- StocksGeniusMastery

- Posts

- 💥 Wall Street Sees a $1 Trillion Semiconductor Market in 2026 — These 2 Stocks Stand Out

💥 Wall Street Sees a $1 Trillion Semiconductor Market in 2026 — These 2 Stocks Stand Out

Attractive valuations meet powerful AI-driven tailwinds.

Hi Fellow Investors,

Semiconductor demand is entering a historic expansion phase driven by artificial intelligence.

Wall Street forecasts suggest the industry is approaching a $1 trillion revenue milestone.

Two companies stand out as prime beneficiaries of this accelerating trend.

Key Points:

Semiconductor sales could surpass $1 trillion in 2026 as AI infrastructure spending explodes.

AI accelerators and data center buildouts are driving unprecedented demand growth.

Nvidia and Lam Research offer complementary ways to capitalize on this cycle.

TODAY’S SPONSOR

Easy setup, easy money

Making money from your content shouldn’t be complicated. With Google AdSense, it isn’t.

Automatic ad placement and optimization ensure the highest-paying, most relevant ads appear on your site. And it literally takes just seconds to set up.

That’s why WikiHow, the world’s most popular how-to site, keeps it simple with Google AdSense: “All you do is drop a little code on your website and Google AdSense immediately starts working.”

The TL;DR? You focus on creating. Google AdSense handles the rest.

Start earning the easy way with AdSense.

A $1 Trillion Semiconductor Catalyst Is Taking Shape

The semiconductor industry delivered strong growth in 2025, with global sales rising more than 20%.

Momentum is expected to accelerate sharply as AI infrastructure spending ramps into 2026.

Industry forecasts project sales nearing $1 trillion, while some analysts see revenues exceeding that mark.

AI data centers are the primary driver, with spending projected to grow at an extraordinary pace through 2030.

This creates a powerful multi-year tailwind for companies tied directly to AI hardware demand.

The Clear Leader in AI Chips

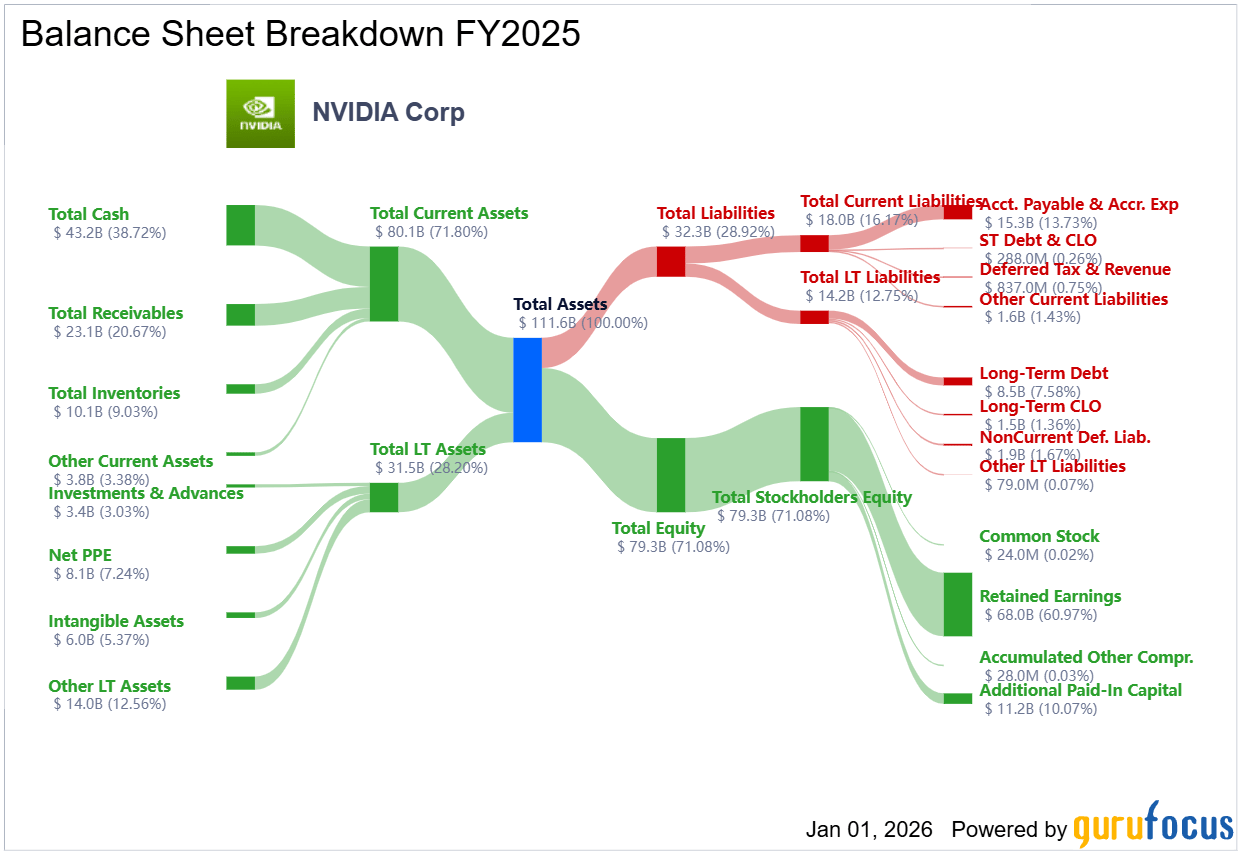

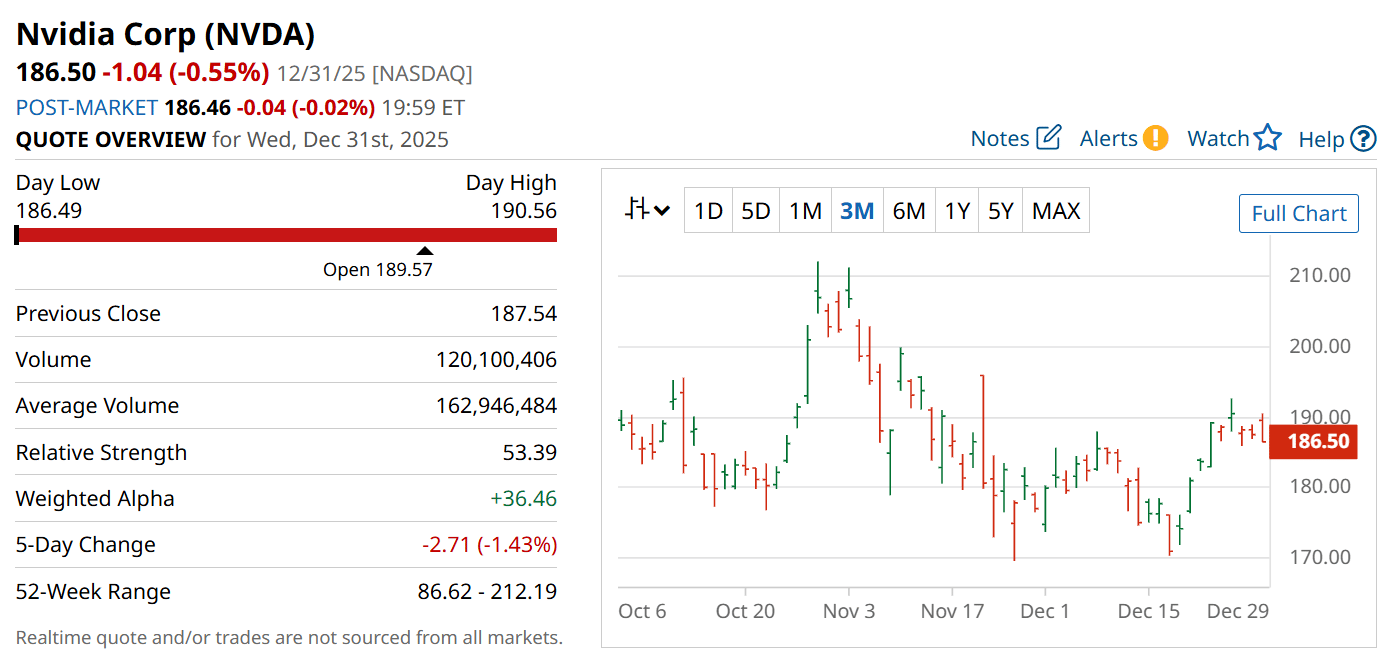

Nvidia (NASDAQ: NVDA) remains the dominant force in AI accelerators.

The company controls an overwhelming share of the data center GPU market.

Its chips power the training and inference of the world’s most advanced AI models.

Analysts expect revenue and earnings to surge again in the upcoming fiscal year.

Despite its leadership, the stock trades at a valuation that remains reasonable relative to its growth.

Why Nvidia’s Growth Runway Remains Long

Nvidia’s technological lead has allowed it to stay one step ahead of emerging competitors.

AI chip demand continues to outstrip supply as hyperscalers race to expand capacity.

Revenue expectations for the next two years continue to move higher.

That growth is expected to translate directly into strong earnings expansion.

As AI spending accelerates into 2026, Nvidia remains one of the most direct beneficiaries.

Strengths

Dominant market share in AI data center GPUs creates a powerful competitive moat.

Rapid revenue and earnings growth driven by insatiable AI demand.

Strong margins provide flexibility to reinvest and innovate ahead of rivals.

Weaknesses

Heavy dependence on AI spending cycles increases volatility risk.

Rising competition could pressure pricing over time.

Enormous scale makes sustaining hypergrowth more challenging long term.

Potential

AI accelerator sales could approach unprecedented levels through 2030.

Continued innovation may extend Nvidia’s leadership beyond current expectations.

Expanding software and platform offerings could deepen customer lock-in.

The Equipment Supplier Riding the AI Wave

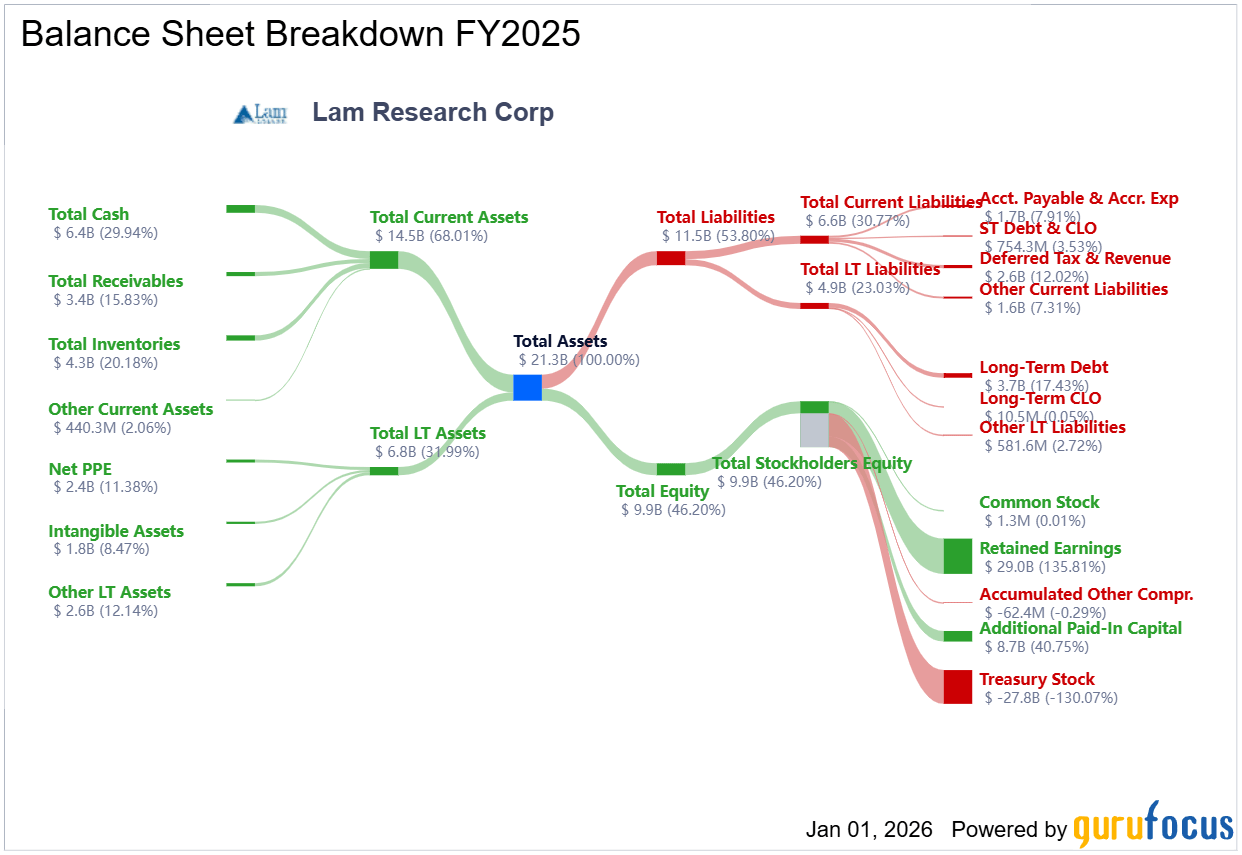

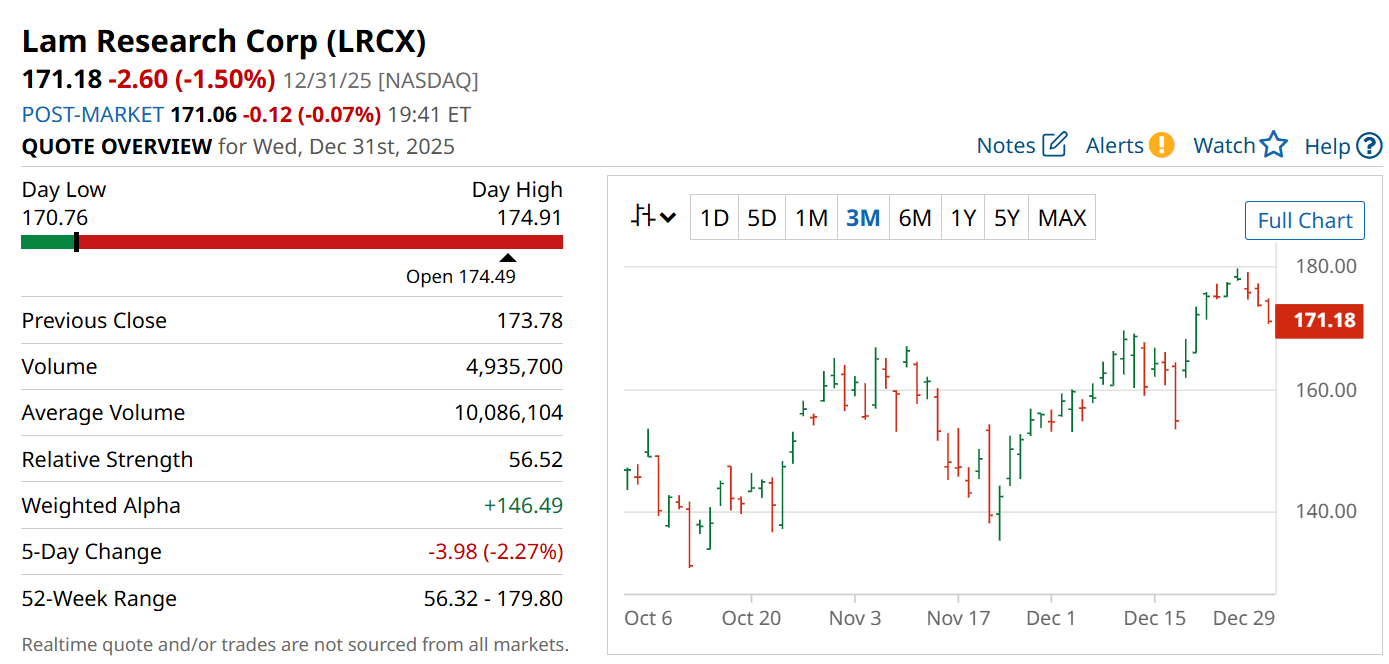

Lam Research (NASDAQ: LRCX) offers a different way to profit from the semiconductor boom.

Rather than selling chips, Lam provides the equipment required to manufacture them.

Demand for its tools is surging as memory and logic chipmakers expand capacity.

Strong revenue and earnings growth highlight the company’s operating leverage.

This positions Lam as a key beneficiary of rising capital expenditures.

Memory Spending Fuels Lam’s Momentum

AI accelerators require massive amounts of high-bandwidth memory.

Memory manufacturers are racing to add capacity to meet surging demand.

This has triggered sharp increases in capital spending budgets.

Lam’s exposure to memory fabrication equipment places it squarely in the sweet spot.

As shortages persist beyond 2026, spending on chipmaking tools is likely to remain elevated.

Strengths

Strong exposure to memory manufacturing equipment tied to AI demand.

Rapid earnings growth demonstrates operating leverage in an upcycle.

Attractive valuation relative to long-term growth prospects.

Weaknesses

Equipment demand can be cyclical and sensitive to capex pullbacks.

Revenue depends heavily on customer spending decisions.

Stock volatility tends to increase during industry slowdowns.

Potential

Sustained memory shortages could drive multi-year equipment demand.

AI-driven capex cycles may extend longer than past semiconductor booms.

Margin expansion could support further upside as volumes grow.

TODAY’S SPONSOR

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop, but people still drive decisions. Levanta’s research shows affiliate and creator content continues to influence conversions, plus it now shapes the product recommendations AI delivers. Affiliate marketing isn’t being replaced by AI, it’s being amplified.

Conclusion

Semiconductor spending appears poised to reach a historic $1 trillion milestone in 2026.

Nvidia and Lam Research offer complementary exposure to this powerful trend.

Together, they provide investors with direct and indirect leverage to the AI-driven semiconductor boom.

Final Thought

The biggest investment opportunities often emerge before the numbers become obvious.

As AI spending accelerates, positioning early in the semiconductor supply chain could prove decisive.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply