- StocksGeniusMastery

- Posts

- 💥 Why 2026 Could Be a Breakout Year for the Nasdaq

💥 Why 2026 Could Be a Breakout Year for the Nasdaq

This Under-the-Radar AI Giant Could Lead the Charge

Hi Fellow Investors,

The Nasdaq’s long-term rally has been fueled by transformative technologies that are still in early innings.

Artificial intelligence continues to reshape corporate profits and investor expectations.

One established tech leader is quietly positioning itself as a major AI winner heading into 2026.

Key Points:

The artificial intelligence market is projected to grow from hundreds of billions into the trillions by the end of the decade.

The Nasdaq’s recent gains reflect early-stage AI adoption rather than peak enthusiasm.

One mega-cap stock combines AI upside with proven cash-generating businesses.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Why the Nasdaq’s AI-Driven Rally May Be Far From Finished

The Nasdaq has surged in recent years as investors positioned themselves ahead of disruptive technologies like artificial intelligence and quantum computing.

Despite strong gains, AI adoption remains in an early commercialization phase across most industries.

Analysts estimate the AI market could expand from roughly $300 billion today into the trillions by decade’s end.

This growth trajectory suggests earnings acceleration may continue well into 2026.

Strong balance sheets and rising profitability across major tech firms reinforce the bullish outlook.

A Surprisingly Modest Performer in a Red-Hot AI Market

One major technology leader delivered only modest stock gains last year despite reporting meaningful AI-driven growth.

Amazon (NASDAQ: AMZN) operates dominant businesses in e-commerce and cloud computing that predate the AI boom.

This diversified revenue base offers downside protection if AI spending temporarily slows.

Its cloud division continues to grow even outside of AI-specific services.

This balance makes the company attractive to both cautious and growth-oriented investors.

How AI Is Quietly Powering the Next Phase of Growth

Amazon is integrating artificial intelligence deeply into its operations to improve efficiency and margins.

AI-driven automation is streamlining logistics and fulfillment processes across its global network.

Amazon Web Services is emerging as a central AI growth engine through proprietary chips and third-party hardware offerings.

Its fully managed AI platform enables enterprises to deploy advanced models at scale.

These initiatives have pushed AWS toward an annualized revenue run rate exceeding $130 billion.

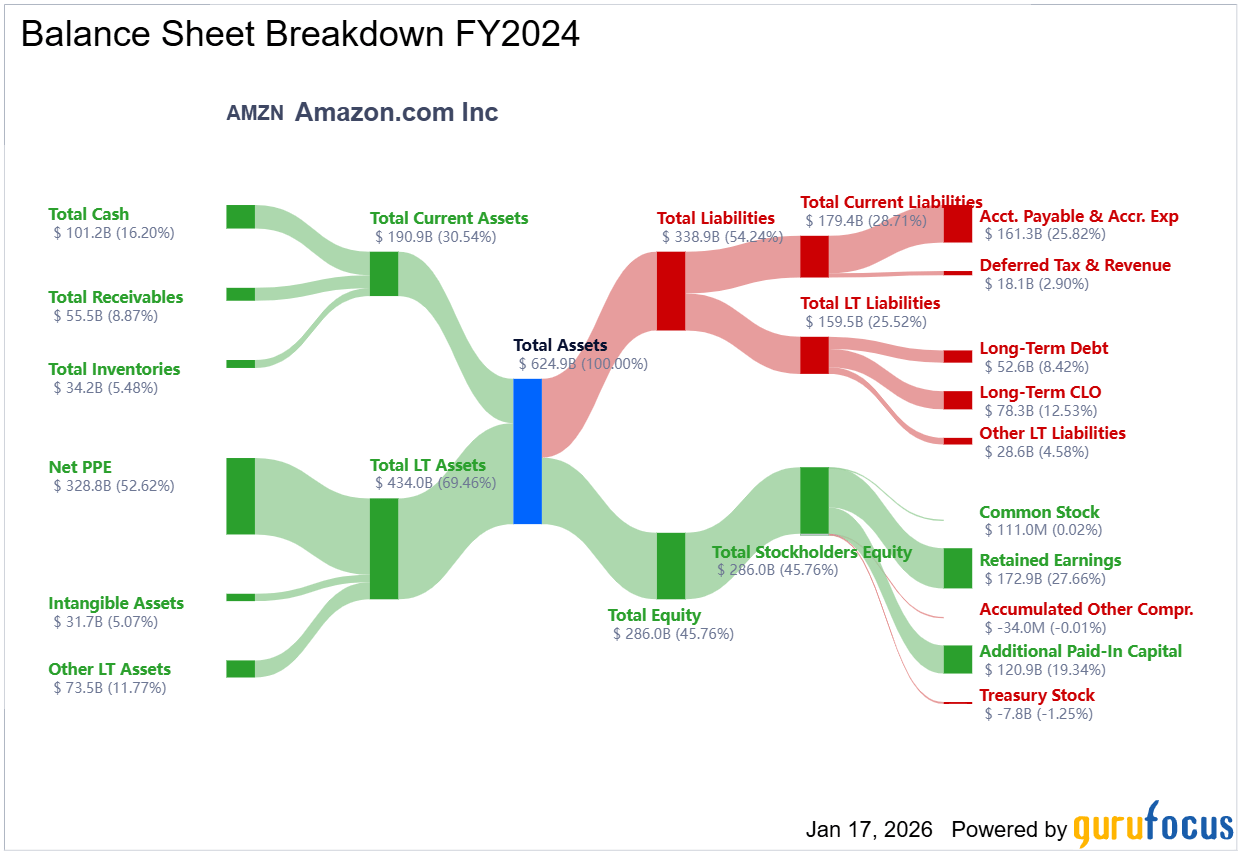

Valuation Remains Compelling Despite Massive Scale

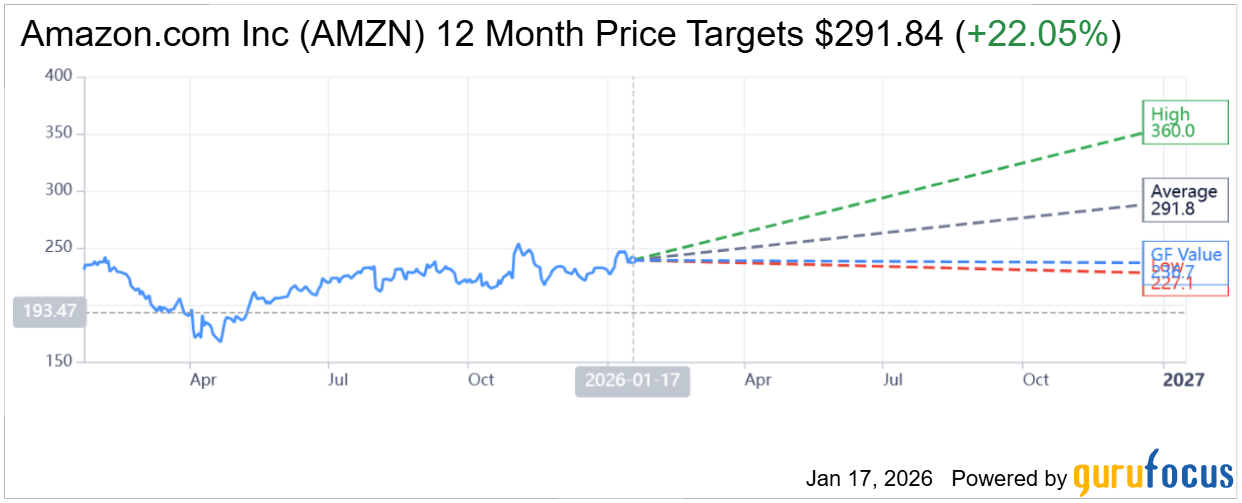

Despite its size and growth prospects, Amazon trades at a valuation well below prior peaks.

The stock currently sits near 30 times forward earnings, down sharply from levels seen earlier in the AI hype cycle.

This pricing reflects investor caution rather than deteriorating fundamentals.

As concerns about an AI valuation bubble increase, capital may rotate toward proven platforms with reasonable multiples.

Amazon’s established earnings power positions it well for this shift.

Strengths

A diversified business model provides resilience even if AI spending cycles fluctuate.

Amazon Web Services is rapidly scaling AI infrastructure with strong enterprise demand.

Operational AI adoption enhances margins across logistics, retail, and cloud operations.

Weaknesses

Massive scale can limit short-term growth rates compared to smaller pure-play AI firms.

Heavy capital expenditures may pressure free cash flow during expansion phases.

Regulatory and antitrust scrutiny remains an ongoing overhang.

Potential

Continued AI monetization could accelerate earnings faster than current forecasts imply.

Valuation multiple expansion may occur as AI winners separate from speculative names.

The Nasdaq’s broader rally could amplify upside in mega-cap leaders with proven results.

TODAY’S SPONSOR

Your annual review, created with Shane Parrish

Behind every successful year is honest reflection. This workbook, written by Shane Parrish and reMarkable, helps you find clarity so patterns become visible.

Traditional annual reviews add goals, tasks, and pressure. This is different. It helps you strip everything back to see what to change in your the ahead.

Ready to identify what matters?

Conclusion

The Nasdaq’s AI-driven growth story appears to be entering its next phase rather than its final chapter.

Amazon offers a rare combination of AI upside, operational strength, and reasonable valuation.

Positioning ahead of 2026 may allow investors to benefit from both earnings growth and sentiment shifts.

Final Thought

When markets chase the future, the biggest winners are often the companies already executing today.

The question for investors is whether they prefer speculation—or proven platforms quietly compounding beneath the headlines.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply