- StocksGeniusMastery

- Posts

- 💥 Why Billionaire Investors Are Loading Up on This AI Stock for 2026

💥 Why Billionaire Investors Are Loading Up on This AI Stock for 2026

The semiconductor giant fueling every major AI chipmaker on the planet.

Hi Fellow Investors,

Billionaire portfolios often reveal long-term conviction plays rather than short-term trades.

One dominant AI infrastructure stock appears repeatedly across elite hedge fund holdings.

That shared conviction points to a company positioned to benefit from AI spending for the rest of the decade.

Key Points:

Taiwan Semiconductor Manufacturing is the critical supplier behind nearly every major AI chip designer.

Global data center capital expenditures are projected to surge through at least 2030.

Multiple billionaire investors independently hold large positions in the same AI infrastructure leader.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Taiwan Semiconductor Manufacturing (NYSE: TSM) has emerged as a common holding across several of the world’s most successful hedge fund managers.

Chase Coleman, Steve Mandel, David Tepper, and Daniel Loeb all maintain meaningful allocations to this single semiconductor company.

These investors are known for selective, high-conviction positions rather than rapid portfolio turnover.

The overlap suggests a rare consensus among elite capital allocators.

Rather than betting on a single AI winner, they are investing in the company that supplies them all.

The Neutral Backbone of the AI Arms Race

AI chip leadership shifts constantly as Nvidia, AMD, and custom accelerator providers compete for dominance.

Predicting which architecture will win long term is increasingly difficult.

However, nearly all leading-edge AI chips share the same manufacturing partner.

Taiwan Semiconductor Manufacturing sits at the center of this competition as a neutral supplier.

As long as AI data centers continue to expand, TSMC benefits regardless of which chip design wins.

Unstoppable Data Center Spending Momentum

Global data center capital expenditures are expected to reach between $3 trillion and $4 trillion by 2030.

That figure dwarfs current spending levels and reflects a massive multi-year infrastructure buildout.

Computing alone is projected to become a trillion-dollar market by the end of the decade.

Every incremental dollar spent on AI hardware increases demand for advanced semiconductor manufacturing.

Few companies are as leveraged to this trend as Taiwan Semiconductor Manufacturing.

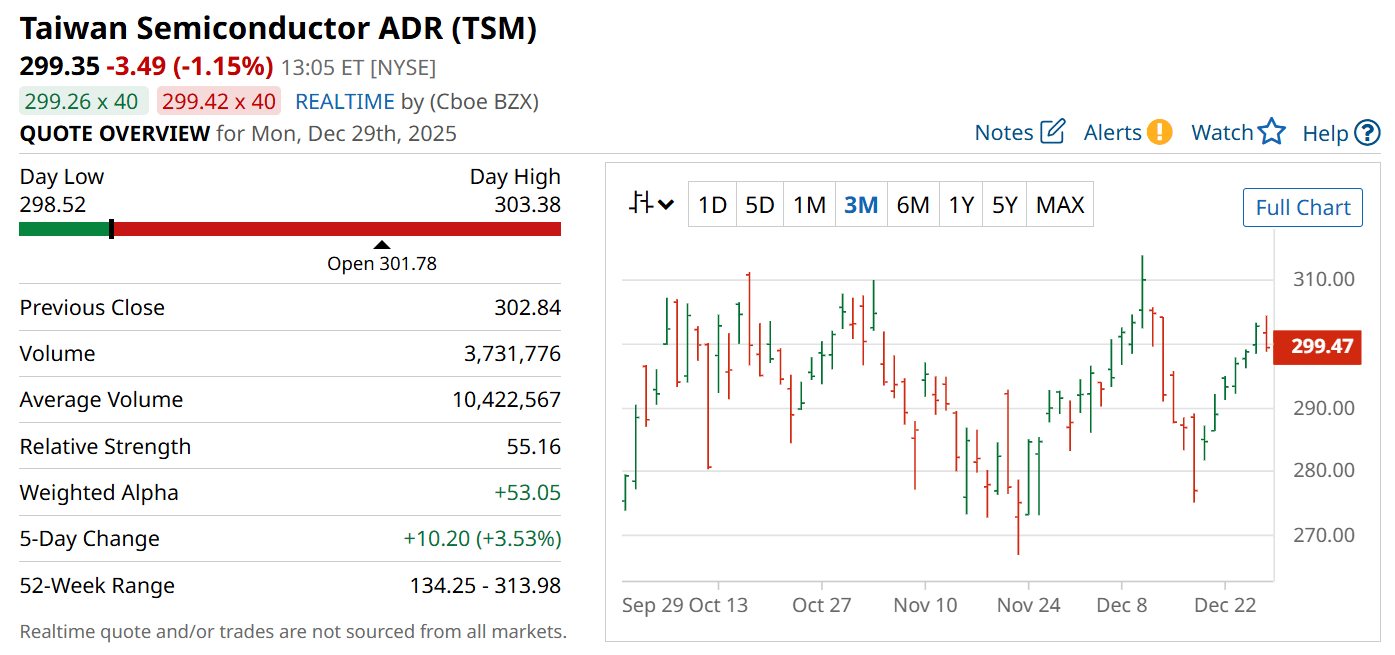

Valuation Sets the Stage for 2026 Upside

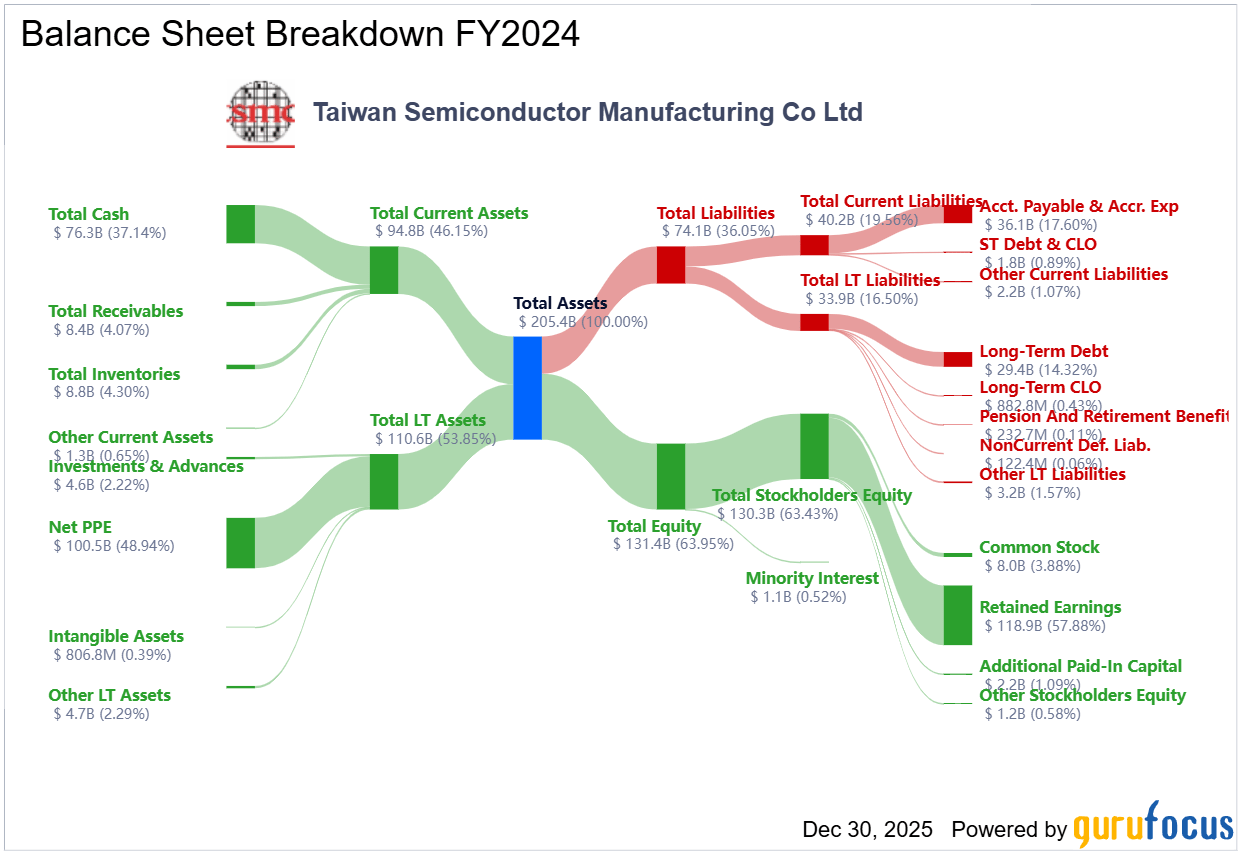

Despite its dominant market position, Taiwan Semiconductor trades at a reasonable forward valuation.

At roughly 23 times 2026 earnings, the stock is not priced like a speculative AI bubble play.

That valuation fails to fully reflect the duration and scale of expected AI-driven demand.

With margins, scale, and technological leadership firmly intact, earnings growth remains powerful.

This combination creates a compelling setup for a potential breakout as 2026 approaches.

Strengths

Unmatched manufacturing scale makes Taiwan Semiconductor indispensable to every major AI chip designer.

Neutral supplier status allows the company to profit from all sides of the AI competition.

Strong margins and technological leadership provide durable competitive advantages.

Weaknesses

Capital-intensive operations require sustained investment to maintain technological leadership.

Geopolitical risk introduces uncertainty that periodically weighs on investor sentiment.

Heavy reliance on advanced-node demand ties results closely to global AI spending cycles.

Potential

Explosive growth in AI data center construction could drive sustained revenue acceleration.

Continued adoption of cutting-edge process nodes strengthens long-term pricing power.

Rising AI workloads through 2030 position the company for multi-year earnings expansion.

TODAY’S SPONSOR

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

Conclusion

Taiwan Semiconductor Manufacturing stands at the center of the global AI buildout with unmatched leverage.

Billionaire investors recognize its unique position as the backbone of the AI ecosystem.

As data center spending accelerates, this stock appears poised to deliver outsized returns into 2026 and beyond.

Final Thought

When the smartest investors all own the same AI stock, it is rarely by accident.

The biggest winners of the AI revolution may be the companies powering every competitor behind the scenes.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply