- StocksGeniusMastery

- Posts

- 💥Will Nvidia Hit $400 by 2030? Here’s What Investors Should Expect

💥Will Nvidia Hit $400 by 2030? Here’s What Investors Should Expect

Massive AI growth and bold expansion bets could take shares to new historic heights.

Hi Fellow Investors,

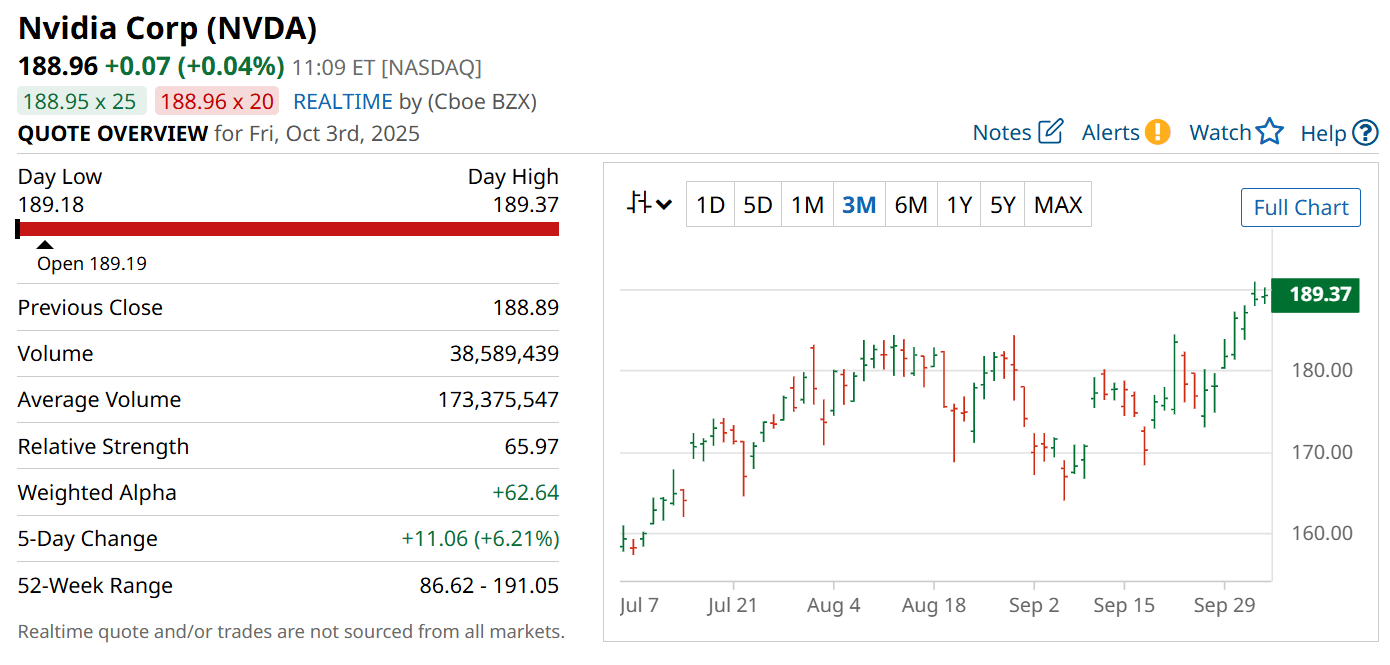

Nvidia (NASDAQ: NVDA) has already delivered one of the greatest runs in stock market history, climbing more than 2,100% in just five years.

With AI spending projected to soar into the trillions, the question now is whether Nvidia can extend its dominance through the rest of the decade.

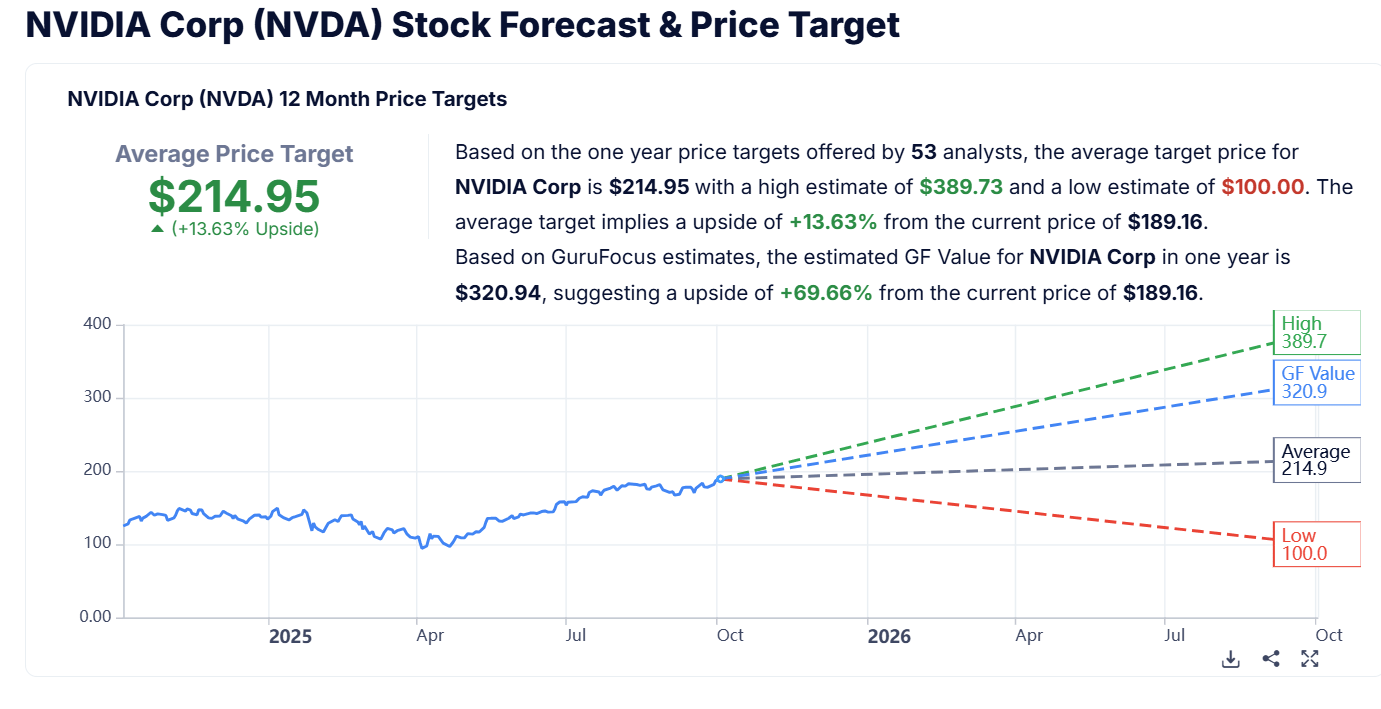

Analysts are already pointing to a potential $10 trillion valuation, with share prices possibly topping $400 by 2030.

Could the world’s most valuable chipmaker pull off another historic leap? Let’s dive in.

Key Points:

Nvidia’s revenue could more than double to $370 billion by 2030.

AI infrastructure spending is projected to hit $4 trillion this decade, fueling demand for GPUs

A $10 trillion market value and $400 share price may be achievable if growth holds.

TODAY’S SPONSOR

Typing is a thing of the past

Typeless turns your raw, unfiltered voice into beautifully polished writing - in real time.

It works like magic, feels like cheating, and allows your thoughts to flow more freely than ever before.

With Typeless, you become more creative. More inspired. And more in-tune with your own ideas.

Your voice is your strength. Typeless turns it into a superpower.

How Nvidia Became the Face of AI

Once known primarily for powering video games, Nvidia reinvented itself as the engine of the artificial intelligence revolution.

Its early pivot toward AI GPUs created a first-mover advantage that rivals like AMD and Intel still struggle to match.

Today, Nvidia controls the backbone of AI computing, from training language models to running enterprise applications.

Its innovation pipeline remains relentless, ensuring each new generation of GPUs raises the performance bar.

This history of reinvention explains why investors see Nvidia as more than just a chipmaker — it’s the foundation of modern computing.

Betting on AI’s Next Phases

Nvidia isn’t stopping at GPUs.

The company is expanding into networking, enterprise software, AI agents, and even humanoid robotics.

It also made billion-dollar investments in OpenAI and struck deals with Intel to broaden its reach into PCs and AI infrastructure.

These moves ensure Nvidia captures revenue across every stage of AI development — from data centers to consumer devices.

By embedding itself across the ecosystem, Nvidia strengthens its moat and broadens its growth runway.

Nvidia’s Path to $400 in 2030

At a price-to-sales ratio of 27, Nvidia already commands a premium valuation.

Yet if revenue climbs to $370 billion by 2030, its market cap could reach $10 trillion.

That translates into a share price of about $411, representing a 125% gain from today’s level.

While growth will likely slow compared to the past five years, Nvidia’s scale and demand backdrop make these targets achievable.

And with AI spending forecast to top $4 trillion by decade’s end, Nvidia’s growth story is far from finished.

Strengths

Nvidia dominates the AI accelerator market, maintaining performance and efficiency advantages that keep customers locked in.

Its expansion into networking, software, and robotics creates multiple revenue streams, reducing dependence on GPUs alone.

Brand recognition and first-mover advantage cement Nvidia as the gold standard, attracting both enterprises and governments to its platform.

Weaknesses

The stock’s premium valuation leaves little margin for error, with shares trading at 27 times sales.

Competition from AMD, Intel, and hyperscalers designing custom chips is heating up, threatening future market share.

Geopolitical risks tied to AI chip exports could create volatility, especially with restrictions on Chinese customers.

Potential

If revenue hits $370 billion by 2030, Nvidia’s valuation could exceed $10 trillion, propelling shares beyond $400.

AI infrastructure spending of $4 trillion provides a massive tailwind, giving Nvidia long-term demand visibility.

New markets like humanoid robotics and AI PCs offer untapped growth opportunities, potentially extending its dominance well into the next decade.

TODAY’S SPONSOR

Get Real Estate Training from Wharton Experts

Gain the skills top firms demand with the Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate.

In 8 weeks, learn from leaders at Blackstone, KKR, Ares, and more while analyzing real deals.

Save $300 with code SAVE300 + $200 with early enrollment by January 12.

Conclusion

Nvidia’s past performance has already been legendary, but the AI boom suggests its story is still unfolding.

With revenue growth, expansion into new markets, and trillions in AI spending on the horizon, Nvidia may yet double again by 2030.

For long-term investors seeking exposure to the AI megatrend, Nvidia remains the stock to watch.

Final Thought

Nvidia has already reshaped industries once.

The only question now is whether it will make history again by becoming the first $10 trillion company.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply