- StocksGeniusMastery

- Posts

- 💥 Why Wall Street Is Watching Nvidia Before Earnings

💥 Why Wall Street Is Watching Nvidia Before Earnings

Why upcoming earnings signals may drive the next leg higher

Hi Fellow Investors,

Nvidia’s upcoming earnings are weeks away, but the market will not be waiting quietly.

Several key corporate reports between mid-January and early February may quietly reveal Nvidia’s next move.

Investors paying attention to these signals could gain an early edge.

Key Points:

Earnings Signals Ahead: Reports from Nvidia’s customers, supplier, and a key competitor could act as early indicators of NVDA’s upcoming earnings performance.

AI Spending Watch: Capital expenditure guidance from Big Tech will be closely scrutinized for confirmation that AI infrastructure spending remains strong into 2026.

Sector Confirmation: Continued growth across the AI chip ecosystem would reinforce Nvidia’s dominant position and support higher valuations.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Why This Earnings Window Matters for Nvidia

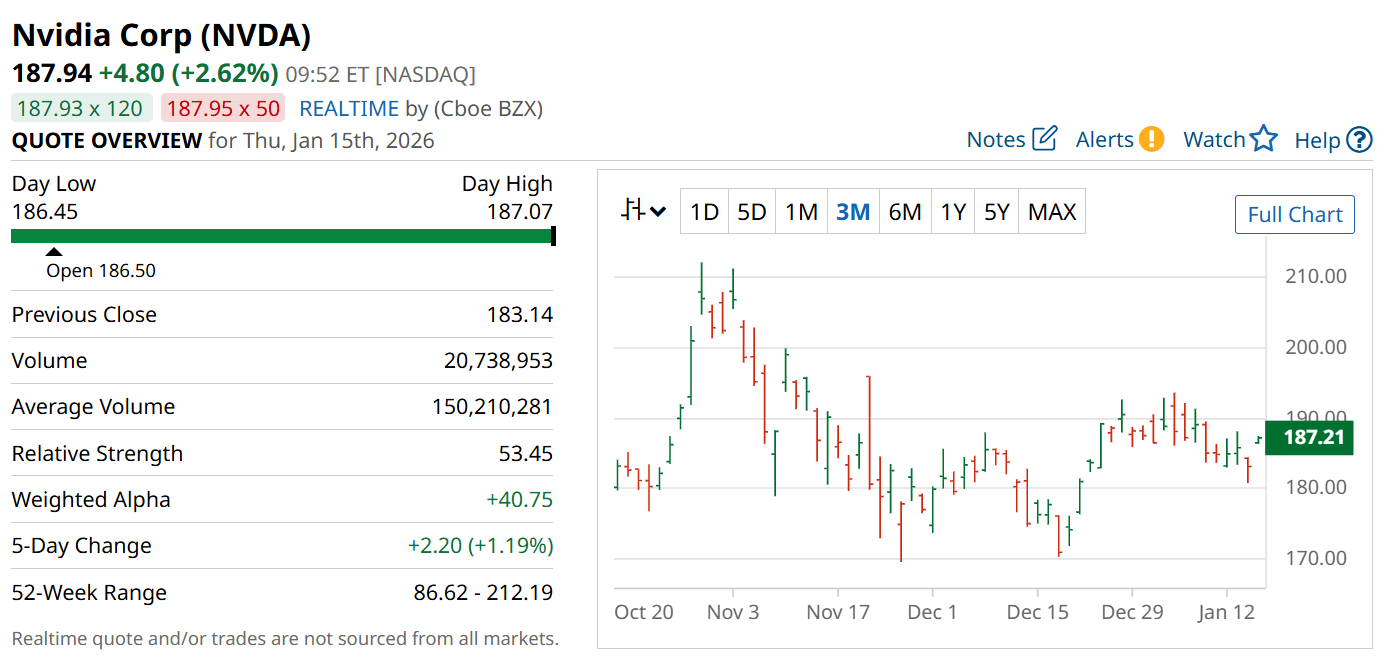

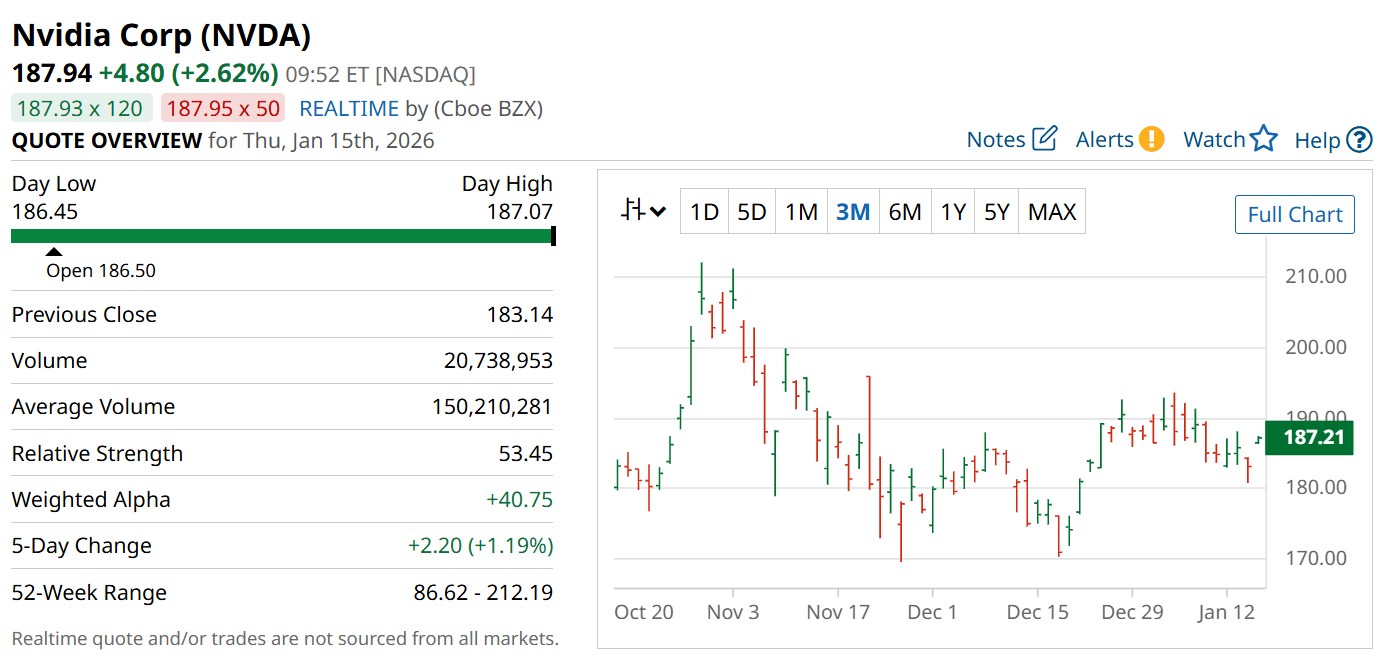

Nvidia (NASDAQ: NVDA) has been one of the most powerful wealth-creating stocks of the past decade, driven by its dominance in AI-focused GPUs.

Even after a historic rally, shares remain only modestly below all-time highs, suggesting investor conviction remains intact.

Importantly, markets often move in anticipation of earnings rather than in reaction, making the weeks before Feb. 25 especially meaningful.

Supplier Results Can Reveal Demand Trends

Nvidia relies heavily on foundry partners to meet demand for its advanced chips, making supplier earnings a critical signal.

Taiwan Semiconductor Manufacturing’s upcoming results and guidance can offer insight into whether AI-driven chip orders continue accelerating.

Strong forward commentary would suggest Nvidia’s production pipeline remains full, supporting expectations for another solid quarter.

Big Tech Spending Is the Key Indicator

Microsoft, Alphabet, Meta Platforms, and Amazon represent some of Nvidia’s largest and most influential customers.

Each company depends on Nvidia’s hardware to scale AI models, cloud services, and data-center infrastructure.

If these firms signal rising AI capital expenditures for 2026, it would strongly imply continued demand growth for Nvidia’s data center segment.

Why Even AMD’s Earnings Matter

Advanced Micro Devices remains Nvidia’s closest competitor in data-center accelerators, albeit at a much smaller scale.

Sustained growth in AMD’s data center revenue would confirm that enterprise and hyperscaler demand for AI compute remains robust.

When the entire sector is expanding, the market leader typically captures the largest share of investor enthusiasm and capital.

Strengths

Nvidia controls the most widely adopted AI computing platform, creating significant pricing power and customer lock-in.

Deep relationships with hyperscalers make Nvidia a core beneficiary of long-term AI infrastructure investment.

A strong innovation roadmap keeps the company ahead of emerging competitors.

Weaknesses

Elevated valuation leaves the stock vulnerable to short-term volatility around earnings.

Regulatory and geopolitical risks could intermittently disrupt global chip distribution.

Heavy exposure to a concentrated group of large customers increases sensitivity to spending shifts.

Potential

Accelerating AI capital spending could drive another leg of data-center revenue growth.

New chip generations may expand Nvidia’s reach into enterprise and sovereign AI projects.

Positive earnings signals before Feb. 25 could push shares back toward record highs.

TODAY’S SPONSOR

We’re running a super short survey to see if our newsletter ads are being noticed. It takes about 20 seconds and there's just a few easy questions.

Your feedback helps us make smarter, better ads.

Conclusion

The period from Jan. 15 to Feb. 4 may quietly shape Nvidia’s near-term outlook.

Earnings reports from suppliers, customers, and competitors collectively offer a preview of Nvidia’s demand environment.

For investors, these signals could provide confirmation that Nvidia’s AI momentum remains firmly intact.

Final Thought

Markets often reward those who read the signals early rather than waiting for headlines.

Sometimes the most important earnings preview comes from everyone except the company itself.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply