- StocksGeniusMastery

- Posts

- Unleashing Tech Titans: 3 Stocks Primed for Explosive Growth

Unleashing Tech Titans: 3 Stocks Primed for Explosive Growth

Harness industry tailwinds with these top tech stock picks

Unleashing Tech Titans: 3 Stocks Primed for Explosive Growth

For investors looking to capitalize on the tech sector's momentum, this month presents prime opportunities. The technology industry continues to propel the stock market forward, as evidenced by Nvidia (NASDAQ) briefly tripling its market value to $3 trillion, surpassing Apple (NASDAQ) to become the second most valuable stock before recently slipping back to third place.

Other tech stocks are also making significant gains. For example, software company Dave (NASDAQ) has skyrocketed nearly 400% this year, and Microstrategy (NASDAQ) has surged 170%, largely due to the resurgence of Bitcoin (BTC-USD). These impressive performances highlight the lucrative potential within the tech sector.

To tap into this growth, consider these three tech stocks poised for explosive returns. Each offers unique catalysts that could propel them to new heights, making them top picks for savvy investors.

Super Micro Computer (SMCI):

Super Micro Computer, a powerhouse in AI-driven data center solutions, is set for a remarkable rebound as its massive growth potential is realized.Palo Alto Networks (PANW):

As a frontrunner in AI-powered cybersecurity, Palo Alto Networks is uniquely positioned to thrive amidst the rising tide of cyber threats.ACM Research (ACMR):

With its specialized semiconductor equipment, ACM Research is on the cusp of significant growth, fueled by the surging demand in the tech sector.

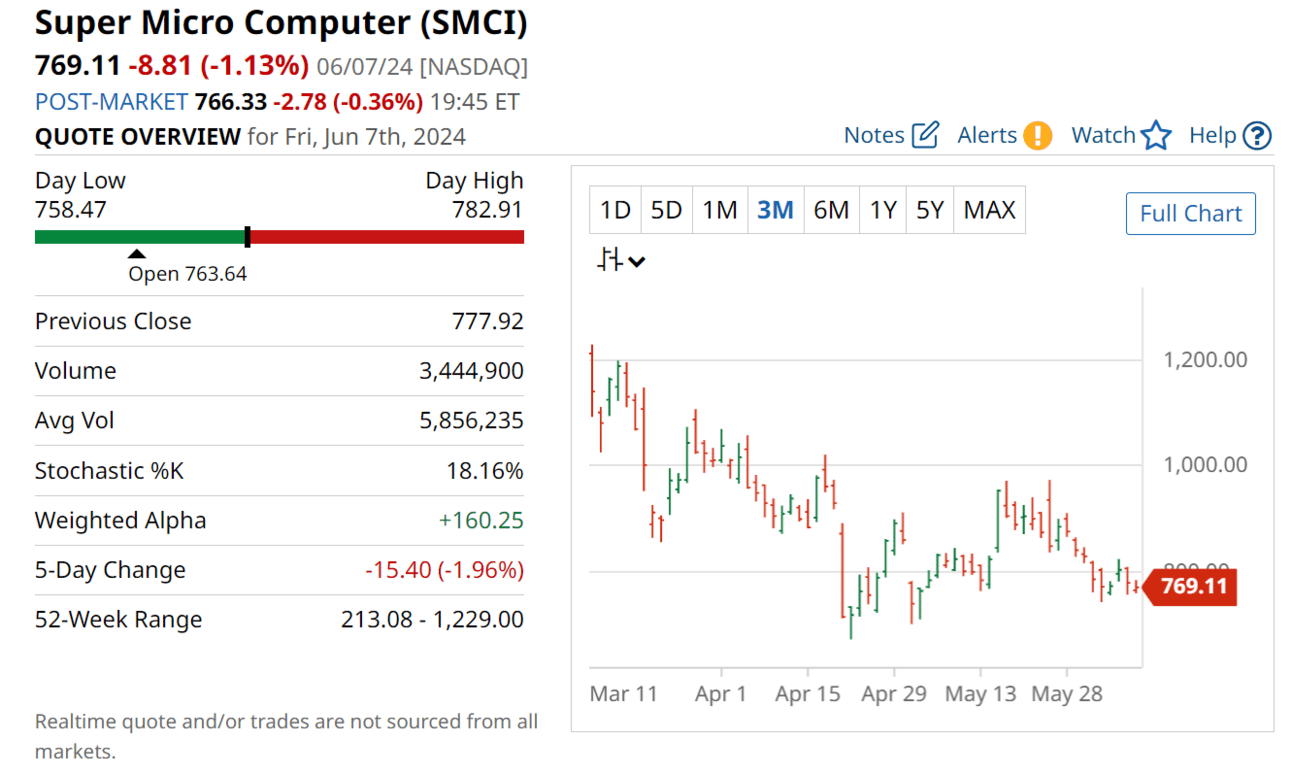

Super Micro Computer (NASDAQ: SMCI):

Super Micro Computer, a leading provider of AI-optimized computing solutions, has experienced a significant pullback from its all-time high despite strong growth. The company's recent fiscal results exceeded expectations, but cautious guidance led to a sell-off. With the ongoing demand for enhanced data center capacity from hyperscalers like Alphabet, Amazon, and Microsoft, Super Micro is well-positioned for future growth.

Strengths:

Market leader: Dominant position in AI-optimized computers and data center solutions.

High growth forecast: Expected to grow earnings by 62% annually over the next five years.

Strong demand: Continuous demand from major tech companies for data center expansions.

Weaknesses:

Stock volatility: Significant recent pullback from all-time highs.

Cautious guidance: Conservative outlook impacting investor sentiment.

Competitive market: High competition in the AI and data center sectors.

Potential:

Rebound opportunity: Potential for significant stock recovery as growth continues.

Industry tailwinds: Benefiting from the increasing need for AI and data processing power.

Attractive valuation: Trades at a fraction of its projected growth rate, presenting a buying opportunity.

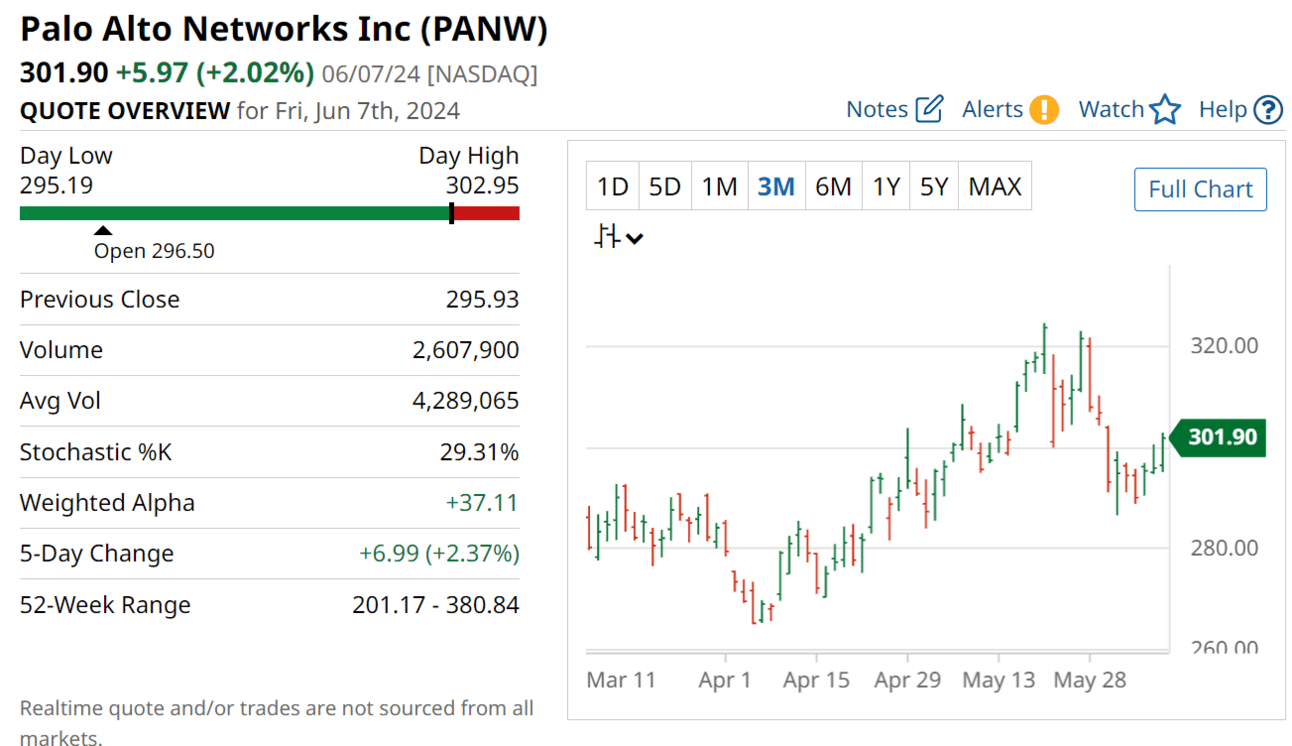

Palo Alto Networks (NASDAQ: PANW):

Palo Alto Networks remains a formidable force in the cybersecurity sector, offering advanced AI-driven solutions. Despite a modest stock performance this year and concerns over slowing billings growth, the company is capitalizing on the growing threat of cybercrime. Its strategy of consolidating customer spending under a single-platform offering positions it well for sustained growth.

Strengths:

Market position: Leading provider of cybersecurity solutions.

Growing demand: Increasing cyber threats drive continuous need for robust security.

Innovative offerings: AI-driven protection and program bundling attract customers.

Weaknesses:

Billing growth concerns: Slower billings growth impacting market perception.

Stock performance: Modest increase in stock value despite strong fundamentals.

Pricing strategy: Discounts to existing customers may affect short-term revenues.

Potential:

Discounted entry point: Current lower price offers a buying opportunity.

AI advancements: Leveraging AI for enhanced cybersecurity solutions.

Customer consolidation: Benefiting from customers consolidating their security spending with Palo Alto.

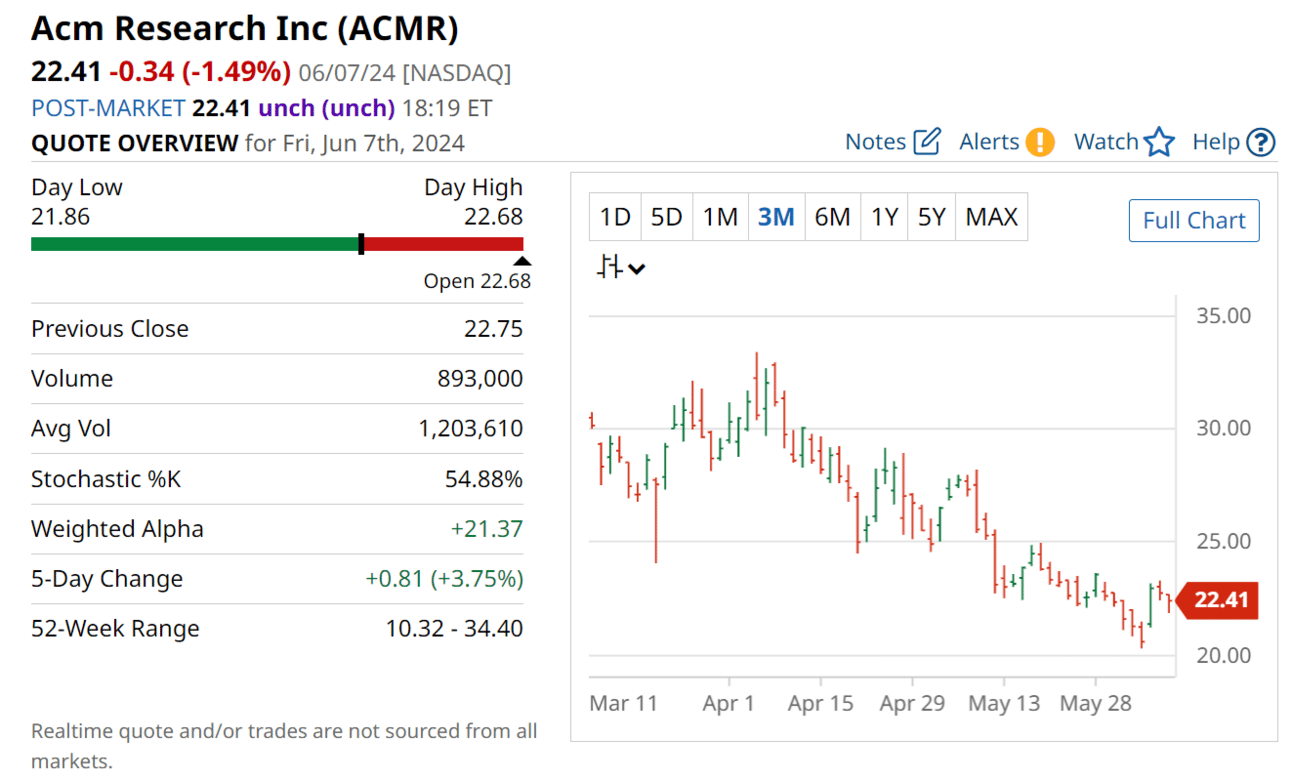

ACM Research (NASDAQ: ACMR):

ACM Research specializes in advanced wafer cleaning technologies essential for chip manufacturing. Despite a recent decline in stock price due to a temporarily declining market, long-term demand for clean wafer surfaces is expected to grow significantly. With analysts predicting a market recovery starting in 2025, ACM Research is well-positioned to capitalize on this trend.

Strengths:

Industry essential: Critical provider of wafer cleaning equipment for chip manufacturers.

Growth outlook: Expected market recovery and growth from 2025 onwards.

Rising chip demand: Increasing need for computer chips driven by AI and other technologies.

Weaknesses:

Market decline: Current market decline affecting short-term performance.

Stock volatility: Significant pullback from 52-week highs.

Industry dependence: Highly dependent on the semiconductor industry's health.

Potential:

Future growth: Positioned for substantial growth as the market recovers.

Industry demand: Increasing demand for clean wafer surfaces boosts long-term prospects.

Technological advancements: Continued innovation in wafer cleaning technology.

Summary:

Super Micro Computer, Palo Alto Networks, and ACM Research are three tech stocks poised for substantial growth. Super Micro's AI-optimized solutions, Palo Alto's cutting-edge cybersecurity offerings, and ACM Research's essential wafer cleaning technology position them as top picks for investors seeking massive returns.

Conclusion:

These tech titans are set to capitalize on industry tailwinds, offering significant growth potential for investors. With strong market positions and innovative solutions, Super Micro Computer, Palo Alto Networks, and ACM Research are well-equipped to navigate the evolving tech landscape and deliver impressive returns.

Final Thought:

As the tech industry continues to evolve, which of these emerging giants will lead the charge in redefining market leadership? The race for dominance is on, and the next decade will reveal the true titans of technology.

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors. Let’s strive towards financial freedom together!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply