- StocksGeniusMastery

- Posts

- 💥 Why This Magnificent Seven Giant Is the Best Stock for 2026

💥 Why This Magnificent Seven Giant Is the Best Stock for 2026

How Alphabet quietly built the strongest setup for long-term AI-driven returns.

Hi Fellow Investors,

Not all Magnificent Seven stocks are built equally heading into 2026.

One company combines unmatched internet dominance with rapidly accelerating AI infrastructure growth.

That rare mix places it firmly at the top of the rankings for long-term investors.

Key Points:

Alphabet remains the most influential internet company in the world by a wide margin.

Google Cloud is delivering rapid growth and expanding profitability.

Custom AI hardware gives Alphabet a strategic alternative to Nvidia’s GPUs.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Why Alphabet Ranks No. 1 for 2026

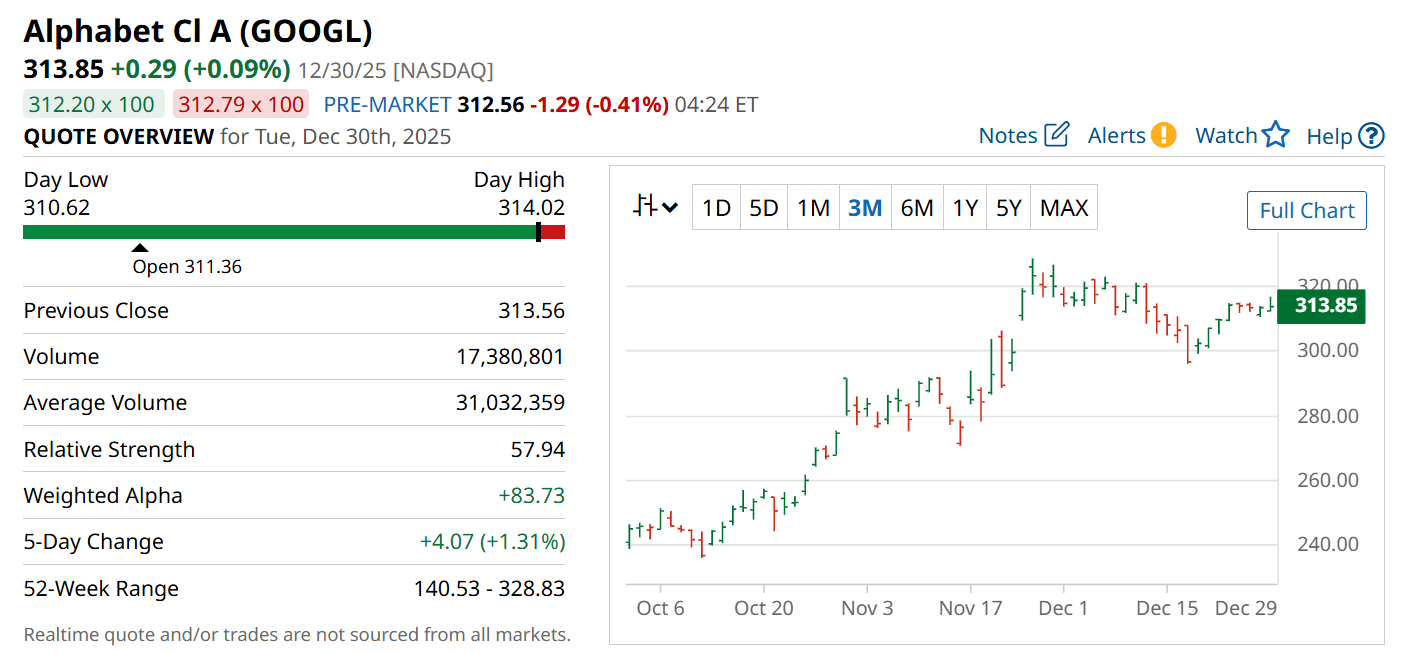

Alphabet (NASDAQ: GOOGL) stands apart as the most consequential internet platform ever built.

Google Search controls nearly 90% of global search traffic, creating a nearly unassailable moat.

Chrome dominates browser usage, reinforcing Alphabet’s ability to distribute content and ads at scale.

This dominance allows Alphabet to monetize attention more efficiently than any peer.

As AI enhances search relevance and ad targeting, this advantage only strengthens.

Advertising Still Powers Massive Cash Flow

Advertising remains Alphabet’s financial engine and continues to scale.

Search, YouTube, and the Google Network generated more than $74 billion in quarterly ad revenue.

AI-driven features now improve search results, email productivity, and ad placement efficiency.

Advertising accounts for over 70% of total revenue, producing extraordinary free cash flow.

That cash provides unmatched flexibility to invest aggressively in AI and cloud infrastructure.

Cloud Computing Is Becoming a Second Growth Engine

While advertising dominates today, cloud computing may define Alphabet’s future.

Google Cloud is the third-largest cloud platform globally, but it is growing the fastest among the leaders.

Revenue surged more than 30% year over year, while operating income nearly doubled.

This shift proves the business is scaling profitably, not just chasing growth.

As enterprise AI adoption accelerates, cloud demand could rival advertising over time.

A Strategic AI Advantage Beyond GPUs

Alphabet is not solely dependent on external chip suppliers.

Its in-house Tensor Processing Units are purpose-built for training AI models efficiently.

These chips are already attracting external demand from major AI developers.

Deals to supply TPUs through cloud partnerships expand Alphabet’s reach beyond internal use.

This vertical integration reduces reliance on competitors and strengthens long-term margins.

Strengths

Near-total dominance in global search creates unmatched advertising leverage.

Rapidly growing cloud business adds a powerful second revenue engine.

Proprietary AI chips reduce dependency on third-party hardware suppliers.

Weaknesses

Heavy reliance on advertising exposes results to economic cycles.

Regulatory scrutiny remains a persistent overhang for sentiment.

Cloud market share still trails larger rivals despite faster growth.

Potential

AI-enhanced search could unlock new monetization formats and pricing power.

Cloud profitability expansion may drive a major valuation re-rating.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

Alphabet combines scale, cash flow, and AI innovation better than any Magnificent Seven peer.

Its dominance today funds the technologies that will define tomorrow.

For investors looking toward 2026, this stock stands out as the most balanced and powerful opportunity.

Final Thought

The best long-term investments are often the least flashy.

When dominance, growth, and valuation align, the results can be extraordinary.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply