- StocksGeniusMastery

- Posts

- 💥Why Amazon’s AI Strategy Just Sparked a Record-Breaking Rally

💥Why Amazon’s AI Strategy Just Sparked a Record-Breaking Rally

A 20% jump in AWS sales and $125B in AI-driven investments are transforming Amazon’s growth trajectory.

Hi Fellow Investors,

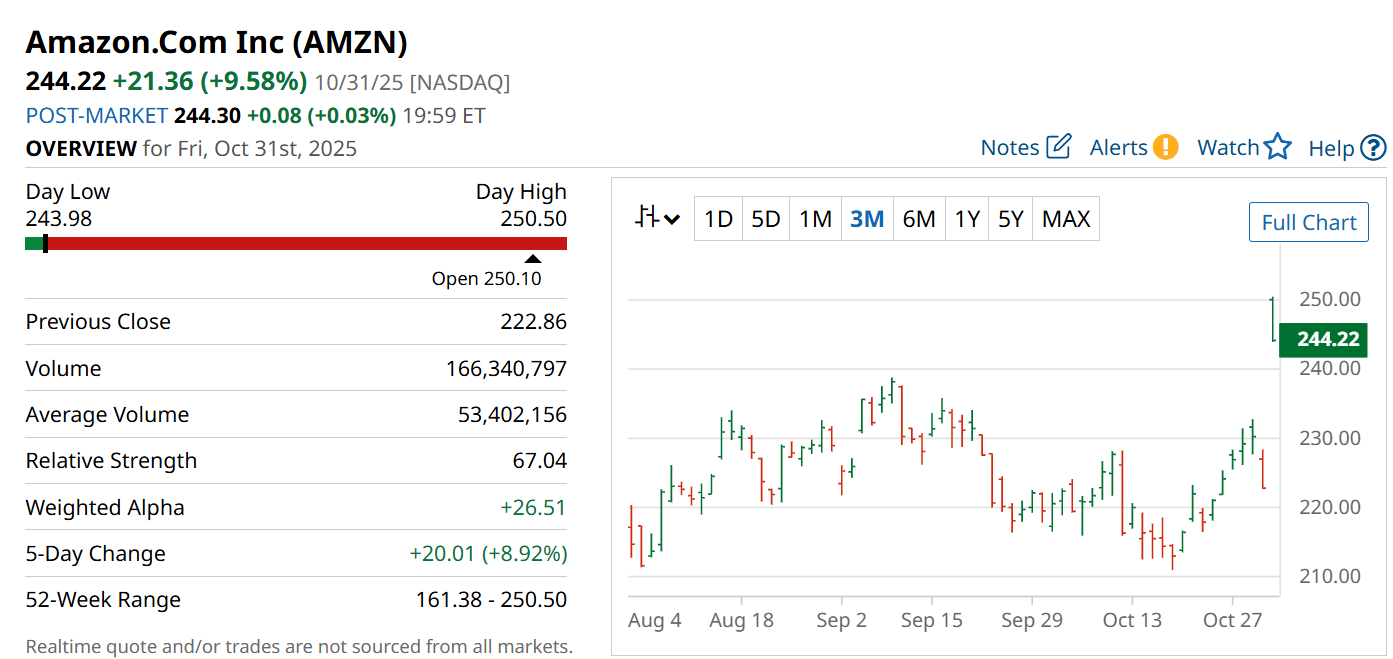

Amazon (NASDAQ: AMZN) just surged nearly 10% to a fresh all-time high.

Investors are cheering explosive cloud growth, aggressive AI spending, and a leaner, more efficient business model.

Every signal points to one message — Amazon intends to dominate the AI decade.

Key Points:

Amazon’s cloud arm, AWS, delivered 20% sales growth — its fastest rate in over a year.

The company plans to invest over $125 billion in AI infrastructure through 2026.

Cost-cutting and automation efforts are boosting margins and investor confidence.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Cloud Power Meets AI Ambition

Amazon’s third-quarter sales soared 13% to $180 billion, as investors witnessed the return of rapid growth.

Its cloud computing leader, Amazon Web Services (AWS), jumped 20% to $33 billion in revenue — up sharply from 17.5% in the prior quarter.

CEO Andy Jassy highlighted surging AI demand and accelerated capacity expansion as key growth levers.

AWS remains Amazon’s cash machine, delivering the profits fueling its AI and automation bets.

This dual-engine strategy — cloud dominance plus AI scale — is driving the latest rally.

Cutting Costs, Boosting Margins

Behind the surge lies a disciplined operational overhaul.

Amazon has been slashing costs aggressively, with reports suggesting up to 30,000 job cuts across various business units.

At the same time, it’s pouring billions into robotics and automation to drive higher productivity across its vast logistics empire.

With over one million robots now deployed in its warehouses, efficiency gains are compounding rapidly.

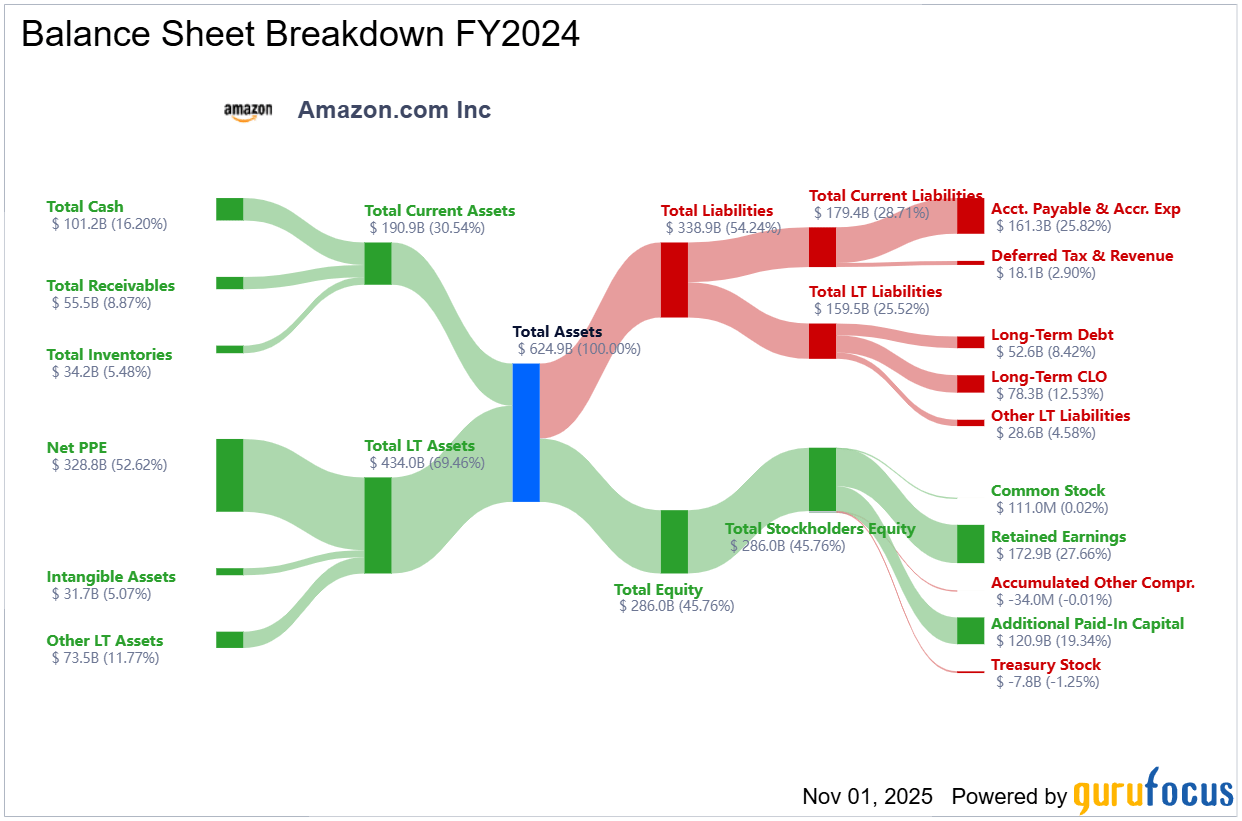

Operating cash flow has climbed 16% year over year to a staggering $130 billion — reinforcing the strength of Amazon’s financial engine.

The AI Revolution Is Just Beginning

Amazon is channeling this massive cash flow straight into the AI arms race.

CFO Brian Olsavsky revealed that capital expenditures are expected to hit roughly $125 billion in 2025 — and rise even higher in 2026.

Jassy added that AI is reshaping every layer of Amazon’s business, from logistics to retail to cloud infrastructure.

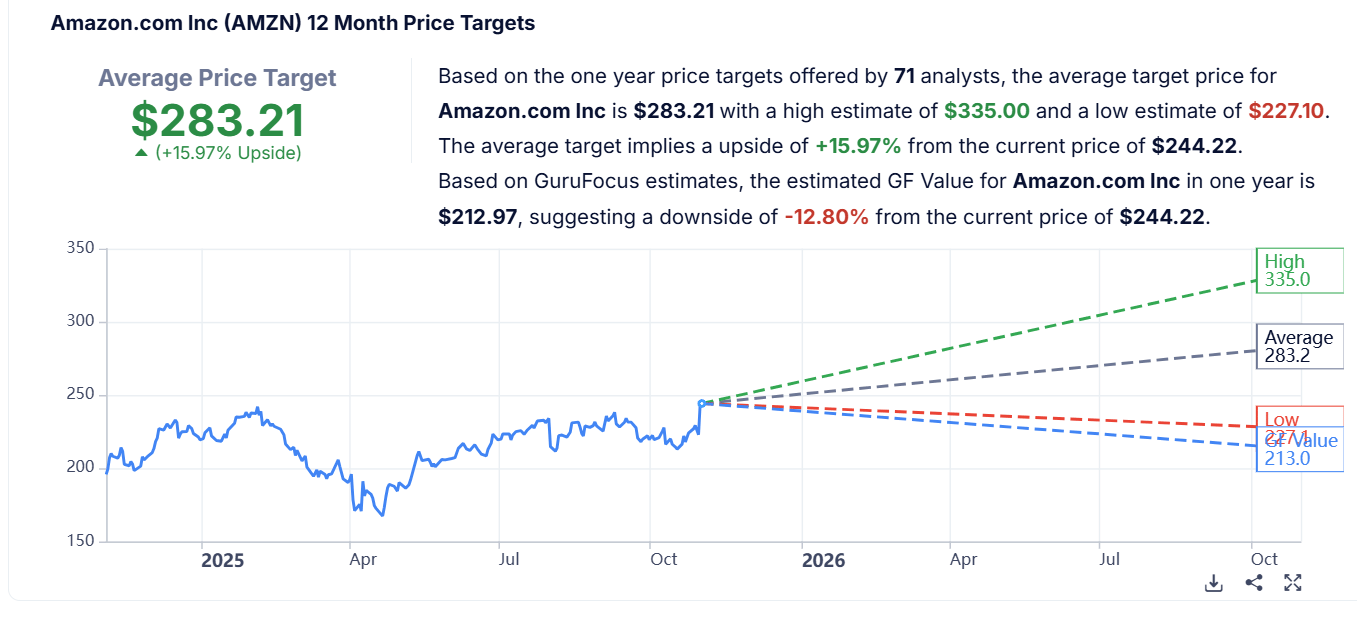

These forward-looking investments position Amazon to lead the next decade of tech transformation.

For investors, this isn’t just about short-term stock momentum — it’s about long-term dominance in one of the most lucrative markets of the century.

Strengths

AWS continues to command the lion’s share of global cloud profits, giving Amazon unmatched scale and cash flow.

AI-driven initiatives are embedding Amazon deeper into future tech ecosystems.

Automation and robotics investments are enhancing cost efficiency and margin expansion.

Weaknesses

Heavy AI spending could pressure near-term profits if macro conditions tighten.

Workforce reductions may risk operational disruption during holiday and logistics peaks.

Rising competition from Microsoft Azure and Google Cloud threatens AWS’s market lead.

Potential

Sustained AI demand could catapult AWS growth into a new multi-year acceleration phase.

Expanding robotics and automation could double warehouse efficiency and profitability.

Long-term AI infrastructure dominance could drive Amazon toward a $4 trillion market cap milestone.

TODAY’S SPONSOR

How High-Net-Worth Families Invest Beyond the Balance Sheet

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how you compare to your peers.

Conclusion

Amazon’s record-breaking rally isn’t just a market reaction — it’s validation of a bold, AI-centered strategy.

By aligning its cloud dominance, cost discipline, and next-gen innovation, Amazon is setting a new standard for tech giants entering the AI era.

For long-term investors, the story is only getting started.

Final Thought

Will Amazon’s $125 billion AI gamble define the next wave of tech leadership — or mark the peak of an incredible run?

Smart investors will be watching closely.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply