- StocksGeniusMastery

- Posts

- 💥Warren Buffett’s Hidden Quantum Giant: Why Alphabet Just Became His New Favorite Tech Stock

💥Warren Buffett’s Hidden Quantum Giant: Why Alphabet Just Became His New Favorite Tech Stock

The Oracle of Omaha quietly doubled down on a surprising quantum leader.

Hi Fellow Investors,

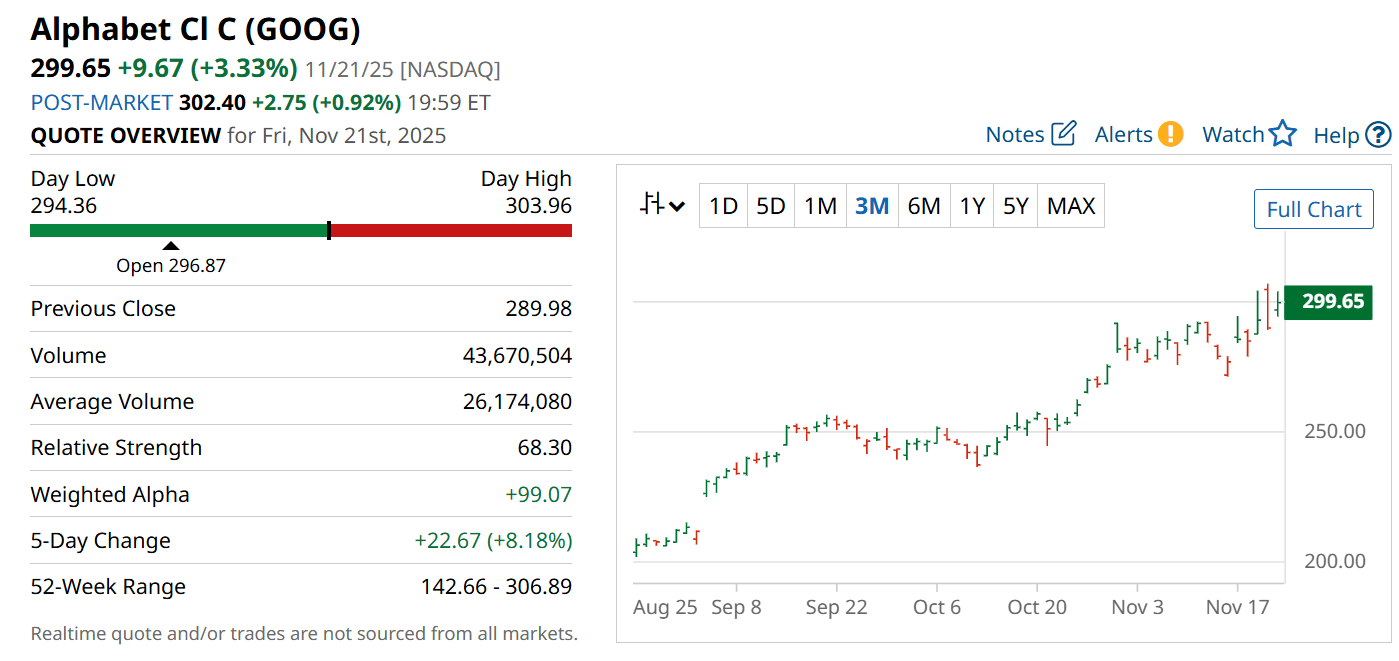

Alphabet (NASDAQ: GOOG) just became the newest and largest quantum-exposed stock in Berkshire Hathaway’s portfolio.

Buffett’s team more than doubled their exposure to quantum innovation in Q3, making Alphabet the new standout.

The move comes even as Buffett traditionally avoids emerging tech trends.

Key Points:

Berkshire’s new $5B stake makes Alphabet Buffett’s biggest quantum-related holding.

Alphabet’s quantum division is advancing error-corrected qubits faster than most competitors.

Buffett likely bought Alphabet for its dominant advertising machine, not just quantum computing.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Alphabet’s Quantum Momentum Accelerates in 2025

Alphabet’s rapidly advancing quantum roadmap is gaining investor attention as Google Quantum AI pushes toward scalable, error-corrected qubits.

The company achieved its first major breakthrough in 2019 when its quantum processor solved a problem in seconds that would take traditional supercomputers thousands of years.

Four years later, Google researchers demonstrated a prototype logical qubit that showed measurable improvement in reducing quantum errors as qubits scaled.

These milestones signal that Alphabet is closer than most rivals to a practical quantum architecture.

The timing aligns with Buffett’s Q3 accumulation, which positioned Alphabet as Berkshire’s new flagship quantum holding.

Even if the buy was driven by advertising strength, the quantum optionality only enhances Alphabet’s long-term upside.

Why Alphabet’s Core Business Still Drives the Thesis

Alphabet’s advertising machine produced over $74 billion in revenue during Q3, reaffirming its dominance across Google Search, YouTube, and partner networks.

Buffett famously regretted not buying Alphabet earlier despite recognizing its unmatched ad economics.

Today, Alphabet’s AI-powered search upgrades and multilayer ad ecosystem are deepening its already formidable moat.

Generative AI improvements are lifting engagement and improving the commercial value of search queries.

With billions of users integrated across Google’s platforms, advertisers continue to prioritize Google as their highest-ROI destination.

Alphabet’s AI and Cloud Ecosystem Adds Even More Upside

Google Cloud is accelerating as new AI-driven workloads expand across enterprises.

The launch of Google Gemini 3.0 marks a major leap in large-scale AI performance, strengthening Alphabet’s position against AWS and Azure.

AI-powered developer tools and enterprise APIs are repositioning Google Cloud as a high-growth catalyst for the next decade.

Waymo’s autonomous ride-hailing platform is also expanding into new cities, reinforcing Alphabet’s growing presence in transportation AI.

These combined ecosystems support Alphabet’s broader quantum ambitions and extend its leadership across multiple industries.

Why Buffett’s Bet Matters for Investors Today

Buffett historically avoids speculative technologies, making his massive Alphabet buy especially noteworthy.

The position is now more than twice the size of Berkshire’s Amazon stake, signaling where his team sees durable competitive advantage.

Alphabet benefits from a trifecta of catalysts: dominant advertising cash flow, accelerating AI adoption, and emerging quantum breakthroughs.

This combination makes Alphabet one of the most well-positioned global tech leaders heading into 2026.

Its quantum efforts may be optional today, but they could become transformational in the next decade.

Strengths

Alphabet’s advertising engine continues to produce massive, recurring cash flows that finance long-term innovation.

Google Cloud is benefiting from powerful AI tailwinds and gaining share in enterprise workloads.

Google Quantum AI maintains a technological lead with logical qubits and breakthrough error-correction milestones.

Weaknesses

Heavy investment in AI, autonomous driving, and quantum initiatives pressures operating margins.

Regulatory scrutiny around advertising practices, data usage, and antitrust could increase volatility.

Competition in cloud and AI infrastructure from AWS and Azure remains intense and capital-heavy.

Potential

Scalable, error-corrected quantum systems could unlock entirely new enterprise and scientific markets.

Waymo’s expansion could position Alphabet as the dominant autonomous mobility platform worldwide.

Further AI integration across Google Search, YouTube, and Workspace could meaningfully accelerate revenue growth.

TODAY’S SPONSOR

Startups get Intercom 90% off and Fin AI agent free for 1 year

Join Intercom’s Startup Program to receive a 90% discount, plus Fin free for 1 year.

Get a direct line to your customers with the only complete AI-first customer service solution.

It’s like having a full-time human support agent free for an entire year.

Conclusion

Alphabet stands out as one of the most durable, diversified, and forward-leaning tech giants available to investors today.

Buffett’s multibillion-dollar endorsement reinforces its long-term potential across advertising, AI, cloud, and quantum computing.

For investors seeking a resilient compounder with significant technological upside, Alphabet remains a powerful contender.

Final Thought

Will Alphabet’s quantum breakthroughs become as valuable as its search empire one day?

Or will they amplify an already unstoppable AI and cloud ecosystem?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply