- StocksGeniusMastery

- Posts

- 💥 Wall Street’s Overlooked AI Powerhouse for 2026

💥 Wall Street’s Overlooked AI Powerhouse for 2026

This semiconductor giant is positioning for massive revenue and margin expansion.

Hi Fellow Investors,

The artificial intelligence boom is entering a new phase of infrastructure diversification.

Hyperscalers are no longer relying on a single chip supplier to power next-generation AI workloads.

One semiconductor company is emerging as a critical second pillar in the global AI stack.

Key Points:

Nvidia still dominates AI GPUs, but hyperscalers are actively diversifying their chip architectures.

Advanced Micro Devices is gaining traction as a credible, large-scale AI accelerator supplier.

Even modest market share gains could translate into outsized revenue and valuation expansion in 2026.

TODAY’S SPONSOR

AI in HR? It’s happening now.

Deel's free 2026 trends report cuts through all the hype and lays out what HR teams can really expect in 2026. You’ll learn about the shifts happening now, the skill gaps you can't ignore, and resilience strategies that aren't just buzzwords. Plus you’ll get a practical toolkit that helps you implement it all without another costly and time-consuming transformation project.

Why Hyperscalers Are Rebalancing Their AI Chip Strategy

Advanced Micro Devices (NASDAQ: AMD) is rapidly evolving from a secondary GPU player into a strategic AI infrastructure partner.

The company’s accelerators are now handling a growing portion of hyperscaler workloads.

This shift represents a major validation of AMD’s long-term AI roadmap.

Major cloud platforms are no longer testing AMD hardware in isolation.

Instead, AMD is being deployed alongside incumbent architectures in production-scale environments.

This dynamic signals growing confidence in AMD’s ability to support mission-critical AI operations.

Hyperscaler Adoption Is the Real Inflection Point

Microsoft, Meta Platforms, Oracle, and OpenAI are actively integrating AMD’s Instinct accelerators.

These deployments span both AI training and inference workloads.

Such usage confirms that AMD’s chips are capable of operating at hyperscale efficiency.

This adoption also changes the economics of AI infrastructure procurement.

By introducing AMD into their stacks, hyperscalers gain pricing leverage across the entire supply chain.

Over time, this could pressure incumbent pricing power while accelerating AMD’s deal flow.

Software Flexibility Is Undermining the GPU Status Quo

Nvidia’s CUDA platform remains the industry standard, but it is also highly proprietary.

AMD’s ROCm software ecosystem takes a fundamentally different approach.

Its open-source framework gives developers greater control and customization.

For hyperscalers, this flexibility translates into architectural independence.

That independence is increasingly valuable as AI workloads diversify.

This software strategy may quietly erode one of Nvidia’s strongest competitive moats.

AMD Is Becoming an End-to-End AI Systems Provider

AMD’s opportunity extends far beyond standalone GPUs.

The company is cross-selling CPUs, accelerators, and networking components.

This integrated approach allows hyperscalers to optimize performance across the full AI stack.

Few competitors can offer this level of architectural cohesion.

As AI infrastructure scales, integrated solutions become more attractive than fragmented sourcing.

This positions AMD as a long-term strategic partner rather than a tactical alternative.

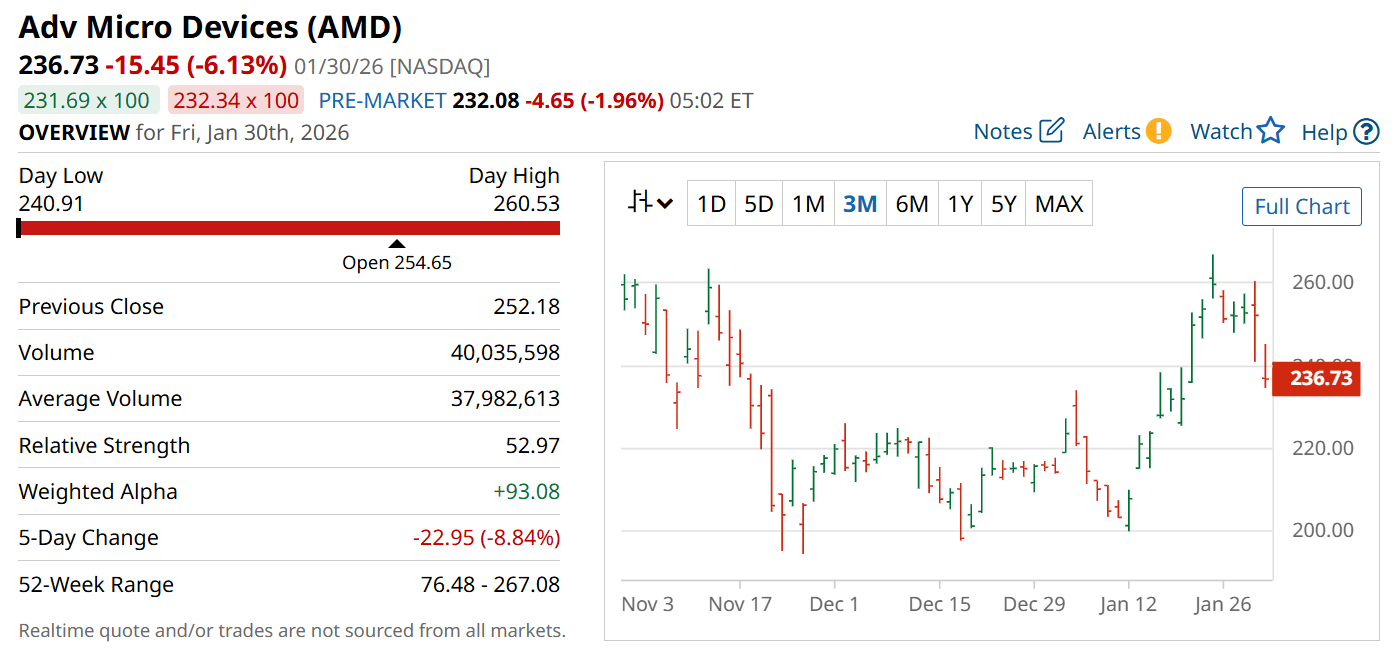

Why 2026 Could Be the Breakout Year

Industry forecasts suggest hyperscalers will spend over $500 billion on AI infrastructure annually.

AMD does not need dominant market share to materially benefit from this spending wave.

Even incremental adoption can drive meaningful revenue acceleration.

Operating leverage could amplify earnings growth as volumes scale.

As the market recognizes AMD’s expanding role, valuation multiples may re-rate higher.

This combination makes 2026 a potentially pivotal year for the stock.

Strengths

Rapidly increasing hyperscaler adoption validates AMD’s AI hardware at production scale.

Integrated portfolio spanning GPUs, CPUs, and networking strengthens long-term customer relationships.

Open-source software strategy appeals to large customers seeking architectural flexibility.

Weaknesses

Nvidia still commands overwhelming mindshare and ecosystem dominance in AI development.

Margins remain sensitive to pricing competition in large enterprise contracts.

Scaling AI accelerators fast enough to meet demand remains execution-critical.

Potential

Even small AI market share gains could unlock outsized revenue growth.

Expanding deployments may drive sustained margin expansion through operating leverage.

Growing perception as a core AI infrastructure pillar could fuel long-term valuation upside.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator?

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

Advanced Micro Devices is no longer just a secondary AI chip supplier.

Its accelerating hyperscaler adoption suggests a structural shift in the AI semiconductor landscape.

For investors seeking asymmetric upside, 2026 may mark a defining inflection point.

Final Thought

The AI revolution is no longer about a single winner.

The next phase may reward investors who recognize the power of strategic alternatives before the crowd.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply