- StocksGeniusMastery

- Posts

- 💥 Why Nvidia’s 2026 Outlook Just Got a Massive Upgrade

💥 Why Nvidia’s 2026 Outlook Just Got a Massive Upgrade

China market access could reignite explosive earnings growth

Hi Fellow Investors,

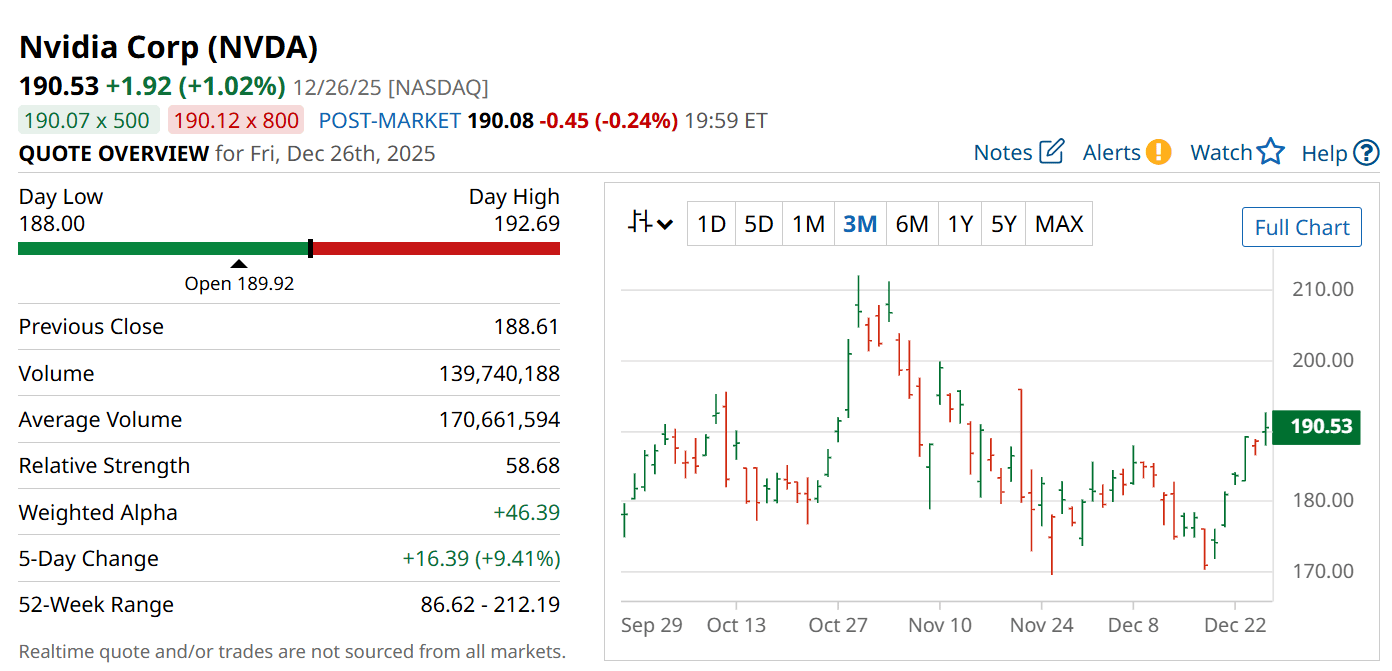

Nvidia’s (NASDAQ: NVDA) long-blocked access to China may finally reopen in early 2026, creating a meaningful revenue catalyst.

Fresh analyst upgrades suggest earnings estimates could still be too conservative.

The next phase of Nvidia’s AI expansion may arrive sooner and stronger than expected.

Key Points:

Nvidia could begin shipping advanced H200 AI chips to China as early as February 2026.

Initial shipments alone could generate more than $1 billion in quarterly revenue.

Analysts see meaningful upside risk to 2026 earnings forecasts as China demand returns.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Nvidia’s China Door May Be Reopening Faster Than Expected

Nvidia (NASDAQ: NVDA) enters 2026 with a powerful tailwind forming beneath the surface.

A Reuters report indicates Nvidia has informed Chinese customers that H200 shipments could begin before mid-February.

This development follows U.S. government approval allowing sales of advanced GPUs to approved Chinese buyers.

For a company that was effectively locked out of China since April 2025, this represents a sharp reversal.

The timing suggests Nvidia could monetize pent-up demand almost immediately as the new year begins.

Billions in Revenue Could Flow in the First Quarter Alone

Initial shipments are expected to range between 40,000 and 80,000 H200 processors.

At an estimated price of roughly $32,000 per chip, that translates to $1.28 billion to $2.56 billion in potential sales.

Those revenues could land in Nvidia’s first quarter of fiscal 2027, beginning late January 2026.

Although Nvidia must remit a portion of Chinese revenue to the U.S. government, the incremental impact remains substantial.

More importantly, this marks the first step toward reestablishing a massive revenue stream.

Capacity Expansion Signals Strong Confidence in Demand

Sources indicate Nvidia plans to bring additional production capacity online specifically for Chinese customers.

Orders for this expanded capacity are expected to open in the second quarter of 2026.

That move signals management confidence that demand will extend well beyond initial shipments.

The H200 offers roughly six times the performance of the China-specific H20 chips previously sold in the region.

Major Chinese technology firms are reportedly eager to secure supply despite regulatory complexity.

2026 Earnings Estimates May Still Be Too Low

Nvidia already carries an estimated data center backlog approaching $275 billion for 2026.

Reentry into China could push that figure even higher.

Wall Street currently forecasts earnings per share of $7.52 next fiscal year, up sharply from current levels.

Those projections imply roughly 60% year-over-year growth, even before fully accounting for China’s contribution.

As new orders materialize, further upward revisions appear increasingly likely.

Strengths

Dominant AI accelerator leadership allows Nvidia to monetize reopening markets rapidly.

H200 chips deliver step-change performance that competitors struggle to match.

Massive existing backlog provides earnings visibility well into 2026 and beyond.

Weaknesses

Revenue-sharing requirements with the U.S. government reduce net margins on China sales.

Export policy risk remains an overhang that could shift with political changes.

Heavy reliance on data center demand increases cyclicality exposure.

Potential

China shipments could add billions in incremental high-margin revenue within quarters.

Earnings estimates may reset meaningfully higher as new orders are confirmed.

Renewed international access strengthens Nvidia’s long-term AI ecosystem dominance.

TODAY’S SPONSOR

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

Conclusion

Nvidia’s potential return to China materially changes the company’s 2026 growth narrative.

Early H200 shipments and capacity expansion suggest earnings momentum could accelerate further.

For long-term investors, recent developments point to upside that may not yet be fully priced in.

Final Thought

When a market as large as China reopens to the world’s most advanced AI chips, valuation assumptions can shift quickly.

The question for investors is whether today’s expectations truly reflect Nvidia’s next growth chapter.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply