNH) entered 2026 as a potential recovery story after a turbulent year.

Fresh earnings guidance and policy developments have now reignited investor concerns.

The stock’s sharp decline highlights the challenges still facing the healthcare giant.

Key Points:

UnitedHealth’s 2026 revenue outlook disappointed investors and raised growth concerns.

Proposed Medicare Advantage rate freezes threaten profitability in a rising cost environment.

Despite near-term pressure, UnitedHealth retains long-term competitive advantages.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Earnings Growth Remains Elusive

UnitedHealth Group has spent much of the past year battling operational and financial headwinds.

Rising healthcare costs weighed heavily on earnings throughout 2025.

Fourth-quarter results showed only a marginal earnings beat, failing to reassure the market.

More importantly, management projected 2026 revenue above $439 billion, implying a 2% year-over-year decline.

That outlook signaled continued difficulty in reigniting sustainable growth.

Policy Risk Adds Pressure to Margins

Investor sentiment worsened following a proposed policy shift affecting Medicare Advantage plans.

The Trump administration suggested keeping reimbursement rates flat for 2027.

In an environment of increasing healthcare utilization, flat rates could compress margins.

UnitedHealth may be forced to raise premiums, reduce benefits, or absorb higher costs.

Each option complicates the company’s efforts to stabilize profitability.

A Recovery Story With More Volatility Ahead

UnitedHealth had shown signs of progress in the second half of 2025.

Operational adjustments and internal reviews helped restore partial investor confidence.

However, the recent 20% single-session decline underscores lingering uncertainty.

The turnaround appears slower and more complex than initially anticipated.

Patience may be required as management navigates both financial and regulatory challenges.

Strengths

Market leadership as the largest U.S. health insurer provides unmatched scale advantages.

Diversified operations through insurance and healthcare services reduce reliance on a single revenue stream.

Strong cash generation supports dividends and long-term strategic investments.

Weaknesses

Rising medical costs continue to pressure margins across core insurance businesses.

Regulatory scrutiny and policy changes add uncertainty to earnings forecasts.

Slowing revenue growth challenges the company’s premium valuation history.

Potential

Successful cost controls could restore earnings momentum over the next cycle.

Long-term demand for healthcare services supports durable revenue streams.

A stabilized Medicare environment could reignite investor confidence.

TODAY’S SPONSOR

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop, but people still drive decisions. Levanta’s research shows affiliate and creator content continues to influence conversions, plus it now shapes the product recommendations AI delivers. Affiliate marketing isn’t being replaced by AI, it’s being amplified.

Conclusion

UnitedHealth’s recent decline reflects legitimate concerns rather than temporary market noise.

Earnings pressure and policy risk remain real obstacles in the near term.

For long-term investors, the stock still represents a high-quality business facing cyclical challenges.

Final Thought

Market leaders are often tested most severely during periods of transition.

The question now is whether investors have the patience to wait for UnitedHealth’s next chapter.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply