- StocksGeniusMastery

- Posts

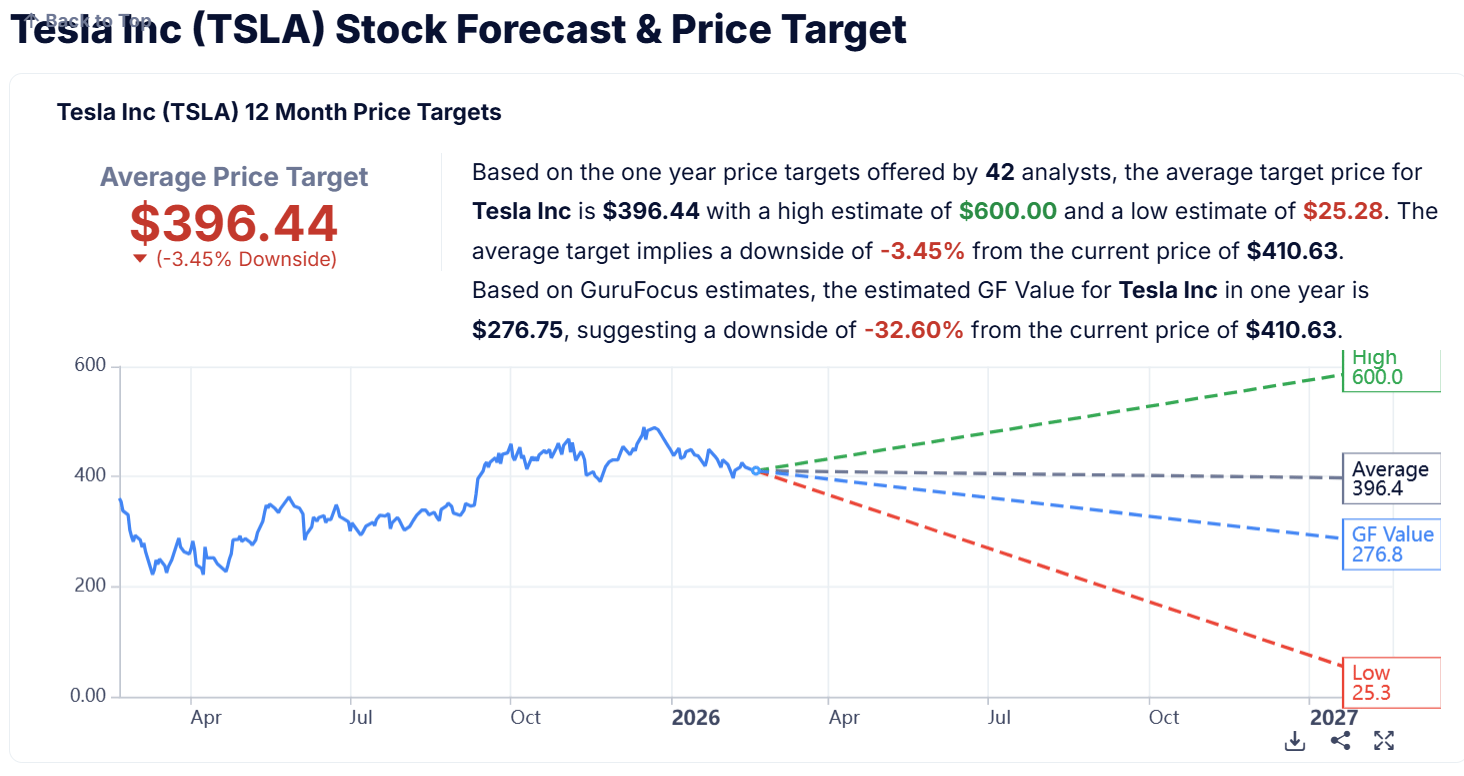

- 💥 Wall Street Is Divided on Tesla — Here’s Why 2026 Could Decide Everything

💥 Wall Street Is Divided on Tesla — Here’s Why 2026 Could Decide Everything

Rising margins meet falling sales in one of the market’s most polarizing stocks.

Hi Fellow Investors,

Tesla (NASDAQ: TSLA) has become one of the most debated AI stocks heading into 2026.

Some analysts see a catalyst-rich year driven by autonomous vehicles and humanoid robotics.

Others point to falling revenue, shrinking earnings, and an extremely stretched valuation.

Key Points:

Analysts are increasingly bullish on Tesla’s robotaxi and AI ambitions.

Revenue declined 3% in 2025 while earnings fell 47%, signaling operational pressure.

With a P/E ratio near 393, Tesla trades at a massive premium to the broader tech sector.

TODAY’S SPONSOR

Still searching for the right CRM?

Attio is the AI CRM that builds itself and adapts to how you work. With powerful AI automations and research agents, Attio transforms your GTM motion into a data-driven engine, from intelligent pipeline tracking to product-led growth.

Instead of clicking through records and reports manually, simply ask questions in natural language. Powered by Universal Context—a unified intelligence layer native to Attio—Ask Attio searches, updates, and creates with AI across your entire customer ecosystem.

Teams like Granola, Taskrabbit, and Snackpass didn't realize how much they needed a new CRM. Until they tried Attio.

Wall Street’s Growing Optimism Around Tesla’s AI Vision

Several analysts have recently upgraded their outlook on Tesla.

Autonomous vehicle expansion and robotaxi services are seen as massive long-term revenue drivers.

Some projections estimate robotaxi revenue could reach $250 billion annually by 2035.

Tesla’s gross margin improved to 20.1% in the fourth quarter, its highest level in two years.

The company also ended 2025 with $44 billion in cash and investments, strengthening its strategic flexibility.

Large total addressable markets in AVs and robotics are fueling bullish forecasts.

The Financial Reality: Sales and Earnings Are Under Pressure

Despite AI optimism, Tesla’s core business is facing measurable strain.

Revenue declined 3% in 2025, marking its first annual drop.

Earnings per share plunged 47% to $1.08.

Vehicle revenue fell 10% as EV demand cooled and competitive pressures intensified.

Meanwhile, capital expenditures are expected to more than double to $20 billion as Tesla ramps spending on autonomy and robotics.

The transition phase is creating short-term financial headwinds.

Valuation: The Biggest Risk in the Equation

Tesla currently trades at a price-to-earnings ratio of roughly 393.

That compares to a tech sector average closer to the low-40s range.

Such a premium assumes extraordinary future growth.

Any delay in robotaxi deployment or humanoid commercialization could compress that multiple sharply.

Investors are effectively pricing Tesla as a future AI platform rather than a cyclical automaker.

The controversy stems from whether that transformation happens soon enough to justify today’s price.

Strengths

Massive long-term opportunities in autonomous vehicles and humanoid robotics.

Improving gross margins and a strong $44 billion cash position provide strategic flexibility.

Brand recognition and technological integration give Tesla a first-mover perception in AI-driven mobility.

Weaknesses

Revenue and earnings declines highlight operational vulnerability during transition.

Capital expenditures are surging, increasing execution and cash flow risk.

A P/E near 393 leaves virtually no room for disappointment.

Potential

Successful robotaxi rollout could unlock a multi-hundred-billion-dollar revenue stream.

Humanoid robotics may open an entirely new industrial AI category.

If Tesla proves it can reignite earnings growth, sentiment could shift dramatically in its favor.

TODAY’S SPONSOR

Clear financial writing, faster

Turn spoken explanations into accurate, formatted financial copy for reports and investor comms. Wispr Flow saves editing time and keeps messaging consistent. Try Wispr Flow for finance.

Conclusion

Tesla’s AI ambitions are bold and potentially transformative.

However, current fundamentals and valuation create significant risk alongside the opportunity.

Investors must decide whether to prioritize long-term vision or near-term financial realities.

Final Thought

Visionary companies often look expensive before breakthrough moments.

The question is whether Tesla is on the verge of one — or still years away.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply