- StocksGeniusMastery

- Posts

- 💥 Why a Top Billionaire Investor Is Taking Profits in Nvidia and Betting Elsewhere

💥 Why a Top Billionaire Investor Is Taking Profits in Nvidia and Betting Elsewhere

A hedge fund heavyweight quietly repositions for the next phase of the AI boom

Hi Fellow Investors,

Billionaire hedge fund managers often reveal their highest-conviction ideas through regulatory filings.

Philippe Laffont’s latest portfolio adjustments offer a revealing snapshot of how elite investors are repositioning for the next phase of artificial intelligence.

A modest Nvidia trim paired with an aggressive Alphabet purchase suggests strategy, not skepticism.

Key Points:

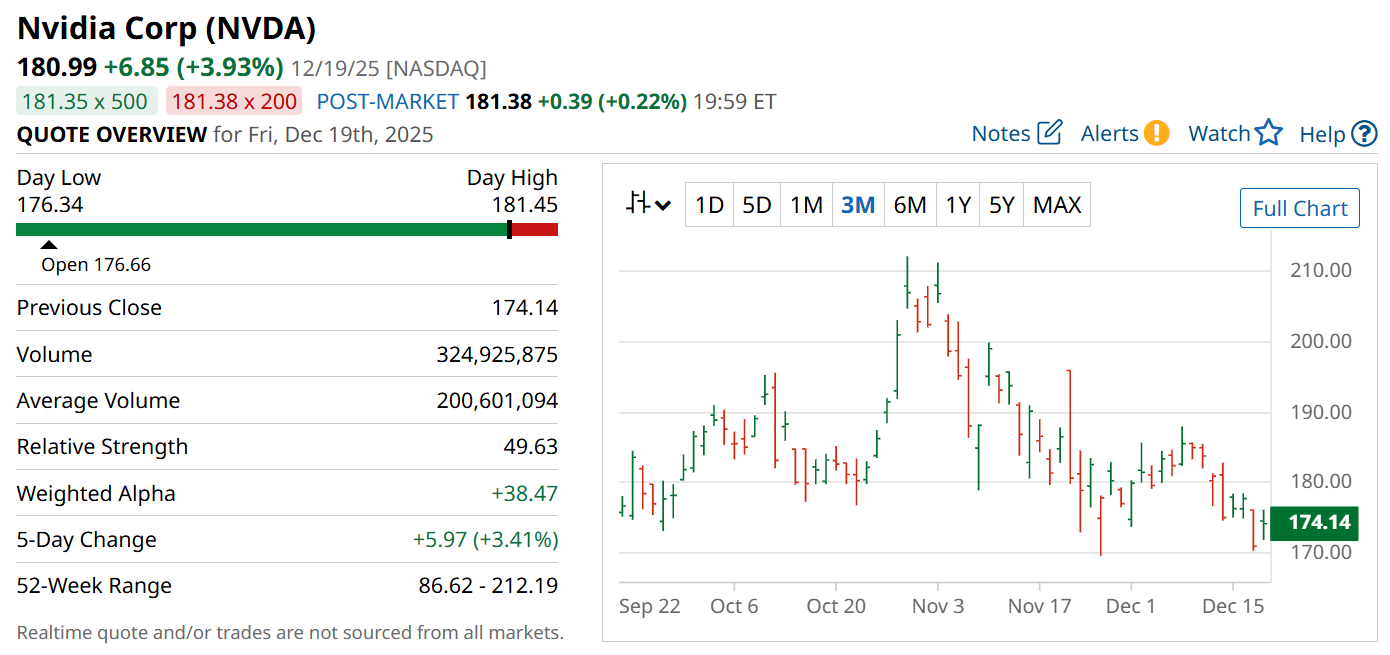

Philippe Laffont reduced Coatue’s Nvidia exposure by 14% while keeping it a top portfolio holding.

The fund simultaneously increased its Alphabet stake by more than 250% in a decisive rotation.

The move reflects a shift from pure-play AI chips toward vertically integrated AI platforms.

TODAY’S SPONSOR

Effortless Tutorial Video Creation with Guidde

Transform your team’s static training materials into dynamic, engaging video guides with Guidde.

Here’s what you’ll love about Guidde:

1️⃣ Easy to Create: Turn PDFs or manuals into stunning video tutorials with a single click.

2️⃣ Easy to Update: Update video content in seconds to keep your training materials relevant.

3️⃣ Easy to Localize: Generate multilingual guides to ensure accessibility for global teams.

Empower your teammates with interactive learning.

And the best part? The browser extension is 100% free.

Why Nvidia Still Matters — Even After a Partial Exit

Nvidia (NASDAQ: NVDA) has transformed from a niche graphics supplier into the backbone of the global AI infrastructure buildout.

The company’s market capitalization has surged from hundreds of billions to more than four trillion dollars in just a few years.

Coatue has owned Nvidia since 2016, making profit-taking after such an extraordinary run both rational and disciplined.

Importantly, Nvidia remains one of the fund’s largest holdings, underscoring continued confidence in its long-term relevance.

The reduction appears tactical rather than bearish, reflecting valuation awareness rather than deteriorating fundamentals.

This move suggests Nvidia’s dominance is intact, but expectations are now exceptionally high.

Strengths

Nvidia controls the AI accelerator market with unmatched software, ecosystem depth, and customer lock-in.

Gross margins north of 70% highlight extraordinary pricing power in data center GPUs.

Deep partnerships with hyperscalers reinforce Nvidia’s role as foundational AI infrastructure.

Weaknesses

Valuation leaves little room for execution missteps or slowing AI capital expenditures.

Customer concentration among cloud giants increases sensitivity to spending cycles.

Rising competition from custom silicon threatens long-term market share at the margins.

Potential

Continued AI model scaling could sustain elevated demand for years.

Expansion into networking, software, and AI services deepens monetization beyond chips.

Emerging sovereign AI initiatives may unlock new global demand streams.

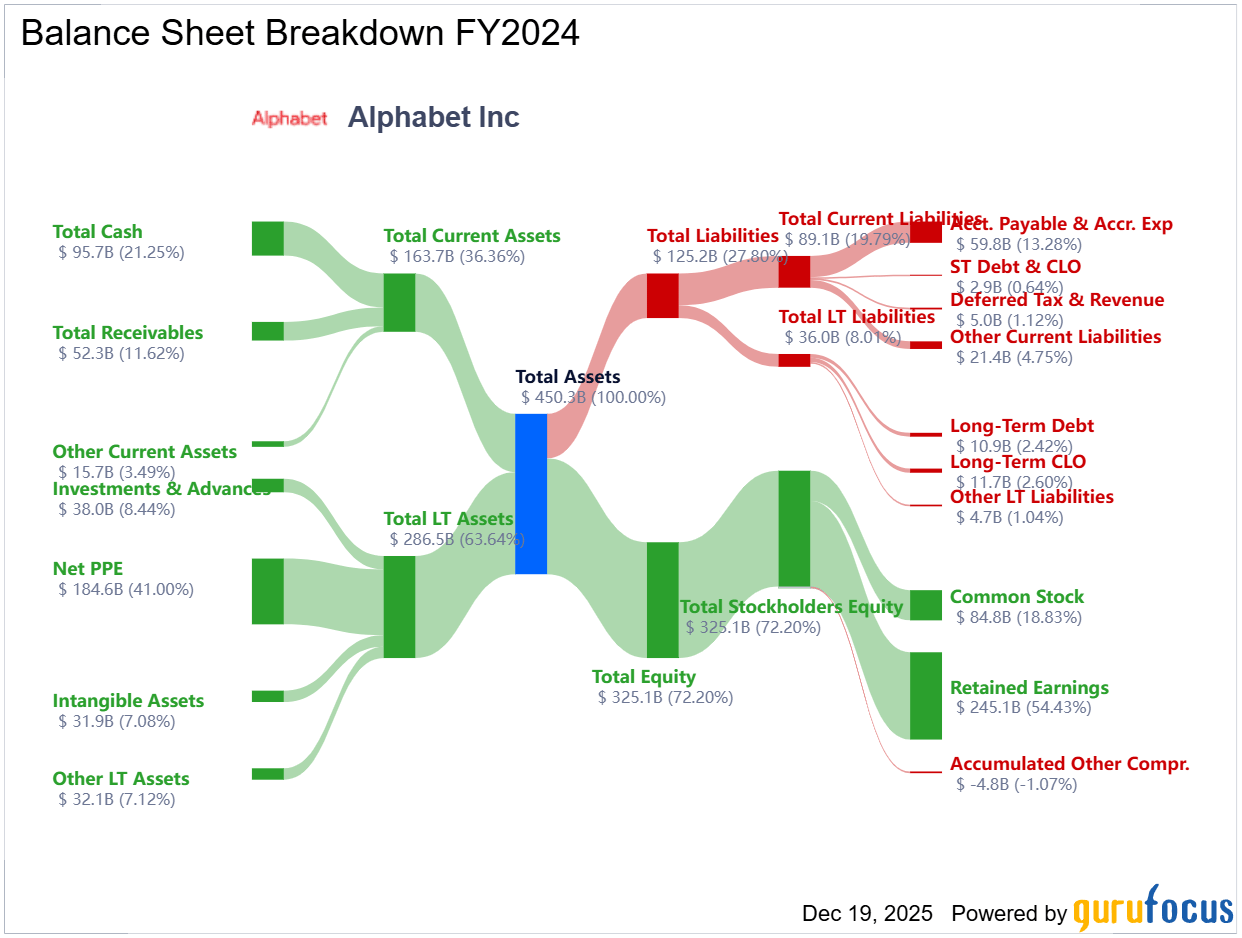

Why Alphabet Is Emerging as a Smarter AI Rotation

Alphabet (NASDAQ: GOOGL) spent much of the AI boom under a cloud of skepticism as investors feared search disruption.

While competitors captured headlines, Alphabet quietly rebuilt its AI strategy across products, infrastructure, and hardware.

The Gemini large language model is now embedded directly into Google’s core search experience.

Google Cloud has matured into a credible hyperscaler, winning enterprise clients and major AI partnerships.

Custom Tensor Processing Units give Alphabet in-house silicon leverage that reduces reliance on third-party chipmakers.

Waymo’s expanding autonomous footprint further demonstrates how deeply AI is woven across Alphabet’s ecosystem.

Strengths

Vertically integrated AI stack spanning software, cloud, hardware, and consumer platforms.

Google Cloud growth adds diversification beyond advertising-driven revenue.

Proprietary TPUs position Alphabet as both an AI user and AI infrastructure provider.

Weaknesses

Advertising still accounts for the majority of profits, increasing macro sensitivity.

AI monetization beyond search remains a work in progress.

Regulatory scrutiny continues to loom over core business lines.

Potential

AI-enhanced search and YouTube monetization could reaccelerate revenue growth.

TPUs may evolve into a strategic advantage against Nvidia’s GPU dominance.

Waymo represents a long-duration AI optionality few peers can match.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

Philippe Laffont’s portfolio shift reflects refinement, not retreat, from artificial intelligence.

Nvidia remains foundational, but Alphabet offers broader, more diversified exposure at a still-reasonable valuation.

For investors sitting on large Nvidia gains, rotating selectively into Alphabet may balance upside with durability.

Final Thought

The AI revolution is no longer just about who builds the fastest chips.

It is increasingly about who controls the platforms, data, and ecosystems that turn intelligence into profit.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply